Are car insurance settlements taxable? This isn’t a simple yes or no. It depends heavily on the specifics of the settlement. We’ll break down the complexities, from different settlement types to negotiating strategies, helping you understand the tax implications involved. This casual lecture-style guide will provide practical insights and help you navigate the tricky world of insurance settlements and taxes. …

Read More »Tag Archives: taxes

Taxing Car Insurance Payouts A Critical Review

Do you have to pay taxes on car insurance payouts? This complex issue involves various factors, from the type of payout to the specific circumstances and jurisdiction. Navigating the tax implications of car insurance settlements can be tricky, often requiring careful consideration of policy details, legal frameworks, and individual financial situations. This review will delve into the intricacies of car …

Read More »Long-Term Care Insurance Benefits Taxable?

Is long term care insurance benefits taxable? This intricate question unveils a labyrinth of financial considerations, where the delicate balance between security and taxation shapes individual decisions. Navigating the complexities of insurance premiums and benefits, we explore the nuances of tax implications, illuminating the paths to both advantage and disadvantage. Long-term care insurance, a crucial safeguard against future medical expenses, …

Read More »Long-Term Care Insurance Taxable Benefits?

Is long term care insurance benefits taxable? This crucial question impacts your financial planning significantly. Understanding the tax implications of long-term care benefits is essential for anyone considering this type of insurance, as it affects how these benefits are treated when received. This comprehensive guide delves into the complexities of long-term care insurance taxation, examining the various scenarios and their …

Read More »Dissolving an S-Corp A Comprehensive Guide

How to dissolve an S corp is a complex process, demanding meticulous attention to detail. This guide provides a comprehensive overview, walking you through every step, from initial preparation to finalizing outstanding matters. Understanding the intricacies of S-corp dissolution is crucial for a smooth transition and to avoid costly mistakes. Navigating the legal and financial complexities of dissolving an S …

Read More »How to Do Taxes for Feet Finders A Guide

Kicking off with how to do taxes for feet finders, let’s dive into the world of foot-finding finances! Whether you’re a seasoned shoe-expert or just starting your foot-finding journey, understanding your tax obligations is crucial. This guide simplifies the process, providing a clear path through the often-confusing world of self-employment taxes for those in the foot-finding profession. From income reporting …

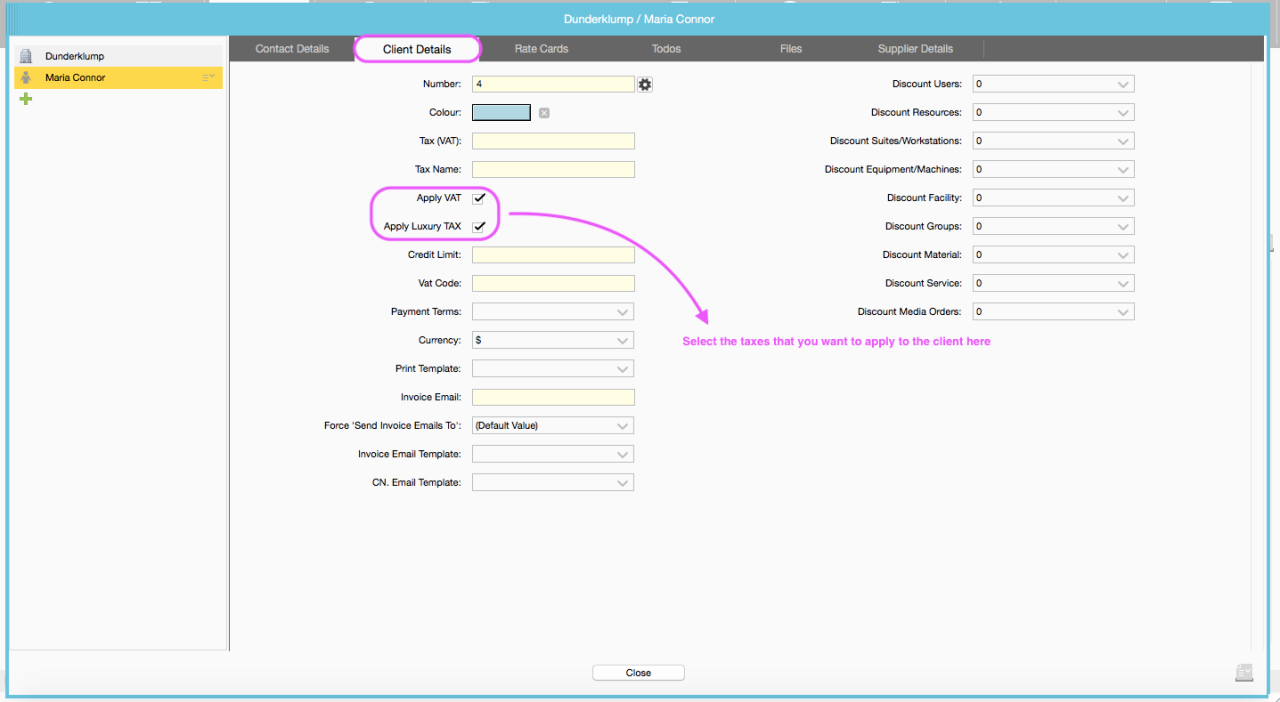

Read More »How to Add Taxes in Plant Swift A Comprehensive Guide

How to add taxes in Plant Swift? This guide provides a comprehensive walkthrough of the process, from understanding basic tax functionalities to advanced tax reporting. Mastering tax management in Plant Swift is crucial for accurate financial records and regulatory compliance. This detailed tutorial will cover various aspects of adding and managing taxes within the Plant Swift system. We’ll explore different …

Read More »How to Add Taxes in PlanSwift Your Ultimate Guide

How to add taxes in PlanSwift? This guide breaks down the whole process, from basic setup to advanced configurations. It’s like a cheat sheet for getting your taxes right in PlanSwift, so you can focus on the important stuff. We’ll cover everything from adding different tax types to generating reports, making sure you’re totally clued up on the ins and …

Read More » Nimila

Nimila