Can you write off car insurance for DoorDash? Navigating the world of gig economy driving and tax deductions can feel like a maze. Understanding how your vehicle use impacts your insurance and tax obligations is crucial for gig drivers. This exploration will illuminate the intricacies of deducting car expenses, specifically for DoorDash drivers, offering a roadmap to maximize your returns …

Read More »Tag Archives: tax deductions

Does Car Insurance Count as a Utility Bill?

Does car insurance count as a utility bill? This question delves into the often-confusing realms of recurring payments and their categorization. Understanding the differences between utility bills like electricity and water, and the unique nature of car insurance, is key to correctly classifying these essential expenses. While both are regular payments, car insurance safeguards your vehicle and financial well-being, whereas …

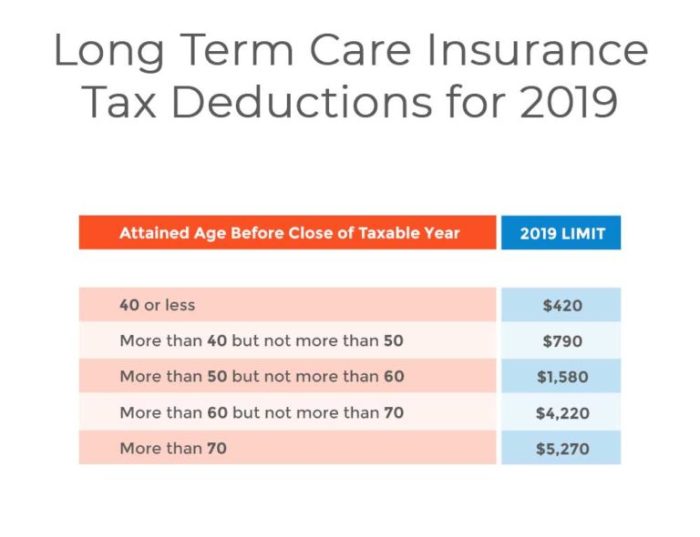

Read More »Long-Term Care Insurance Benefits Tax Implications

Is long term care insurance benefits taxable – Is long-term care insurance benefits taxable? Navigating the complexities of long-term care insurance and its tax implications can feel daunting. This exploration delves into the intricacies of this crucial topic, shedding light on the potential tax benefits and liabilities associated with these vital policies. From understanding coverage options to deciphering tax rules, …

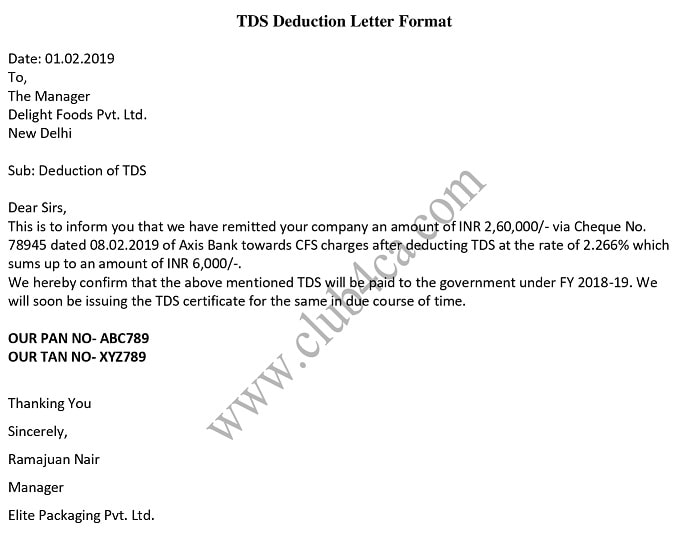

Read More »How to Write a Deductible Letter to Employer

How to write a letter stating deductible to employer? This comprehensive guide provides a step-by-step approach to successfully submitting deductible claims to your employer. It delves into the intricacies of understanding deductible claims, from the fundamental definitions to the crucial documentation needed for a smooth reimbursement process. We’ll explore the necessary letter structure, supporting documentation requirements, and strategies for handling …

Read More » Nimila

Nimila