How to detox from weed pen? This ain’t no walk in the park, fam. Getting …

Read More »Alliant Credit Union Car Insurance Comprehensive Coverage

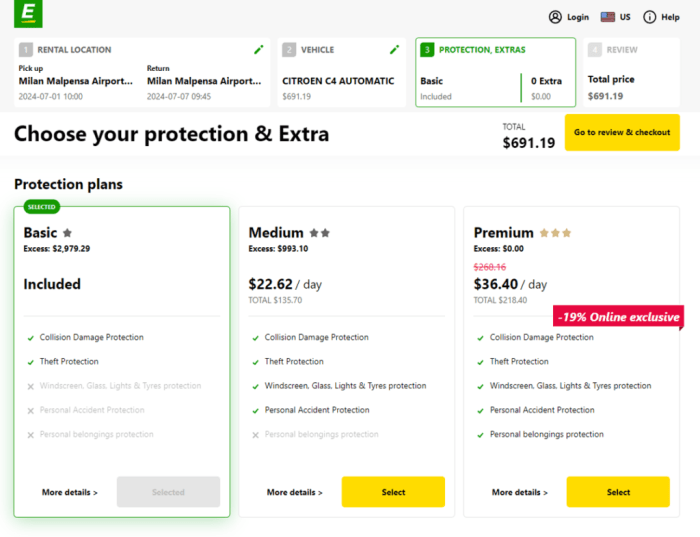

Alliant Credit Union car insurance offers a comprehensive range of coverage options, tailored to meet diverse needs. Understanding the policies, rates, and customer service aspects is crucial for making an informed decision. This analysis delves into the specifics of Alliant’s offerings, comparing them to competitors and highlighting unique features. A deep dive into the claim process, coverage details, and pricing …

Read More » Nimila

Nimila