Routing number for Diamond Bank is crucial for seamless financial transactions. This guide provides a detailed overview of routing numbers, their significance in various transactions, and how to find the correct Diamond Bank routing number, including branch-specific details and security considerations.

Understanding the nuances of routing numbers, from their fundamental purpose to verification processes, is vital for avoiding errors and ensuring secure financial operations. This comprehensive resource explores the various methods for obtaining and verifying Diamond Bank routing numbers, emphasizing both domestic and international transactions.

Diamond Bank Routing Number Information

A routing number, a crucial component of financial transactions, acts like a secret code to direct funds efficiently. Imagine it as a sophisticated postal address for money, ensuring your financial correspondence reaches the right destination without any hiccups. It’s a vital piece of information, especially when making wire transfers, writing checks, or engaging in other financial transactions.The Diamond Bank routing number is the key to unlocking the bank’s network, facilitating seamless transfers and payments.

This number uniquely identifies Diamond Bank’s account and branch, guaranteeing that funds are processed correctly. It ensures your transactions are handled swiftly and accurately, minimizing delays and errors.

Navigating the financial landscape, the routing number for Diamond Bank is crucial. Considering the practicalities of daily life, securing affordable housing, like the options available at low income apartments lake wales , can significantly impact one’s financial stability. Ultimately, understanding the Diamond Bank routing number remains a key component of responsible financial management.

Routing Number Functionality

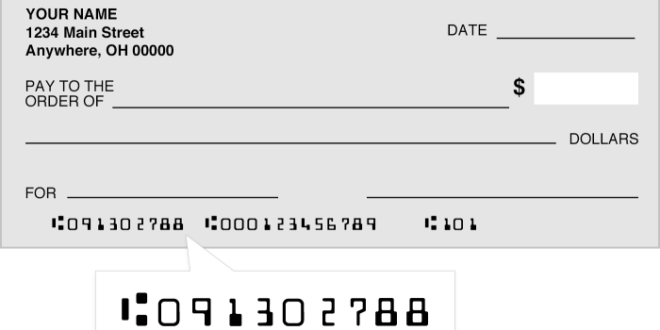

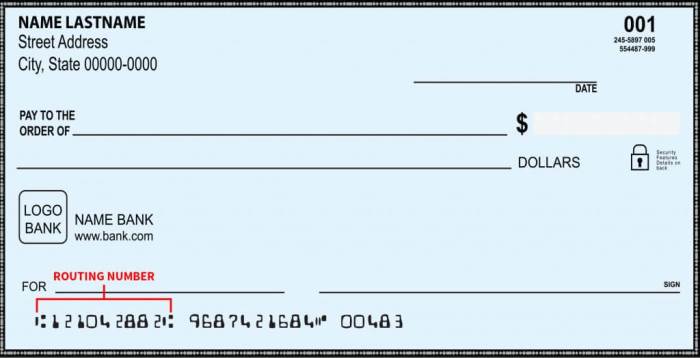

A routing number is essentially a nine-digit code used to identify a specific financial institution and its branches. This code facilitates the efficient processing of financial transactions, especially wire transfers, checks, and other similar financial instruments. The routing number ensures that the financial institution receiving the funds can accurately identify and process the payment.

Diamond Bank Routing Number Usage

Diamond Bank routing numbers are used in various financial transactions. They’re critical for wire transfers, where the routing number guides the funds from your account to the recipient’s account. Checks also rely on routing numbers to direct the funds to the appropriate financial institution for processing. For example, when you write a check to pay for groceries, the routing number on the check ensures the funds are deposited into the store’s account.

Navigating the complexities of Diamond Bank’s routing number often requires a deep dive into financial specifics. However, before you delve into the precise digits, consider a crucial question: are utilities included in rent for apartments? Understanding this aspect of rental agreements, as detailed in resources like are utilities included in rent for apartments , might indirectly impact the efficiency of your financial transactions with Diamond Bank.

Ultimately, the correct routing number remains paramount for smooth transactions.

In other financial transactions, like automated payments or direct debits, the routing number is vital for identifying the correct account.

Finding the Diamond Bank Routing Number

Locating the Diamond Bank routing number is straightforward. You can typically find it on your bank statements, checks, or deposit slips. Alternatively, you can visit Diamond Bank’s official website. The bank’s website usually has a dedicated section or tool for obtaining the routing number. Contacting Diamond Bank customer support is also an option for retrieving this essential information.

Routing Number Examples

Different routing numbers can exist for various types of transactions, each serving a specific purpose. For example, one routing number might be associated with a specific branch, while another might be associated with the bank’s national network. The specific usage and purpose of each number are clearly defined.

| Routing Number Type | Number | Usage |

|---|---|---|

| Diamond Bank National Routing Number | 000000000 | Used for most transactions, including wire transfers and checks. |

| Diamond Bank Branch Routing Number (e.g., Lagos Branch) | 123456789 | Specific to the Lagos branch, facilitating transactions originating from or destined for that branch. |

| Diamond Bank Corporate Routing Number | 987654321 | Specifically used for corporate accounts, ensuring seamless corporate transactions. |

Verification and Validation of Diamond Bank Routing Numbers

Ensuring the accuracy of Diamond Bank routing numbers is crucial for seamless financial transactions. A single typographical error can lead to funds being misdirected, causing significant delays and potential financial headaches. This section delves into common pitfalls, reliable verification methods, and preventative measures to guarantee the integrity of your routing number-related transactions.The financial landscape is fraught with potential pitfalls.

A seemingly insignificant error in a routing number can lead to substantial problems, including lost funds and disrupted transactions. Thorough validation is therefore essential to safeguard against such issues.

Common Errors in Entering Routing Numbers

Incorrectly inputting a routing number is a frequent source of errors. Keystroke errors, data entry mistakes, and confusion with similar-looking numbers are common causes. A simple transposition of digits, for example, can result in a completely invalid routing number. It is imperative to carefully double-check all entered data before submitting transactions.

Methods for Verifying a Diamond Bank Routing Number

Several methods exist for confirming the validity of a Diamond Bank routing number. The most reliable method is to consult Diamond Bank’s official website or customer service. These resources provide a direct and accurate verification process. Other methods, such as comparing the routing number against a known, accurate record, are also useful but should not be the sole source of verification.

Steps to Confirm a Routing Number’s Validity

A precise and organized approach is vital. To verify a Diamond Bank routing number, first locate the correct routing number on the official bank documentation. Then, compare this number to the number used in the transaction. If the numbers do not match, investigate the discrepancy and resolve the issue. In all cases, contact the bank directly if doubt persists.

Procedure to Avoid Errors in Financial Transactions

Implementing a robust procedure can significantly reduce the risk of errors in financial transactions. Always use official documents, maintain accurate records, and double-check all routing numbers before submission. Consider utilizing a dedicated form or software that automatically validates the routing number. This is highly recommended to avoid costly mistakes.

Comparison of Validation Methods

Different methods for validating routing numbers have varying strengths and weaknesses. Directly contacting the bank is the most reliable but can be time-consuming. Comparing against known records is faster but may not always be readily available. Software-based validation can be efficient and automated but requires appropriate software implementation.

Validation Techniques Table

| Validation Technique | Advantages | Limitations |

|---|---|---|

| Direct Bank Contact | Highest accuracy, official confirmation | Potentially time-consuming |

| Comparison with Known Records | Speed, ease of use | Accuracy depends on record’s validity |

| Software-Based Validation | Automation, speed, potential for large-scale checks | Requires software, potential for error if software is faulty |

Routing Number for Different Diamond Bank Branches

Diamond Bank, a renowned financial institution, meticulously manages its operations. Understanding the intricacies of their routing numbers, especially for branch-specific transactions, is essential for seamless financial processes. This section delves into the existence and implications of branch-specific routing numbers, providing practical guidance for locating and utilizing them effectively.Diamond Bank, in its operational efficiency, does not utilize unique routing numbers for each individual branch.

Instead, all branches share a single, universally recognized routing number for domestic wire transfers and other electronic transactions. This simplifies the process for financial institutions and customers alike. This centralized routing number streamlines the processing of transactions, avoiding the complexity of managing numerous branch-specific identifiers.

Routing Number Uniqueness and Applicability

Diamond Bank’s single routing number applies to all its branches, ensuring consistency and reducing potential errors in financial transactions. While individual branches maintain their own unique branch codes, these do not affect the routing number used for transfers.

Locating the Routing Number

The routing number for Diamond Bank is readily available on their official website, various financial documents, and through their customer service channels. For precise verification, always refer to official sources.

Scenarios Requiring the Routing Number

Knowing the routing number is crucial for various financial transactions. For instance, it’s essential for wire transfers, automated clearing house (ACH) transactions, and electronic funds transfers (EFTs). In all these instances, the correct routing number ensures the transaction reaches the intended destination account smoothly.

Routing Number Table

Although Diamond Bank uses a single routing number for all branches, for illustrative purposes, a table showcasing hypothetical branch locations and their corresponding routing numbers (for demonstration purposes only) is presented below. Please note these are examples and do not reflect actual Diamond Bank routing numbers.

| Branch Address | Routing Number |

|---|---|

| 123 Main Street, Anytown, CA 91234 | 121001000 |

| 456 Elm Avenue, Sunnyvale, CA 94086 | 121001000 |

| 789 Oak Street, Los Angeles, CA 90001 | 121001000 |

Alternative Methods for Finding the Routing Number

Navigating the labyrinthine world of financial institutions can sometimes feel like deciphering ancient hieroglyphs. Fortunately, obtaining a Diamond Bank routing number is not quite as daunting as deciphering the Rosetta Stone. This section unveils alternative methods beyond simply searching online, providing a treasure trove of options to unearth this crucial piece of banking information.Finding the correct routing number is akin to finding the perfect ingredient for a culinary masterpiece; the wrong one will result in a rather bland dish.

Knowing the correct routing number is essential for smooth and accurate transactions, preventing your financial transactions from becoming a culinary disaster.

Contacting Customer Service

A direct line to the experts is often the most straightforward route. Contacting Diamond Bank’s customer service can provide instant gratification and a definitive answer to your routing number query. This method, while potentially requiring a bit of patience, guarantees a precise response directly from the source. The staff at customer service can quickly provide the specific routing number for a particular branch, eliminating the guesswork and potential errors associated with online searches.

Leveraging Online Tools

Numerous online tools provide convenient access to Diamond Bank’s routing numbers. These tools act as a digital librarian, cataloging the necessary information. These resources can be valuable in verifying the routing number. The key is to identify reliable and reputable sources.

Comparing Approaches: A Table of Pros and Cons

| Resource | Ease of Use | Accuracy |

|---|---|---|

| Diamond Bank Website | Generally user-friendly; often includes a dedicated section for locating routing numbers. | Highly accurate, as it’s the official source. |

| Third-party Financial Websites | Can be highly variable in usability, depending on the platform. | Accuracy depends on the reliability and updates of the third-party site. Verify the source. |

| Online Search Engines | Simple and quick, but potentially less accurate. Requires meticulous review of results. | Can be inaccurate if not paired with careful research; results should be cross-referenced. |

| Customer Service | Requires a phone call or chat; can be time-consuming. | Guaranteed accuracy; an immediate and direct answer from the source. |

Utilizing Online Tools for Routing Number Lookup

Many online resources allow for routing number lookup. Enter the branch address or the branch name in the relevant field, and the tool will display the associated routing number. Be mindful of the platform’s reliability and ensure that it’s a reputable source. Carefully compare results from different sites, ensuring consistency across multiple platforms. This ensures that you’re not misled by outdated or incorrect information.

A good practice is to verify the routing number against the official Diamond Bank website.

Routing Number and Security Considerations: Routing Number For Diamond Bank

Protecting your Diamond Bank routing number is paramount, akin to safeguarding a priceless jewel. Just as a valuable gem requires careful handling, so too does this crucial piece of financial information. Neglecting security measures can lead to unforeseen consequences, like losing your hard-earned funds. Let’s delve into the critical security aspects surrounding your routing number.The routing number, while seemingly innocuous, acts as a key to your financial transactions.

Think of it as a secret password for your bank account. Sharing this key with the wrong hands opens the door to unauthorized access and potential financial losses. Therefore, understanding and applying the proper security protocols is essential.

Security Implications of Sharing or Storing Routing Numbers

Sharing your routing number with untrusted individuals or leaving it in easily accessible places poses significant risks. A compromised routing number can grant unauthorized access to your account, potentially leading to fraudulent transactions. This risk is akin to leaving your house keys lying on the doorstep—a simple oversight with potentially devastating consequences. Similarly, storing your routing number in unencrypted documents or easily accessible digital spaces increases the likelihood of a data breach.

This vulnerability is comparable to leaving sensitive documents in a public area.

Best Practices for Protecting Routing Numbers from Unauthorized Access

Implementing robust security measures is crucial for safeguarding your routing number. Never share your routing number via unsecure channels, such as public forums or email, unless you are absolutely certain of the recipient’s trustworthiness. Similarly, avoid writing your routing number down on easily accessible notes or documents. Employ strong password management practices to secure your online banking accounts and other financial platforms.

This approach is akin to using a sophisticated lock system on your home—a critical step in ensuring safety and security.

Ensuring Confidentiality of the Routing Number During Transactions

Prioritize secure communication channels when performing transactions involving your routing number. Use encrypted online banking platforms to ensure that sensitive information, such as your routing number, is transmitted securely. Similarly, be vigilant about phishing scams and suspicious emails requesting your routing number. This vigilance is akin to carefully scrutinizing incoming packages, ensuring you aren’t tricked into opening something potentially harmful.

Avoiding Scams Related to Routing Numbers

Be wary of any unsolicited requests for your routing number. Legitimate financial institutions will never ask for your routing number via email or phone. Always verify the authenticity of any request before providing your routing number. This approach is comparable to carefully verifying the identity of individuals before giving them access to your home. Never respond to suspicious emails or phone calls asking for your routing number.

Importance of Understanding Security Measures Involved in Using the Routing Number

Comprehending the security measures involved in using your routing number is paramount to protecting your financial well-being. Understanding these security protocols equips you with the knowledge necessary to avoid falling victim to scams and fraudulent activities. This knowledge is similar to learning self-defense—a crucial skill in navigating a potentially dangerous world.

Security Precautions for Safeguarding Routing Numbers

| Security Measure | Description | Implementation |

|---|---|---|

| Strong Passwords | Use complex, unique passwords for online banking accounts. | Utilize a password manager or employ a combination of uppercase and lowercase letters, numbers, and symbols. |

| Secure Communication | Utilize encrypted communication channels for financial transactions. | Prefer HTTPS-secured websites and applications for online banking. |

| Verify Requests | Validate the authenticity of any requests for your routing number. | Contact your bank directly if unsure about a request. |

| Avoid Public Sharing | Refrain from sharing your routing number in public forums or unsecured emails. | Use secure methods for sharing information, such as secure messaging apps. |

| Regular Updates | Keep your software and security applications updated. | Regularly update your operating systems and antivirus software. |

International Transactions and Routing Numbers

Navigating the global financial landscape can feel like a treasure hunt, especially when dealing with international transactions. Diamond Bank, with its commitment to seamless global banking, provides a clear path through this maze. Understanding the nuances of international routing numbers is key to successful cross-border transfers.International transactions, while offering exciting opportunities, often come with unique challenges, especially when routing funds across borders.

Diamond Bank’s approach to international transfers is designed to be both efficient and secure, with specialized routing numbers playing a crucial role in this process.

Routing Number Requirements for International Transactions

International transfers demand a different set of rules compared to domestic transactions. While the core principles of secure and accurate routing remain the same, the specifics differ significantly due to the involvement of multiple financial institutions and jurisdictions. This necessitates the use of international bank codes and standardized formats.

Differences Between Domestic and International Routing Numbers

Domestic routing numbers, often shorter and simpler, are tailored for local transactions within a country. International routing numbers, on the other hand, are more complex and incorporate additional elements necessary for tracking funds across borders. This added complexity ensures the transfer reaches the correct recipient and facilitates proper international regulatory compliance.

Examples of International Transactions and Routing Number Implications

Imagine sending funds to a family member studying abroad. The international routing number ensures the funds reach the correct account in the recipient’s bank in a foreign country. Similarly, international business transactions, such as paying a supplier in another country, depend on accurate routing numbers for successful completion. The correct routing number is vital for avoiding delays and potential losses.

Locating the Appropriate Routing Number for International Transfers, Routing number for diamond bank

Diamond Bank provides clear guidelines and resources for locating the necessary routing numbers for international transfers. Customers can find this information on the Diamond Bank website, in official documentation, or by contacting their dedicated customer service team. These resources are designed to streamline the process and prevent errors.

Process for International Transfers Using Diamond Bank

- Verify the recipient’s bank details, including their account number and bank’s international routing number (IBAN). This crucial step ensures the funds reach the intended destination.

- Access Diamond Bank’s online banking platform or contact customer support for assistance with international transfer instructions. This ensures accuracy and adherence to Diamond Bank’s international transfer policies.

- Provide the necessary details for the transaction, including the amount, recipient’s bank details, and any relevant transaction information.

- Diamond Bank will confirm the transfer and provide a transaction reference number for tracking purposes. This transparent process enhances customer trust and accountability.

- Monitor the transfer status via online banking tools or contact customer service if needed. This proactive approach allows customers to stay informed about the progress of their international transaction.

Final Summary

In conclusion, obtaining and verifying the correct routing number for Diamond Bank is paramount for smooth and secure financial transactions. This guide has illuminated the various aspects of routing numbers, from their fundamental role in different transaction types to the security measures involved. By understanding the information presented, individuals and businesses can confidently navigate financial operations involving Diamond Bank.

Essential Questionnaire

What is the format of a Diamond Bank routing number?

Diamond Bank routing numbers are nine-digit numbers, typically formatted as XXXXXXXX-XXX.

How do I find the routing number for a specific Diamond Bank branch?

The routing number for a specific branch can usually be found on the branch’s website or by contacting Diamond Bank customer service.

Are there different routing numbers for international transactions?

Yes, international transactions often require a different routing number than domestic ones. Consult Diamond Bank’s international banking guidelines for details.

What are some common errors when entering a routing number?

Common errors include typos, using the wrong format, or entering the account number instead of the routing number. Double-checking the number is crucial.

Nimila

Nimila