Does car insurance cover lightning strike? Understanding your policy’s coverage is crucial when faced with unexpected damage. This comparison explores typical insurance policies, examining liability, collision, and comprehensive coverage. We’ll delve into lightning strike specifics, outlining potential damage to various car components, and analyze how insurance policies might handle such claims. Ultimately, you’ll gain a clear picture of your protection …

Read More »Tag Archives: car insurance

Do You Have to Fix Your Car With Insurance Money? Unveiling the Truth

Do you have to fix your car with insurance money? This cryptic question unveils a labyrinthine world of coverage, exclusions, and often-conflicting claims. The path to repair can be fraught with complexities, from understanding your policy’s intricacies to navigating the often-deceptive language of insurance adjusters. A thorough understanding of the process is crucial for securing a fair settlement and a …

Read More »Do New Cars Have Higher Insurance?

Do new cars have higher insurance? This question delves into the complexities of car insurance, exploring how the age and condition of a vehicle affect its premium. Understanding the factors influencing insurance rates for both new and used cars is crucial for informed decision-making. Insurance premiums are influenced by a variety of factors beyond just the age of the vehicle. …

Read More »Do I Need Gap Insurance on Leased Car? A Critical Analysis

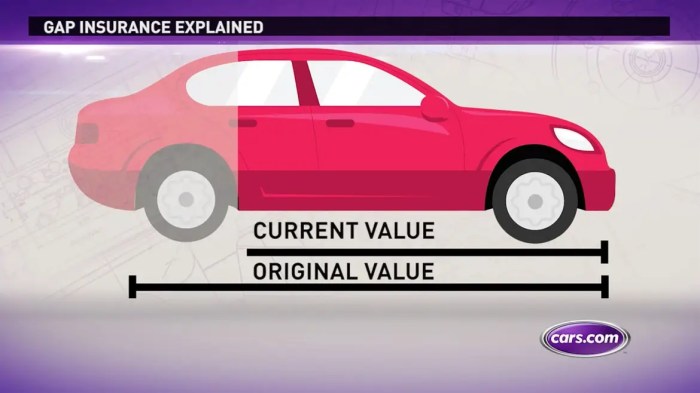

Do I need gap insurance on leased car? This crucial question confronts many leaseholders, navigating the complex landscape of automotive financing. Lease agreements often obscure the true financial implications of potential damage or loss. The decision to secure gap insurance requires a nuanced understanding of the lease terms, potential risks, and available alternatives. This analysis meticulously examines the intricacies of …

Read More »Do I Need Gap Insurance for Leased Car?

Do I need gap insurance for leased car? Understanding the potential financial pitfalls of a leased vehicle is crucial. A lease agreement typically protects you from damage up to a certain point, but what happens if the car’s value drops below what you owe? This comprehensive guide explores the complexities of gap insurance, examining how it safeguards your interests and …

Read More »Direct Line Car Insurance Renewal Your Guide

Direct Line car insurance renewal: Are you dreading the paperwork? Fear not, intrepid driver! This comprehensive guide breaks down the entire process, from logging in to getting paid. We’ll navigate the ins and outs, comparing Direct Line to its competitors, and uncovering all the coverages you can snag. We’ll also look at different policy types, from comprehensive to third-party, and …

Read More »Do Driveway Bollards Reduce Car Insurance?

Do driveway bollards reduce car insurance? This pivotal question delves into the complex relationship between safety measures, property protection, and the financial burden of car ownership. Understanding how insurance companies assess risk is crucial, and the impact of bollards on accident outcomes and claim frequency is key to answering this question effectively. Driveway bollards, often seen as a crucial component …

Read More »Car Insurance Dual Ownership

Do both owners of a car need insurance? Navigating the complexities of shared vehicle ownership often raises questions about insurance coverage. This exploration delves into the legal, practical, and insurance company perspectives to help you understand the intricacies of insuring a car with multiple owners. From the legal requirements in various countries to the nuances of shared ownership scenarios, we’ll …

Read More »Compliant Drivers Program Car Insurance Savings & Safety

Compliant driver’s program car insurance offers a unique opportunity to save money on premiums and enhance your driving record. By adhering to specific program guidelines, drivers can potentially reduce their insurance costs while simultaneously improving their driving habits and safety. This program details the benefits, eligibility, structure, and potential impact on your insurance rates. These programs often involve various initiatives, …

Read More »Combined Single Limit Car Insurance Your Comprehensive Guide

Combined single limit car insurance offers a streamlined approach to vehicle protection, consolidating coverage for bodily injury and property damage into a single limit. Understanding the intricacies of this coverage is key to ensuring you’re adequately protected. This guide dives deep into the specifics, benefits, and potential drawbacks of this type of insurance, helping you make informed decisions. This coverage, …

Read More » Nimila

Nimila