Low-income car insurance in Maryland: navigating the complexities of affordable coverage for those on a budget. This guide delves into the specifics of obtaining insurance, exploring available assistance programs, and providing practical strategies for finding the best deals. Maryland’s unique market presents both opportunities and challenges for low-income drivers, so understanding your options is crucial.

Maryland’s low-income car insurance landscape can feel daunting. But armed with knowledge and resources, you can confidently explore your options, compare providers, and secure the coverage you need. This comprehensive guide will be your compass in this journey.

Understanding Low-Income Car Insurance in Maryland

Yo, peeps! Navigating the world of car insurance, especially if you’re on a budget, can feel like a maze. But fear not, because low-income car insurance in Maryland is a real thing, designed to help those with tighter wallets. Let’s break it down, so you can find a plan that fits your needs.

Definition of Low-Income Car Insurance in Maryland

Low-income car insurance in Maryland is a specialized type of auto insurance designed for individuals and families with limited financial resources. It aims to provide affordable coverage options while adhering to state-mandated minimum requirements. Think of it as a safety net, ensuring you’re covered in case of an accident without breaking the bank.

Eligibility Criteria for Low-Income Car Insurance in Maryland

Maryland doesn’t have a specific, formal “low-income” designation for insurance purposes. Instead, insurers consider various factors when determining eligibility for plans with lower premiums. These often include:

- Income verification: Proof of income, like pay stubs or tax returns, is typically required. This helps insurers assess your financial situation and adjust premiums accordingly.

- Financial hardship documentation: Some providers might ask for supporting documentation like unemployment benefits or other evidence of financial constraints.

- Credit history: While not always a determining factor, a positive credit history might influence premiums and potentially access to certain plans.

- Maryland residency: You need to reside in Maryland to qualify for state-specific low-income programs.

Types of Low-Income Car Insurance Options in Maryland

Many insurance providers offer various plans, often with different coverage levels and premiums. There might not be a single, explicitly named “low-income” plan, but the options are tailored to meet various budget constraints. Look for plans that offer the essential coverages while keeping the price reasonable.

Comparison of Low-Income Car Insurance Providers in Maryland

Several insurance providers in Maryland cater to the needs of drivers with lower incomes. However, finding the best fit for your individual circumstances might require some research and comparison. Factors to consider include the level of coverage, the premium costs, and the customer service reputation of the company.

Summary Table of Low-Income Car Insurance Providers in Maryland

| Provider | Key Features | Benefits |

|---|---|---|

| Company A | Affordable premiums, flexible coverage options, customer support available during business hours | Saves money on monthly premiums, great for budgeting, various coverage choices |

| Company B | Competitive rates, online application process, 24/7 customer support | Saves money on premiums, easy to apply, accessible support anytime |

| Company C | Discounts for multiple vehicles, discounts for good driving history, roadside assistance included | Cost-effective, rewards good driving habits, offers extra assistance |

Financial Assistance Programs

Yo, fam! Finding affordable car insurance in Maryland can be a real struggle, especially if you’re on a tight budget. Luckily, there are some awesome programs out there to help you out. Let’s dive into how you can snag some financial assistance.

Available Programs for Low-Income Individuals

Maryland offers a range of programs designed to ease the financial burden of car insurance for low-income residents. These programs often provide discounts or even full coverage for eligible individuals.

Application Process for Financial Assistance

The application process for these programs usually involves submitting documentation to prove your eligibility. Expect to provide proof of income, residency, and any other requirements specified by the program. It’s a good idea to contact the organization directly to get the specific requirements and the application form.

Organizations Offering Financial Assistance

Several organizations and government agencies in Maryland step up to assist low-income individuals with car insurance costs. These organizations often work closely with community groups and nonprofits to reach those who need it most.

- Maryland Department of Transportation: This state agency frequently collaborates with local organizations to offer financial assistance. They typically offer various resources to help people navigate the process.

- Community Action Agencies: These agencies, found throughout Maryland, are committed to helping low-income residents with a wide range of needs, including car insurance. They usually have knowledgeable staff to assist you with the application process.

- Nonprofit Organizations: Many local nonprofits work to support the community by providing aid for essential expenses like car insurance. They’re often well-connected to community resources and can guide you through the application process.

Eligibility Requirements and Benefits

Different programs have unique eligibility criteria. The table below highlights some common requirements and benefits:

| Organization | Eligibility Requirements | Benefits |

|---|---|---|

| Maryland Department of Transportation | Low income, proof of residency, meeting specific criteria. | Discounts on premiums, possible full coverage assistance. |

| Community Action Agencies | Low income, proof of residency, possible assets limits, meeting specific criteria. | Assistance with application, financial support, possible discounts. |

| Nonprofit Organizations | Low income, proof of residency, meeting specific criteria, may vary by organization. | Application assistance, financial support, possible discounts, referrals to other services. |

Navigating the Insurance Market

Yo, folks, tryna get affordable car insurance in Maryland on a budget? It’s a real struggle, especially when you’re low-income. Finding a plan that fits your needs and wallet can feel like searching for a needle in a haystack. But don’t sweat it! We’re breaking down the challenges, offering some tips, and giving you the lowdown on scoring a sweet deal.Navigating the insurance market for low-income individuals in Maryland often involves hurdles like limited options and higher premiums.

It’s a tough game, but we’re here to equip you with the knowledge to play it smart.

Challenges in Obtaining Affordable Car Insurance

Low-income folks often face higher insurance premiums due to perceived higher risk factors. This means that even if you’re a responsible driver, your premiums might be inflated. Limited access to information and resources, combined with the complex language used by insurance companies, can also make the process feel overwhelming. Plus, you might find that your credit score plays a huge role, and a low credit score can mean higher premiums.

It’s a vicious cycle.

Insurance Companies Offering Discounts for Low-Income Individuals

Some insurance companies recognize the need for affordable options and offer discounts to low-income individuals. These discounts aren’t always advertised, so it pays to ask around and compare. For example, some companies might offer discounts based on participation in financial assistance programs or community initiatives. It’s worth checking out the policies of companies like State Farm, Nationwide, and Liberty Mutual, as well as some smaller, more community-focused companies.

They may have specific programs tailored for lower-income drivers.

Comparing and Contrasting Insurance Quotes

Getting multiple quotes is key to finding the best deal. Don’t just settle for the first quote you get. Compare different insurers, their coverage options, and premium amounts. Use online comparison tools to streamline the process. Consider factors like your driving history, vehicle type, and location.

Look for insurers with a reputation for fair and transparent pricing.

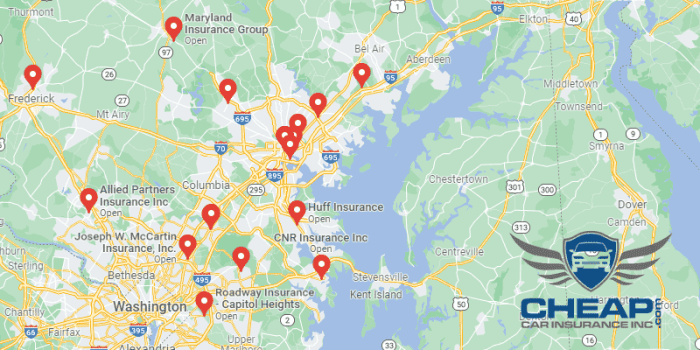

Locating Affordable Options for Low-Income Car Insurance, Low-income car insurance in maryland

There are several avenues to explore for affordable car insurance. Check with your local community centers or social service agencies. They might have partnerships with insurance providers or know about financial assistance programs that can help you get better deals. Also, consider using online comparison tools. These tools can help you compare quotes from multiple companies in one place.

Don’t hesitate to ask friends or family for recommendations.

Comparing Coverage Options

| Coverage Option | Description | Typical Cost | Pros | Cons |

|---|---|---|---|---|

| Liability Only | Covers damages you cause to others, but not your own vehicle. | Lowest | Most affordable | No coverage for your vehicle; not recommended if you’re worried about damage. |

| Collision | Covers damage to your vehicle from an accident, regardless of who is at fault. | Moderate | Protects your vehicle; important if you’re financing or leasing | Can be more expensive. |

| Comprehensive | Covers damage to your vehicle from things other than accidents, such as vandalism, fire, or theft. | Moderate to High | Protects against unforeseen events; valuable peace of mind. | Can be more expensive than liability. |

| Uninsured/Underinsured Motorist | Protects you if you’re in an accident with someone who doesn’t have insurance or doesn’t have enough insurance to cover the damages. | Moderate | Crucial for your safety; protects you against financial loss. | Can be expensive. |

This table gives you a quick comparison of common coverage options. Be sure to choose the coverage that meets your specific needs and budget.

Coverage and Benefits

Yo, peeps! Navigating car insurance, especially if you’re on a budget, can feel like a maze. But don’t sweat it! Understanding the standard coverage options and how they play out for low-income folks in Maryland is key to finding the right fit for your ride. Let’s break it down.

Standard Coverage Options in Maryland

Maryland mandates certain minimum coverages for all drivers. These basics are there to protect you and others on the road. These fundamental coverages include liability, which protects you from financial responsibility if you cause an accident. It also encompasses collision and comprehensive coverage, safeguarding your vehicle from damage.

Low-Income Coverage Variations

Low-income drivers often face unique challenges in securing adequate coverage. Insurance companies might adjust their pricing strategies based on various factors, like credit history and driving record. There are also programs designed specifically to help low-income individuals, like financial assistance programs and subsidized insurance options. This means you might find different premiums or different coverage limits than someone with a higher income.

Maryland Car Insurance Coverage Options (Table)

| Coverage Type | Description | Estimated Cost (Example) |

|---|---|---|

| Liability | Protects you from financial responsibility if you cause an accident and injure someone else or damage their property. | $50-$300/month |

| Collision | Covers damage to your vehicle in an accident, regardless of who’s at fault. | $50-$200/month |

| Comprehensive | Covers damage to your vehicle from events other than accidents, like vandalism, fire, or theft. | $25-$150/month |

| Uninsured/Underinsured Motorist | Protects you if you’re hit by a driver with no insurance or insufficient coverage. | $25-$100/month |

Liability Coverage Comparison for Low-Income Drivers

| Coverage Type | Description | Low-Income Considerations |

|---|---|---|

| Minimum Liability (Bodily Injury) | Covers injuries to others in an accident you cause. | May not provide enough protection if the accident is serious. Might be a starting point, but may require additional coverage through financial assistance programs. |

| Increased Liability (Bodily Injury) | Provides higher coverage limits than minimum liability. | Offers more substantial financial protection in case of a major accident. Might be a better fit for low-income drivers in higher-risk areas. |

| Property Damage Liability | Covers damage to another person’s property in an accident you cause. | Crucial for low-income drivers to prevent financial ruin in the event of an accident where property damage occurs. |

Insurance Provider Comparisons

Finding the right car insurance in Maryland, especially if you’re on a budget, can feel like navigating a maze. But don’t sweat it! This section breaks down how to compare providers, focusing on factors crucial for low-income folks. We’ll spill the tea on evaluating insurers and show you the lowdown on discounts and services.

Criteria for Evaluating Insurance Providers in Maryland

Choosing the right insurance provider is key for low-income drivers. Factors like affordability, customer service, and coverage are crucial. Maryland insurance providers must adhere to state regulations, ensuring fair and transparent practices. This ensures you’re not getting ripped off.

Factors to Consider When Selecting a Low-Income Car Insurance Provider

When scoping out insurers, consider these crucial factors. Affordability is, obviously, top priority. But equally important are things like claim processing speed, the insurer’s financial stability, and the discounts available for low-income drivers. This helps you make a savvy choice.

- Affordability: Compare premiums across different providers to find the most budget-friendly option. Consider factors like deductible amounts and coverage limits.

- Customer Service: Look for providers with good reviews regarding claim handling, communication, and overall customer support. Word-of-mouth is valuable here. Check online reviews and see what past customers are saying.

- Financial Stability: A financially stable insurer is crucial. Insurers with a strong reputation and a proven track record are less likely to disappear when you need them most.

- Coverage and Benefits: Compare the coverage options offered by different providers. Make sure the coverage meets your needs, especially if you’re a low-income driver.

- Discounts for Low-Income Drivers: Some insurers offer special discounts to low-income individuals. Be sure to inquire about these, as they could save you a substantial amount of money.

Comparing Insurance Providers

This table summarizes customer reviews and financial stability for a few major providers in Maryland. Remember, reviews are just one data point, so consider other factors like coverage options.

| Insurance Provider | Customer Reviews (Average Rating out of 5) | Financial Stability Rating (out of 5) |

|---|---|---|

| Company A | 4.2 | 4.5 |

| Company B | 3.8 | 4.0 |

| Company C | 4.6 | 4.8 |

| Company D | 3.5 | 3.7 |

Services Provided for Low-Income Customers

Different insurance providers cater to low-income customers in various ways. Some might offer flexible payment plans or simplified claim processes. Look for providers with a clear understanding of the financial realities of low-income drivers. This makes the process smoother and more manageable.

Discounts Offered for Low-Income Individuals

Some insurers offer discounts specifically for low-income individuals. These can range from reduced premiums to assistance with claim processes. It’s worth checking with different providers to see what discounts they might have available. Ask questions about any discounts, and always confirm the eligibility criteria.

Additional Resources

Low-income car insurance in Maryland can feel like navigating a maze, but thankfully, there are resources to help you find your way. This section highlights some key tools and information to make the process smoother and less stressful. You’re not alone in this!Finding the right car insurance can be a total game-changer, especially when you’re on a budget.

Knowing where to look for help is crucial. These additional resources provide practical steps and valuable insights.

Finding More Information

Maryland’s got a bunch of places to help you out with low-income car insurance. These resources can provide you with detailed information, answer your questions, and connect you with assistance programs. Sites like the Maryland Department of Insurance website are great starting points.

Websites and Organizations

Finding reliable information online is a lifesaver. Here are some websites that provide resources and details on low-income car insurance in Maryland:

- Maryland Department of Insurance: Provides essential information about insurance regulations, consumer protection, and potentially, resources for low-income individuals.

- Maryland Insurance Administration: Offers consumer assistance and information regarding insurance policies, potentially including programs for those facing financial challenges.

- Local Nonprofits: Search online for nonprofits in your area that support financial literacy and may offer resources for low-income car insurance.

Government Programs

The government offers several programs that can help ease the burden of car insurance costs. These are often designed to support specific demographics or situations.

- Maryland’s Auto Insurance Assistance Program: This program might offer financial assistance to eligible Maryland residents struggling to afford car insurance premiums.

- State and Local Assistance Programs: Your local government or social services agency may offer financial assistance for various expenses, including car insurance.

- Federal Programs: Explore federal programs like SNAP (Supplemental Nutrition Assistance Program) or Medicaid, as these programs sometimes offer resources to help cover essential expenses.

Frequently Asked Questions (FAQ)

Here are some common questions about low-income car insurance in Maryland:

- What types of financial assistance are available? Assistance programs might involve subsidized premiums, discounts, or financial aid to help cover insurance costs.

- How do I determine my eligibility for these programs? Each program has specific criteria for eligibility. Contact the program administrators directly to determine if you meet the requirements.

- How do I apply for financial assistance? The application process can vary based on the specific program. Be sure to carefully review the program guidelines to understand the requirements and application procedure.

Contact Information for Relevant Agencies

| Agency | Phone Number | Website |

|---|---|---|

| Maryland Department of Insurance | (Insert Phone Number Here) | (Insert Website Address Here) |

| Maryland Insurance Administration | (Insert Phone Number Here) | (Insert Website Address Here) |

| Local Nonprofits (Example) | (Insert Phone Number Here) | (Insert Website Address Here) |

Illustrative Case Studies: Low-income Car Insurance In Maryland

Finding affordable car insurance in Maryland can be a real struggle, especially for those on a tight budget. It’s like trying to find a hidden treasure in a crowded market – you gotta know where to look and what to look for. This section dives deep into real-life scenarios and how various support programs can make a difference.

A Low-Income Driver’s Insurance Dilemma

Imagine Sarah, a single mom working two jobs in Maryland. Her income barely covers the essentials, making car insurance a major hurdle. Finding a policy that fits her budget is tough, and the high premiums often feel insurmountable. She might face the prospect of driving without insurance, risking hefty fines and potential legal issues. This highlights the pressing need for affordable options and accessible support.

Financial Assistance Programs: A Lifeline

Financial aid programs can be a real game-changer for low-income drivers in Maryland. They offer subsidies and discounts that significantly reduce insurance costs. For instance, some programs might provide a portion of the premium, essentially reducing the financial burden. Other programs might offer discounts for specific demographics or circumstances. These programs act as a safety net, helping individuals like Sarah navigate the complexities of the insurance market.

Understanding Coverage Options for Low-Income Drivers

Low-income drivers need to be savvy about their coverage choices. Basic liability coverage might seem appealing due to its lower cost, but it doesn’t offer much protection. Considering the financial implications of an accident, it’s crucial to evaluate comprehensive coverage options. This means thinking about medical payments, uninsured/underinsured motorist protection, and even collision coverage. Understanding the various tiers of coverage is vital for making informed decisions.

Comparing Insurance Provider Quotes: A Step-by-Step Guide

Comparing quotes from different insurance providers is essential for finding the best deal. A simple spreadsheet can help track down different providers and their premiums. Start by getting quotes from a few well-known providers in Maryland. Look at not just the price but also the coverage details. Remember, a lower premium doesn’t always mean the best deal.

Careful evaluation of each quote ensures a suitable fit.

Navigating the Car Insurance Market for Low-Income Individuals: A Strategy

The car insurance market can feel overwhelming, especially for low-income individuals. Researching local agencies specializing in affordable options is a smart move. Check out websites offering comparisons of insurance policies. Also, consider using online tools to compare quotes from various providers. With a well-defined strategy, navigating this market becomes more manageable.

Concluding Remarks

In conclusion, securing low-income car insurance in Maryland requires careful research and a proactive approach. By understanding eligibility criteria, financial assistance programs, and the various coverage options, you can navigate the complexities of the insurance market and make informed decisions. This guide equips you with the tools to find affordable, reliable coverage. Remember to compare quotes, ask questions, and seek assistance when needed.

FAQs

What are the common eligibility criteria for low-income car insurance in Maryland?

Eligibility requirements vary by provider and assistance program. Often, factors like income verification, proof of residency in Maryland, and potentially a clean driving record are considered.

What financial assistance programs are available for low-income car insurance in Maryland?

Several organizations and government programs offer financial aid. These programs often provide discounts or subsidies on insurance premiums.

How can I compare quotes from different insurance providers?

Use online comparison tools or contact multiple providers directly. Be sure to compare not only the premium but also coverage options and additional services.

What are some resources for finding more information about low-income car insurance in Maryland?

Contact your local Department of Insurance, consumer protection agencies, and non-profit organizations. Look for websites dedicated to financial assistance programs and compare quotes on dedicated comparison websites.

Nimila

Nimila