Understanding the NAICS code for nail technicians is crucial for success in this dynamic industry. This guide provides a detailed overview of the NAICS code, its significance, and practical applications for nail technicians and business owners.

This comprehensive resource delves into the intricacies of the NAICS code, explaining its purpose and structure, while highlighting its essential role in various aspects of running a successful nail technician business. The guide also provides practical examples and tools to locate and apply the code correctly, offering a clear and accessible pathway to navigate this important aspect of business operations.

Defining Nail Technician Roles

Nail technicians play a vital role in the beauty industry, providing a range of services to enhance and maintain clients’ nail health and aesthetics. Their expertise extends beyond simply applying polish, encompassing specialized techniques and a deep understanding of nail anatomy and care. Different specializations demand varying skill sets and levels of expertise, catering to diverse client needs and preferences.Nail technicians are increasingly sought after for their specialized knowledge and artistry in various nail enhancements.

Their roles are multifaceted, encompassing technical skills, client interaction, and the ability to create beautiful and long-lasting nail designs.

Nail Technician Specializations

Nail technicians can specialize in various areas, each requiring unique skills and techniques. This specialization allows for a focus on specific services, enhancing proficiency and expertise.

Acrylic Nail Technician

Acrylic nail technicians use acrylic powder and liquid to create artificial nails. This process involves carefully shaping and sculpting the nails to achieve the desired form and aesthetics. A key skill is the ability to blend the acrylic material seamlessly with the natural nail to create a strong and durable finish. Acrylic nails are popular for their durability and ability to withstand wear and tear, making them a favored choice for those who require long-lasting results.

Gel Nail Technician

Gel nail technicians use a UV or LED cured gel to create enhancements. Gel applications often involve sculpting, shaping, and layering gel to create a natural or elaborate look. Expertise in application, curing, and removal is crucial for this specialization. Gel nails are favored for their glossy finish and durability.

Natural Nail Care Specialist

Natural nail care specialists focus on maintaining the health and beauty of natural nails. This involves a thorough understanding of nail anatomy, care, and potential problems. They often provide manicures, pedicures, and treatments to nourish and strengthen the natural nails. Essential skills include nail assessment, massage techniques, and the use of specialized products to promote nail health.

Comparison of Nail Technician Roles

| Role | Specialization | Key Skills | Typical Tasks |

|---|---|---|---|

| Acrylic Nail Technician | Acrylic Nail Enhancement | Acrylic application, sculpting, shaping, blending, curing, nail art | Applying acrylic to natural nails, creating desired shapes and designs, maintaining nail health, providing client consultation |

| Gel Nail Technician | Gel Nail Enhancement | Gel application, sculpting, shaping, curing, removal, nail art, color application | Applying gel to natural nails, creating desired shapes and designs, maintaining nail health, removing gel polish, providing client consultation |

| Natural Nail Care Specialist | Natural Nail Care | Nail anatomy, nail health assessment, massage techniques, cuticle care, nail strengthening treatments, product knowledge | Manicures, pedicures, nail assessments, cuticle care, recommending appropriate treatments, providing client consultation |

Understanding NAICS Codes

NAICS codes, or North American Industry Classification System codes, are standardized numerical codes used to classify businesses and industries across North America. They provide a consistent framework for collecting, analyzing, and reporting economic data. This standardized system allows for comparisons and analysis across different sectors and regions.These codes are crucial for various purposes, including economic analysis, market research, government policymaking, and business planning.

They offer a structured way to understand the diverse landscape of industries and the relationships between them. Knowing the NAICS code for a particular industry, like nail technicians, helps in understanding its place within the broader economic structure.

NAICS Code Category for Nail Technicians

Nail technicians fall under the broader category of “Personal and Custom Services”. This classification reflects the nature of the services provided, which are personalized and tailored to individual clients. These services are typically performed in a salon or spa setting, catering to a client’s specific aesthetic needs and preferences.

Detailed Description of the NAICS Code for Nail Technicians

The specific NAICS code for nail technicians, and the precise subcategories, vary depending on the specific services offered and the business structure. For instance, a nail technician working independently within a larger salon might have a different code than one who operates a standalone nail salon.Furthermore, variations in services, such as offering manicures, pedicures, or specialized treatments, can impact the relevant NAICS code.

Understanding these nuances is crucial for accurate data collection and analysis.

Historical Context of the NAICS Code

The NAICS code system has evolved over time to reflect changing economic realities and industry structures. Initial classifications might not have captured the intricacies of emerging sub-specialties within the beauty industry, such as nail technicians. The system’s dynamic nature is essential to maintain its relevance in a constantly evolving economy. Early NAICS codes likely focused on broader categories, like personal services, which then further refined as specific industries developed.

Evolution of the NAICS Code for Nail Technicians

| Year | NAICS Code (Hypothetical) | Description | Changes |

|---|---|---|---|

| 2007 | 531112 | Personal Services: Nail Care | Initial classification, encompassing broader services. |

| 2012 | 531112 | Personal Services: Nail Care (including Manicures, Pedicures, Specialty Treatments) | Refined to include sub-specialties and diverse services. |

| 2017 | 531112 | Personal Services: Nail Care (including Manicures, Pedicures, Specialty Treatments, Nail Art) | Recognizing the growth of nail art and related trends. |

| 2022 | 531112 | Personal Services: Nail Care (including Manicures, Pedicures, Specialty Treatments, Nail Art, Gel/Acrylic Applications) | Adding specific techniques to reflect evolving industry standards. |

Note: The hypothetical NAICS codes used in the table are for illustrative purposes only and may not reflect the exact codes used in a real-world scenario. The precise code will depend on the specifics of the business and services offered.

Locating the NAICS Code for Nail Technicians

Finding the appropriate NAICS (North American Industry Classification System) code for nail technicians is crucial for accurate record-keeping, business operations, and reporting. This code helps categorize businesses, allowing for better analysis and tracking of industry trends and statistics. It also aids in complying with government regulations and accessing specific resources.Understanding the process for locating the NAICS code ensures proper categorization of nail technician services, facilitating accurate reporting and compliance with relevant regulations.

This accurate categorization allows for a better understanding of the industry and its trends.

NAICS Code Resources

Locating the appropriate NAICS code for nail technicians involves accessing reliable resources that provide the necessary information. These resources offer structured information for determining the correct code.

Available Resources for NAICS Code Search

Several resources are available for locating the NAICS code for nail technicians. These resources provide detailed information, enabling accurate identification and use of the appropriate code.

- The North American Industry Classification System (NAICS) website: The official source for NAICS codes is the website maintained by the U.S. Census Bureau. This site offers comprehensive details on the classification system, including definitions and explanations of various industries. Searching this website directly provides detailed information on specific industries and subcategories, ensuring you find the precise code for nail technicians. This website is a primary resource for accessing the official NAICS code structure and definitions.

- Online Databases and Search Engines: Several online databases and search engines allow users to look up NAICS codes by s or industry descriptions. These tools provide a convenient method for finding the appropriate code. Examples include specialized business directories and general search engines. This provides a quick and efficient way to locate the code without extensive manual searching.

- Government Agencies and Publications: Government agencies like the Small Business Administration (SBA) or state business regulatory bodies often provide resources related to NAICS codes. These resources offer valuable context and further details on the code’s implications for specific industries or regulations. This method often provides additional insights beyond the basic code information.

Step-by-Step Guide to Locating the NAICS Code

The process for locating the NAICS code for nail technicians involves a systematic approach using available resources. This process ensures accurate identification of the appropriate code.

- Identify the specific services offered: Begin by clearly defining the services provided by the nail technician. This could include manicures, pedicures, nail art, or other specialized treatments. Understanding the services offered is crucial to find the correct NAICS code.

- Access the official NAICS website or a reliable database: Use a reputable online resource like the U.S. Census Bureau’s NAICS website or a relevant business database. Ensuring the source is reliable avoids errors in finding the correct code.

- Utilize search tools or browse the classifications: Use search tools or browse the provided classifications to locate the relevant industry category for nail technicians. This step involves navigating the classification structure to find the precise code that fits the services offered.

- Verify the code and its associated descriptions: Carefully review the code description and associated details to confirm that it accurately reflects the services offered by the nail technician. This step ensures that the code selected precisely matches the nature of the services.

NAICS Code Applications

The NAICS code for nail technicians provides a standardized way to categorize businesses, enabling various applications in diverse operational aspects. This standardized classification system aids in accurate financial reporting, facilitates efficient tax filings, and allows for targeted marketing strategies. Understanding these applications is crucial for nail technicians to optimize their business practices and maximize profitability.

Business Operations

The NAICS code for nail technicians serves as a crucial identifier in daily business operations. It facilitates accurate tracking of revenue streams, expenses, and overall financial performance. This structured approach simplifies record-keeping, improving the efficiency of internal reporting and analysis. This identification system allows technicians to categorize their services for clarity and traceability.

Financial Reporting

The NAICS code plays a vital role in financial reporting. Accurate categorization allows for better tracking of revenue and expenses specific to nail technician services. This precise classification is essential for preparing financial statements, such as income statements and balance sheets. It ensures that financial data aligns with industry standards and regulatory requirements, contributing to the overall credibility of financial reports.

Consistent use of the code enables better comparison of financial performance with other businesses in the same sector.

Tax Filing

The NAICS code is essential for accurate tax filings. It provides a framework for categorizing income and expenses, enabling tax authorities to correctly assess and collect taxes. Proper classification ensures compliance with tax regulations and minimizes potential tax discrepancies. This accuracy streamlines the tax filing process, reducing administrative burdens and potential penalties. It allows technicians to accurately report their income and expenses, leading to appropriate tax liabilities.

Marketing

The NAICS code facilitates targeted marketing strategies. Understanding the code helps nail technicians identify their ideal customer base and tailor marketing efforts accordingly. This classification provides valuable insights into industry trends and allows for a precise understanding of competitors’ strategies. This allows for a strategic approach to market segmentation, ultimately increasing the effectiveness of marketing campaigns. By focusing on the specific needs of their target market, nail technicians can create targeted marketing strategies.

So, you’re looking for the NAICS code for nail techs, huh? It’s all about classifying businesses, and for a nail tech, it’s crucial. Like, if you’re setting up shop, you need to know the right code for your business, which is totally important for getting your paperwork straight. Think of it like, if you were opening a salon at Whole Foods Denver Union Station, you’d need to know that code, right?

Whole Foods Denver Union Station is a cool spot, but finding the right NAICS code for your nail salon is still key for your biz. You gotta get that code sorted out, no cap.

Identifying Potential Business Partners and Competitors

The NAICS code is a valuable tool for identifying potential business partners and competitors. It allows for targeted networking opportunities, facilitating collaborations within the industry. By identifying competitors operating under the same NAICS code, technicians can gain insights into pricing strategies and service offerings. This understanding enables a more informed business strategy. Identifying potential partners using the same NAICS code can facilitate joint ventures or strategic alliances.

Pricing Strategies

The NAICS code can influence pricing strategies for nail services. By understanding the prevailing market rates for services within the specified NAICS code, nail technicians can develop competitive pricing strategies. Analysis of competitors’ pricing models within the same classification helps in setting prices that are both profitable and attractive to customers. This knowledge allows technicians to accurately assess the value of their services in the market.

NAICS Code and Business Structure: Naics Code For Nail Technician

The North American Industry Classification System (NAICS) code is crucial for businesses to accurately represent their operations and activities. For nail technicians, selecting the appropriate NAICS code is essential for proper record-keeping, financial reporting, and compliance with legal requirements. This section examines how different business structures impact the use of the NAICS code, highlighting the legal and financial implications for nail technicians.The choice of business structure significantly influences how a nail technician operates and reports their business activities.

So, you’re looking for the NAICS code for nail techs, huh? It’s all about classifying businesses, you know? Like, if you’re thinking about opening a salon, you gotta know the right code to file with the government. And if you’re banking with Putnam County Bank Milton WV , that’s totally a different ballgame, but still related to the business side of things.

Finding the right NAICS code is key to making sure your salon is all set up correctly.

This, in turn, directly affects the selection and application of the appropriate NAICS code. Understanding these implications ensures accurate financial reporting and compliance with regulatory requirements.

Impact of Business Structure on NAICS Code Selection, Naics code for nail technician

Different business structures have varying legal and financial implications for the use of the NAICS code. The chosen structure directly affects the way the business operates and the level of responsibility held by the owner(s).

- Sole Proprietorship: In a sole proprietorship, the business and the owner are legally considered the same entity. The NAICS code selected for the nail technician’s business reflects the sole proprietor’s activities. Reporting and compliance are simplified compared to other structures.

- Partnership: A partnership involves two or more individuals sharing in the business’s profits and losses. The NAICS code should reflect the combined activities of all partners. This necessitates a clear understanding and agreement on the business’s services, potentially requiring more detailed record-keeping compared to a sole proprietorship.

- Corporation: A corporation is a separate legal entity from its owners (shareholders). The NAICS code selection for a nail technician operating as a corporation must accurately reflect the corporation’s activities. The reporting requirements are more complex, potentially requiring specialized accounting services.

Legal Implications of Using the Correct NAICS Code

Accurate NAICS code selection is crucial for legal compliance. Incorrect codes can lead to penalties and hinder business operations.

- Taxation: The NAICS code influences tax reporting requirements. Using the correct code ensures appropriate tax deductions and classifications. Incorrect codes can lead to audits and potential tax liabilities.

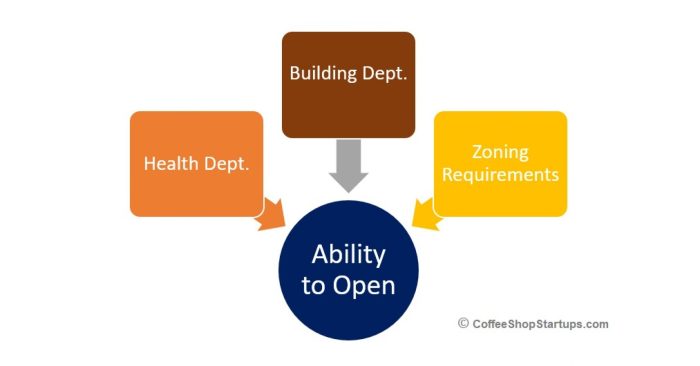

- Regulatory Compliance: Certain regulations and licensing requirements may be tied to the NAICS code. Misrepresentation of the NAICS code could lead to non-compliance issues and penalties. Local regulations may also use NAICS codes for categorizing businesses, affecting licensing, permits, and zoning.

- Government Grants and Funding: Some government grants and funding programs may have eligibility criteria linked to the NAICS code. Using the wrong code could disqualify the nail technician’s business from applying for relevant funding.

Financial Implications of Using the Correct NAICS Code

Proper NAICS code application has significant financial implications for nail technicians.

- Financial Reporting: The NAICS code is vital for preparing accurate financial reports. Using the right code ensures compliance with accounting standards and provides relevant data for informed decision-making.

- Marketing and Advertising: The chosen NAICS code can influence marketing strategies. A precise code allows for targeting the correct customer segments and crafting effective advertising campaigns.

- Insurance and Loan Applications: The NAICS code is used in insurance and loan applications to assess risk and determine premiums. Inaccurate coding can lead to higher insurance costs or difficulty securing loans.

Comparison of Business Structures and NAICS Code Implications

The following table summarizes the differences in NAICS code impact, legal implications, and financial implications across different business structures.

| Business Structure | NAICS Code Impact | Legal Implications | Financial Implications |

|---|---|---|---|

| Sole Proprietorship | Simple reporting, direct reflection of owner’s activities. | Direct legal responsibility; simpler compliance. | Simplified financial reporting, potential for limited liability protection. |

| Partnership | Reflects combined activities of all partners; clear agreement needed. | Shared legal responsibility; agreement crucial. | Potentially more complex financial reporting and record-keeping. |

| Corporation | Separate legal entity; requires accurate reflection of corporation’s activities. | Greater legal separation from owners; more complex compliance. | Complex financial reporting; potential for greater liability protection. |

NAICS Code and Industry Trends

The nail technician industry is experiencing significant transformations driven by evolving consumer preferences, technological advancements, and globalization. Understanding these trends is crucial for businesses to adapt and thrive. A well-defined NAICS code is essential to reflect these shifts, allowing businesses to accurately categorize their operations and access relevant resources.The nail technician industry, once primarily focused on traditional manicures and pedicures, is now a multifaceted sector encompassing diverse services, product lines, and business models.

This evolution necessitates a nuanced understanding of industry trends to ensure the NAICS code accurately reflects the current landscape.

Current Trends in the Nail Technician Industry

The nail technician industry is constantly evolving, adapting to changing consumer demands and technological innovations. Key trends include a rise in specialized services, a growing emphasis on natural nail care, the integration of technology, and increasing globalization.

Impact of Technology on Nail Technician Services

Technological advancements are revolutionizing the nail technician industry. Mobile nail salons and online booking platforms are transforming how clients access services. Digital marketing tools and social media platforms are crucial for building brand awareness and attracting customers. 3D nail art design software and advanced nail sculpting tools are further enhancing the skillset and creativity of technicians.

Globalization and the Nail Technician Industry

Globalization is impacting the nail technician industry through increased cross-border collaborations and the expansion of businesses into new markets. International nail art styles and techniques are influencing the industry, leading to a greater variety of options for clients. This global reach necessitates a deeper understanding of international regulations and standards.

Consumer Preferences and the Nail Technician Industry

Consumer preferences are shifting towards natural nail care and personalized services. Emphasis on healthy nail growth and minimal intervention is growing. Clients are seeking customized experiences, driving demand for unique designs and tailored treatments. This trend is also influencing the products used in nail services.

Evolution of the Nail Technician Industry

- Early 20th Century: Primarily focused on traditional manicures and pedicures, often performed in salons.

- Mid-20th Century: Increased demand for nail services, leading to the emergence of independent nail technicians.

- Late 20th Century: Growth of nail salons, specialized techniques like acrylic nails, and a broader range of services.

- 21st Century: Rise of mobile nail services, online booking, social media marketing, specialized nail art, and a focus on natural nail care. Global expansion of the industry is occurring as well.

Adapting the NAICS Code to Industry Trends

The NAICS code needs to adapt to reflect the expanding services and business models within the nail technician industry. For example, the addition of mobile nail services or online booking platforms may require a more specific categorization within the existing NAICS code. Furthermore, the growing demand for specialized services and the evolution of consumer preferences necessitate a more nuanced approach to the classification of nail technician roles.

The increasing use of technology in nail services also requires a corresponding adjustment in the NAICS code to accommodate these evolving aspects of the industry.

Concluding Remarks

In conclusion, the NAICS code for nail technicians is a vital component of successful business operations, impacting everything from financial reporting to marketing strategies. This guide has explored the multifaceted nature of this code, providing insights into its historical context, current applications, and future implications. By understanding and utilizing this code effectively, nail technicians can ensure their businesses thrive and adapt to the evolving landscape of the industry.

FAQ Resource

What is the NAICS code used for?

The NAICS code is used by the government to categorize businesses for statistical purposes, impacting financial reporting, tax filing, and industry analysis. It helps to track industry trends and provide a structured framework for understanding the nail technician sector.

How can I find the NAICS code for nail technicians?

Various resources, including the official NAICS website and government databases, can help you locate the relevant NAICS code. These resources offer step-by-step instructions and examples to find the appropriate code.

How does the NAICS code affect pricing strategies for nail services?

The NAICS code, when correctly applied, allows for a clearer understanding of the industry’s competitive landscape. This understanding can help nail technicians analyze market conditions and determine competitive pricing strategies.

Nimila

Nimila