Is long term care insurance benefits taxable? This crucial question impacts your financial planning significantly. Understanding the tax implications of long-term care benefits is essential for anyone considering this type of insurance, as it affects how these benefits are treated when received. This comprehensive guide delves into the complexities of long-term care insurance taxation, examining the various scenarios and their corresponding tax outcomes.

We’ll explore how premiums, payouts, and different service types factor into the overall tax picture.

Long-term care insurance policies provide coverage for substantial expenses associated with aging and long-term care needs. The policies help to protect against substantial financial strain, especially when facing prolonged health challenges. However, it’s crucial to understand the tax consequences of these benefits to ensure financial stability during such periods. This guide provides a detailed overview of the tax implications for long-term care insurance benefits, enabling you to make informed decisions.

Understanding Long-Term Care Insurance

Yo, peeps! Long-term care insurance is like a safety net for your future, especially when you’re getting older. It’s designed to help cover the costs of care if you need assistance with daily tasks or end up needing a nursing home. It’s a pretty important thing to think about, so let’s dive in!

Defining Long-Term Care Insurance

Long-term care insurance is a type of policy that pays for care services when you can’t take care of yourself. This could be anything from help with bathing and dressing to skilled nursing care in a facility. It’s essentially insurance that protects your wallet from the high costs of aging and potential health crises.

Types of Long-Term Care Insurance Coverage

Different policies offer various levels of coverage. Some focus on short-term assistance, while others provide extensive coverage for a longer duration. The key is finding a policy that aligns with your needs and budget.

Typical Benefits Offered

Long-term care insurance policies often cover a range of services, from in-home care to assisted living facilities. This might include skilled nursing care, physical therapy, occupational therapy, and other medical support. It’s all about ensuring you get the help you need, no matter the situation.

Examples of Covered Services

Specific services covered can vary by policy. Common examples include help with bathing, dressing, eating, and transferring. It can also include respite care for caregivers, as well as custodial care in a nursing home or assisted living facility.

Premium Structure

Premiums for long-term care insurance are typically based on several factors, including your age, health status, and the level of coverage you select. The more extensive the coverage, the higher the premium will be. You can often customize the policy to fit your budget and needs.

Eligibility Requirements

Eligibility criteria can vary by insurance company, but typically involve age, health assessments, and the desired level of coverage. It’s a good idea to compare different providers to find the best fit for your circumstances.

Policy Comparison Table

| Policy Type | Coverage | Premium | Benefits |

|---|---|---|---|

| Basic Policy | Covers basic needs like bathing and dressing | Lower | Affordable option for those with modest needs |

| Comprehensive Policy | Covers a wide range of services, including skilled nursing care and assisted living | Higher | Provides a more comprehensive safety net |

| Catastrophic Policy | Covers long-term care needs only after a significant period of initial care | Lowest | Good for those who are healthy but want some protection for the future |

Tax Implications of Long-Term Care Benefits

Yo, peeps! Long-term care insurance can be a total lifesaver, but knowing how taxes play into it is crucial. It’s like, totally important to understand the ins and outs of this stuff so you don’t get blindsided by unexpected tax bills. Let’s dive into the deets.Federal Uncle Sam’s Take: The feds generally tax long-term care benefits as ordinary income.

This means they’re treated like regular cash you earn, and you’ll owe taxes on them. However, there are some exceptions. If the benefits are used to pay for things like premiums or medical expenses, that might be different. So, it’s not always a straightforward equation.

Federal Tax Treatment of Long-Term Care Benefits

The federal government considers long-term care benefits as taxable income, just like any other income. This means the money you receive will be added to your gross income and taxed accordingly based on your individual tax bracket. The tax rate will depend on the amount of your income and the applicable tax laws.

State Tax Implications on Long-Term Care Benefits

Different states have different rules regarding taxing long-term care benefits. Some states might not tax them at all, while others may tax them as income. It’s a total wild card, so you should def check with your state’s tax agency for specifics.

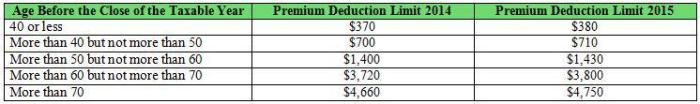

Deductions for Long-Term Care Insurance Premiums, Is long term care insurance benefits taxable

Paying for long-term care insurance can be a serious expense. Luckily, in some cases, you can deduct the premiums you pay. However, this deduction might depend on factors like the amount you pay, your filing status, and other income. So, you gotta dig into the IRS guidelines for the most up-to-date info.

Tax Treatment in Different Scenarios

The tax treatment of long-term care benefits varies depending on how they’re used. For instance, if the benefits are used for home healthcare, the tax implications will likely be different from using them for assisted living. Basically, each scenario has its own unique tax rules.

Direct vs. Third-Party Payments

Getting benefits directly vs. through a third-party, like a home health agency, can affect the tax implications. If you get paid directly, the IRS might see it as a straight income. If a third-party handles it, the tax treatment might be different depending on the specific arrangement.

Special Circumstances and Health Conditions

Certain health conditions or specific situations, like if you’re a veteran or have a disability, might affect how the IRS treats your long-term care benefits. You’ll need to consult with a tax professional or look into the relevant IRS publications to get a clearer picture of these unique cases.

Table of Tax Implications for Different Scenarios

| Scenario | Tax Implications | Deductions |

|---|---|---|

| Home Healthcare Benefits | Generally taxable as income. | Potentially, but depends on specifics, like if the premiums were deducted. |

| Assisted Living Benefits | Generally taxable as income. | Potentially, but depends on specifics, like if the premiums were deducted. |

| Benefits through a Third-Party Agency | Tax treatment might vary depending on the agreement with the third-party. | Potentially, but depends on the specifics of the agreement. |

Taxability of Long-Term Care Insurance Benefits

Yo, fam! Long-term care insurance can be a total lifesaver, but knowing how the IRS views those payouts is crucial. It’s not always a straightforward “tax-free” situation, so let’s break down the tax rules.Understanding the tax implications of long-term care benefits is key to planning for your future. Different payout scenarios have different tax treatments, and it’s important to know how to calculate your tax liability.

Fully Taxable Long-Term Care Benefits

These payouts are like straight-up income, meaning the entire amount is subject to federal and potentially state income taxes. Think of situations where the insurance policy pays for things like assisted living or in-home care. If the policy is designed to cover the cost of those services, the reimbursements are usually fully taxable. For example, if your policy pays $5,000 per month for assisted living, the full $5,000 is taxable.

Partially Taxable Long-Term Care Benefits

Some payouts are a mix, partially taxable and partially non-taxable. This often happens when the policy covers both eligible expenses and non-eligible expenses. For example, if a policy reimburses for both nursing home care and personal care services (like help with dressing or bathing), the portion covering the personal care services might be considered non-taxable, while the nursing home care portion could be fully taxable.

It’s all about the specific details of your policy.

Non-Taxable Long-Term Care Benefits

These are the sweet spots. The insurance company’s payouts are totally tax-free. This usually happens when the policy pays for things that aren’t considered medical expenses, like paying for your mortgage, groceries, or other non-medical costs. For instance, some policies may cover expenses like a caregiver’s salary for your household needs, but not medical ones. Those expenses would be considered non-taxable.

Criteria for Determining Taxable Portions

The IRS uses specific criteria to determine how much of a payout is taxable. This usually involves looking at the specific expenses covered by the policy and whether those expenses are considered medical in nature. The specific wording of the policy and the nature of the services provided are key factors in this determination.

Tax Consequences of Lump Sum vs. Monthly Payments

Receiving benefits as a lump sum or monthly payments changes things. A lump-sum payout is taxed in the year it’s received, while monthly payments are taxed each month. This difference in timing can impact your overall tax burden. For example, if you get a large lump-sum payment, you might have to pay a higher tax rate in that year, compared to receiving the same amount over time.

Impact of Benefit Timing on Tax Implications

The timing of the benefits matters, especially in cases of lump-sum payments. Receiving benefits during a year with a high income bracket can result in a higher tax liability than if the benefits were received in a year with a lower income bracket. It’s like having extra income, and the timing of that income directly affects your tax bracket.

Examples of Long-Term Care Benefit Taxability

| Benefit Type | Taxable Amount | Tax Rate |

|---|---|---|

| Nursing Home Care Reimbursement | $10,000 | 22% |

| In-Home Caregiver Services | $2,000 | 10% |

| Personal Care Services | $1,500 | Non-taxable |

| Policy Payout for House Cleaning | $1,000 | Non-taxable |

Illustrative Case Studies: Is Long Term Care Insurance Benefits Taxable

Yo, fam! Long-term care insurance benefits? Totally a wild ride when it comes to taxes. It’s not always a straight shot to the bank, you know? Sometimes, it’s a little tricky figuring out if you gotta pay the IRS some dough or not. Let’s break down some real-life scenarios to get you clued in.Understanding the tax implications of long-term care benefits is crucial for planning.

Different situations lead to different tax treatments. So, buckle up, because we’re about to dive into some case studies.

Fully Taxable Benefits Case Study

This scenario involves a dude named Mike who bought a long-term care policy. He had to use the benefits for a debilitating illness, needing round-the-clock care. All the payout for his care was considered taxable income. The policy didn’t offer any exclusions or deductions. The IRS considered the entire amount a regular paycheck.

This is a totally standard case where the entire benefit amount is taxed.

Partially Taxable Benefits Case Study

Okay, so picture this: Sarah has a long-term care policy. She uses the benefits for a health condition that requires ongoing care, but her policy has a specific exclusion for the first $10,000 in benefits. So, the first $10,000 is totally tax-free, but the amount above that is taxable income. The amount that’s tax-free depends on the specific policy terms.

Non-Taxable Benefits Case Study

Now, imagine Emily. She has a long-term care policy that covers her care needs due to a condition. However, her policy specifically states that the benefits are completely non-taxable. This is totally cool, right? No IRS headaches here.

These benefits are a sweet deal, totally tax-free. This depends on the specific terms of her policy.

Factors Determining Taxability

The taxability of long-term care benefits is determined by a few key factors. First off, the

- specific policy wording* is crucial. It spells out the exact terms and conditions, including any exclusions or deductions. Secondly, the

- type of care received* plays a role. Lastly, the

- amount of benefits received* is super important. These are all factors that will impact the tax implications.

Importance of Consulting a Tax Professional

Navigating the tax implications of long-term care benefits can be tricky, especially if you’re dealing with complex situations. It’s super important to get professional advice from a tax expert. They can help you understand your specific situation and figure out how the taxes will impact you. They’re the real MVPs when it comes to this stuff. Don’t try to DIY this.

A pro will give you the best advice for your personal situation.

Key Considerations for Tax Planning

Yo, fam! Long-term care insurance can be a total game-changer for your future, but you gotta think about the tax implications. It’s not all sunshine and rainbows, so let’s get down to brass tacks on how to minimize the tax hit.This ain’t your average insurance policy; it’s a serious financial decision. Smart planning now can save you a ton of headaches and dough later.

We’re talking about serious cash, so let’s make sure you’re on the right track.

Strategies for Minimizing Tax Burden

Planning ahead is key to navigating the tax landscape of long-term care benefits. Proactively addressing potential tax implications can save you major coin. Don’t wing it; get organized and get your finances in order.

- Tax-advantaged savings accounts: Look into tax-advantaged accounts like Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs). These accounts can help you save for qualified long-term care expenses without getting hit with immediate taxes. Using these accounts can help offset the tax burden when benefits are paid out.

- Claiming deductions: Certain expenses related to long-term care insurance premiums might be deductible. Check with a tax pro to see what you can write off. Make sure you keep all receipts and documentation.

- Timing of benefits receipt: Strategically planning when you receive benefits can sometimes minimize tax impact. This is something you should discuss with a financial advisor to understand the implications based on your personal financial situation.

Importance of Pre-Planning

Seriously, pre-planning is crucial. You don’t want to be scrambling to figure out your taxes when you’re already dealing with the realities of long-term care. Get your ducks in a row now, and you’ll be way ahead of the game.

- Proactive approach: Think about your long-term financial goals and how long-term care insurance fits into the bigger picture. This involves anticipating your needs and planning accordingly. Don’t just buy a policy; understand its impact on your overall financial strategy.

- Long-term care needs: Understand your potential long-term care needs. Factor in potential costs and how insurance can help. A comprehensive understanding of your situation is crucial for effective planning.

Consulting with a Tax Advisor

Talking to a tax advisor is seriously essential. They can give you personalized advice based on your specific situation. They can help you navigate the tax maze and make sure you’re making the best choices for your money.

- Personalized advice: A tax advisor can provide tailored guidance on tax implications based on your income, expenses, and long-term care needs. Their expertise is invaluable in navigating the complexities of the tax code.

- Navigating the tax code: The tax code is complex. A tax advisor can explain the intricacies of long-term care insurance benefits and their tax treatment. They can help you avoid potential pitfalls.

- Minimizing tax liability: They can help you identify strategies to minimize your tax liability related to long-term care insurance benefits. Their insights can save you a substantial amount of money over time.

Role of Insurance Policies in Long-Term Financial Planning

Insurance policies, like long-term care, are a critical part of your overall financial strategy. They can protect you from significant financial burdens and help you maintain your lifestyle. They’re like a safety net, but you gotta know how to use them.

- Protection from financial burdens: Long-term care insurance can protect you from the substantial costs of care, helping you maintain your financial stability during challenging times.

- Maintaining lifestyle: The ability to maintain your lifestyle, even with the need for long-term care, is a key consideration. Insurance can help offset the financial strain.

Tax-Advantaged Savings Strategies

There are a bunch of tax-advantaged savings strategies you can use to help offset the costs of long-term care. These strategies can make a huge difference in the long run.

- Health Savings Accounts (HSAs): Contribute to a Health Savings Account (HSA) to save for qualified long-term care expenses. Money in an HSA grows tax-free, and withdrawals for qualified medical expenses are tax-free too.

- Flexible Spending Accounts (FSAs): FSAs let you set aside pre-tax dollars for eligible healthcare expenses, including long-term care premiums. This can reduce your current tax burden.

Impact on Overall Financial Planning

Long-term care insurance plays a big role in your overall financial planning. It’s not just about the money; it’s about your future security and peace of mind. Consider the total picture and how insurance can help you stay on track.

- Long-term security: Long-term care insurance can provide crucial financial security during a challenging time, ensuring you can afford the care you need without jeopardizing your savings or investments.

- Peace of mind: Knowing you have a safety net for future care can bring peace of mind. You can focus on other aspects of your life without the constant worry about financial burdens.

Epilogue

In conclusion, navigating the tax implications of long-term care insurance benefits requires careful consideration. While these benefits can provide crucial financial support, understanding the potential tax consequences is paramount for effective financial planning. Consulting with a qualified tax professional is highly recommended to tailor strategies to your specific circumstances and minimize your tax burden. Ultimately, this comprehensive analysis empowers you to make informed choices regarding your long-term care insurance and tax planning.

Expert Answers

Are long-term care insurance premiums tax deductible?

In some cases, long-term care insurance premiums may be tax deductible, depending on your specific circumstances and the applicable tax laws. It’s essential to consult with a tax professional for personalized guidance.

How are long-term care benefits taxed if received through a third-party?

The tax treatment of long-term care benefits received through a third-party, such as a nursing home, will vary based on the specific circumstances. The type of care provided and the payment structure influence the tax implications. Consult a tax advisor for a precise assessment.

Can long-term care benefits be used to offset other healthcare expenses?

The specific way long-term care benefits are used to offset healthcare expenses depends on the terms of the insurance policy and applicable regulations. Consult with your insurance provider and a tax advisor for clarification.

What are the tax implications of receiving long-term care benefits as a lump sum versus monthly payments?

The tax treatment of long-term care benefits differs significantly depending on whether they are received as a lump sum or monthly payments. The timing and structure of the payments significantly affect the tax consequences. Consult a tax professional to understand the nuances.

Nimila

Nimila