Is long term care insurance benefits taxable – Is long-term care insurance benefits taxable? Navigating the complexities of long-term care insurance and its tax implications can feel daunting. This exploration delves into the intricacies of this crucial topic, shedding light on the potential tax benefits and liabilities associated with these vital policies. From understanding coverage options to deciphering tax rules, we aim to empower you with the knowledge needed to make informed decisions about your financial future.

Long-term care insurance is designed to provide essential support during a period of extended care needs. Understanding the tax implications of premiums paid and benefits received is paramount. This guide will help you clarify your rights and responsibilities in this important area. This comprehensive guide provides a detailed overview of long-term care insurance and its taxation. It covers everything from premium deductions to the tax treatment of various benefits, including in-home care, assisted living, and other relevant services.

Defining Long-Term Care Insurance Benefits: Is Long Term Care Insurance Benefits Taxable

Long-term care insurance provides financial protection against the substantial costs associated with prolonged caregiving needs. These policies aim to offset expenses incurred as individuals require assistance with activities of daily living (ADLs) or instrumental activities of daily living (IADLs). Understanding the nuances of coverage is crucial for individuals seeking to mitigate the financial strain of long-term care.Long-term care insurance policies offer varying degrees of coverage, from basic assistance with daily tasks to comprehensive care in specialized facilities.

Policy benefits are typically triggered when an insured individual meets specific criteria related to functional limitations, demonstrating a need for ongoing care beyond the scope of short-term assistance.

Coverage Options

Long-term care insurance policies frequently offer different coverage options, catering to varying needs and financial situations. These options may include specific benefits for in-home care, assisted living facilities, or skilled nursing facilities. Individual policy structures determine the types and levels of care included.

Types of Long-Term Care Services Covered

Policies typically cover a range of services designed to support individuals requiring assistance with daily activities. This encompasses personal care tasks such as bathing, dressing, and transferring, as well as managing medications and household chores. Policies may also include coverage for specialized therapies, such as physical, occupational, or speech therapy, if these services are deemed medically necessary for maintaining or improving the insured’s health and well-being.

Ways Long-Term Care Insurance Benefits Can Be Used, Is long term care insurance benefits taxable

Long-term care insurance benefits can be utilized in diverse settings to provide comprehensive care. These settings can include in-home care services provided by nurses, aides, or other caregivers, assisted living facilities offering a supportive environment with varying levels of assistance, and skilled nursing facilities offering intensive medical care. Policies often detail specific requirements and conditions for utilizing these options, ensuring that benefits are directed toward appropriate care settings.

Typical Expenses Covered by Long-Term Care Insurance

| Expense Category | Description |

|---|---|

| In-home care | Expenses for caregivers providing assistance with personal care, medication management, and household tasks. |

| Assisted living facilities | Costs associated with residence and care in facilities offering varying levels of support, including assistance with activities of daily living. |

| Skilled nursing facilities | Expenses for comprehensive medical care and skilled nursing services in facilities providing intensive care. |

| Medical supplies and equipment | Costs related to durable medical equipment, mobility aids, and other assistive devices. |

| Respite care | Short-term caregiving services allowing primary caregivers to rest and recover. |

Policies vary in the specific expenses covered and the reimbursement amounts. It is essential to carefully review the policy’s terms and conditions to understand the full extent of coverage.

Tax Implications of Long-Term Care Insurance

Long-term care insurance premiums and benefits often have complex tax implications, significantly affecting policyholders’ financial planning. Understanding these implications is crucial for making informed decisions regarding insurance coverage and optimizing financial outcomes. This section delves into the tax treatment of premiums and benefits, considering various scenarios and types of coverage.

Tax Treatment of Premiums Paid

Premiums paid for long-term care insurance are generally not tax deductible, similar to other types of insurance. However, there are exceptions. Tax deductions for premiums are contingent on the specific circumstances of the policyholder and their income.

- Deductibility in Certain Circumstances: In limited cases, premiums may be deductible. For example, if the policyholder is self-employed and the premiums are considered a business expense, or if the policyholder is eligible for a specific tax credit or deduction under applicable regulations, these premiums might be deductible. Further, certain states may have specific laws related to deductibility. It is essential to consult with a qualified tax advisor to determine eligibility.

Tax Implications of Receiving Long-Term Care Benefits

Long-term care benefits received from a policy are generally tax-free, similar to other types of insurance benefits that cover medical expenses. This is a crucial aspect to understand for individuals planning their retirement and long-term financial security.

- Taxation of Benefits: The receipt of long-term care benefits is typically not taxable income. However, the specific tax implications depend on the nature of the benefit. Some benefits may be subject to specific tax rules or requirements, such as certain reimbursements or other financial arrangements related to the benefits. Policyholders should consult with a qualified tax professional for guidance.

Differences in Tax Treatment for Various Types of Benefits

Different types of long-term care insurance benefits may have varying tax treatments. For instance, benefits received for custodial care, such as assistance with daily activities, may be treated differently from benefits received for skilled nursing care.

- Categorization of Benefits: The nature of the care received, whether it’s custodial or skilled nursing care, plays a significant role in the tax treatment. Different types of benefits often have specific regulations governing their tax implications.

Comparison to Other Insurance Benefits

The tax treatment of long-term care insurance benefits often contrasts with that of other types of insurance, such as health insurance. While health insurance premiums are generally not deductible, long-term care premiums may have exceptions under specific circumstances.

- Distinct Treatment: The tax treatment of long-term care insurance differs from health insurance in that the premiums are not typically deductible, although exceptions exist. The benefits received from long-term care policies are generally tax-free, contrasting with potential tax implications associated with health insurance reimbursements or other benefits.

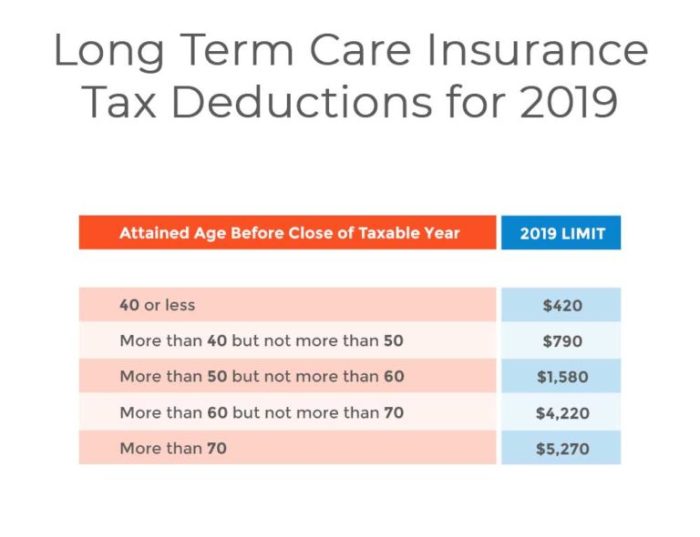

Tax Deductions for Long-Term Care Insurance Premiums

The following table illustrates potential tax deductions for long-term care insurance premiums, considering different scenarios and income levels. It is crucial to note that this is not an exhaustive list, and specific situations may have different implications. Tax laws are subject to change. Consult with a tax professional for personalized advice.

| Scenario | Income Level | Potential Tax Deduction |

|---|---|---|

| Self-employed individual | $50,000 – $100,000 | Possibly deductible as a business expense |

| Employee with health insurance | $75,000 – $150,000 | Not typically deductible |

| High-income individual with significant assets | Over $200,000 | Limited deductibility, subject to specific regulations |

Taxability of Long-Term Care Benefits

Long-term care insurance benefits, while intended to provide crucial financial support during periods of extended care, are not always exempt from taxation. The taxability of these benefits hinges on the specific nature of the benefits received and the individual’s circumstances. Understanding the intricacies of tax implications is essential for beneficiaries to accurately assess the net value of their long-term care insurance policies.

Situations Where Long-Term Care Benefits Are Taxable

Long-term care insurance benefits are generally taxable when they are considered to be payment for services or reimbursement for expenses incurred. This is in contrast to situations where the benefits are solely for personal needs or expenses, such as a lump-sum payout for a pre-existing condition. Taxability often arises when the benefits cover services or expenses directly related to the recipient’s care, and not simply the replacement of lost income.

Specific Circumstances Leading to Taxability

Several specific circumstances can lead to the taxability of long-term care benefits. These include, but are not limited to, situations where the benefits cover skilled nursing facility care, home health aides, or other professional care services. Furthermore, if the benefits are used to compensate for expenses that would otherwise be deductible as medical expenses, they are often deemed taxable income.

Crucially, benefits received in exchange for a service, such as a caregiver’s salary, will be considered taxable.

Tax Rates Applicable to Long-Term Care Benefits

The tax rates applicable to long-term care benefits are consistent with the recipient’s overall tax bracket. The recipient’s taxable income, including any other income sources, is used to determine the applicable tax rate. This is consistent with general income tax principles. Long-term care benefits are not subject to special tax rates.

Factors Influencing the Taxability of Long-Term Care Benefits

Several factors influence the taxability of long-term care benefits. The type of care covered by the benefits, the specific provisions of the insurance policy, and the recipient’s overall financial situation are critical considerations. The nature of the services provided, the amount of expenses covered, and the payment method used can all impact the tax treatment of the benefits.

Categorization of Taxable Long-Term Care Benefits

| Circumstance | Taxability | Explanation |

|---|---|---|

| Benefits used for skilled nursing facility care | Generally Taxable | These benefits often cover expenses that would otherwise be deductible medical expenses. |

| Benefits used for home health aides | Generally Taxable | Payments to home health aides are considered compensation for services rendered. |

| Benefits used for custodial care | Potentially Taxable | The taxability of benefits for custodial care depends on the specific policy and the nature of the care. |

| Benefits used to replace lost income | Generally Taxable | These benefits are often considered a substitute for lost earnings and thus taxable. |

| Benefits used to cover expenses that would otherwise be deductible | Generally Taxable | If the benefits are used to pay for expenses that would otherwise be deductible medical expenses, they are often considered taxable income. |

Deductibility of Long-Term Care Expenses

Long-term care expenses can be significant financial burdens for individuals and families. Understanding the circumstances under which these expenses are deductible is crucial for managing tax liabilities and ensuring appropriate financial planning. This section delves into the specific rules and regulations governing the deductibility of long-term care expenses, outlining eligible types of expenses, calculation methods, and providing illustrative examples.

Circumstances for Deductibility

The deductibility of long-term care expenses is governed by specific statutory provisions and regulations. These provisions often stipulate that expenses are deductible only under certain conditions, such as the nature of the care received, the individual’s health status, and the type of care provider.

Types of Deductible Long-Term Care Expenses

A variety of expenses related to long-term care services may be deductible. These expenses typically include those incurred for professional medical care, such as the services of nurses, physical therapists, and occupational therapists, as well as related supplies and equipment. The expenses must be directly related to the provision of long-term care services and must be reasonable in amount.

Further, costs for home modifications to accommodate long-term care needs may also qualify for deductions in certain situations.

Calculation of Deductible Amounts

The calculation of deductible long-term care expenses often involves specific rules and limitations. Deductible amounts are typically limited by a percentage of the taxpayer’s adjusted gross income or by other prescribed limits. Furthermore, any expenses exceeding these limitations are not deductible. The precise calculation method is dependent on the specific statutory provisions and regulations in effect.

Examples of Deductible and Non-Deductible Expenses

Illustrative examples can clarify the criteria for deductibility. Expenses for skilled nursing care provided in a licensed facility are generally deductible, provided they meet the requirements. Conversely, expenses for routine personal care services, such as help with dressing or bathing, are typically not deductible. Expenses for luxury accommodations or services unrelated to the provision of long-term care are also not deductible.

Criteria for Deducting Long-Term Care Expenses

| Criteria | Qualifying Expenses | Non-Qualifying Expenses |

|---|---|---|

| Nature of Care | Expenses for skilled nursing care, physical therapy, occupational therapy | Expenses for routine personal care, housekeeping |

| Provider Status | Expenses for care provided by licensed professionals | Expenses for care provided by untrained individuals |

| Relationship to Long-Term Care | Expenses for medical equipment and home modifications necessary for long-term care | Expenses for general household repairs or upgrades |

| Reasonable Amounts | Expenses for medically necessary care at reasonable costs | Expenses for extravagant or unnecessary care |

Note: This table provides a general overview. Consult with a qualified tax professional for personalized advice regarding specific situations.

Specific Scenarios and Considerations

The tax implications of long-term care insurance benefits are multifaceted and depend on various individual circumstances. Understanding these nuances is crucial for individuals to accurately assess the financial impact of these benefits. This section delves into specific scenarios, highlighting the interplay between income levels, employment status, state residency, and the source of the benefits themselves.

Tax Implications for Varying Income Levels

The taxability of long-term care benefits is directly tied to the recipient’s overall income. Higher income levels often result in a greater portion of the benefits being subject to taxation. This is due to the progressive nature of the tax system, where higher earners pay a larger percentage of their income in taxes. For example, an individual in the highest tax bracket might find a significantly larger portion of their long-term care benefits taxed compared to someone with a much lower income.

Tax Treatment for Self-Employed Individuals

Self-employed individuals face unique tax considerations regarding long-term care benefits. Because self-employed individuals often have more complex tax situations, including self-employment taxes, the taxation of long-term care benefits must be analyzed within the context of their entire tax picture. These individuals must carefully account for the potential tax implications of both the benefits received and any deductions related to the premiums they paid.

For instance, if the premiums are considered a business expense, the tax deduction will reduce the overall tax burden.

Tax Implications Based on State Residency

State-level tax laws can influence the taxability of long-term care benefits. Different states have varying tax rates and structures. This may affect how much of the benefits are subject to state income taxes. For example, a state with a higher state income tax rate might lead to a larger portion of the benefits being taxed at the state level.

Careful consideration of the recipient’s state of residence is essential in calculating the total tax liability.

Taxation of Employer-Sponsored Plan Benefits

Employer-sponsored long-term care insurance plans can offer significant tax advantages. In many cases, premiums paid by the employer are typically not considered taxable income for the employee. Conversely, the benefits received are generally tax-free if they are used for qualified long-term care services. This creates a favorable tax environment for employees participating in such plans. Further, the employer’s contribution may be tax-deductible, impacting the overall financial picture of the company.

Tax Implications for Specific Health Conditions

The tax treatment of long-term care benefits may vary based on the recipient’s specific health condition. For individuals with pre-existing conditions, the calculation of the benefits might be slightly different. For example, if a pre-existing condition significantly impacts the recipient’s ability to work, this might affect the tax implications.

Table: Impact of Income Level on Taxability of Long-Term Care Benefits

| Income Level | Tax Implications |

|---|---|

| Low | A smaller portion of the benefits is typically taxable, or potentially no portion is taxed, due to lower overall tax bracket. |

| Middle | A moderate portion of the benefits might be subject to taxation, depending on the specific tax rates and brackets applicable to the individual. |

| High | A larger portion of the benefits will likely be taxable due to the higher tax brackets. |

Illustrative Examples

Long-term care insurance premiums and benefits are subject to complex tax rules, varying significantly depending on individual circumstances and specific policy provisions. These illustrations demonstrate the practical application of these rules across diverse situations, highlighting the nuances of tax treatment in long-term care insurance.

Premium Payment Tax Implications

Premiums paid for long-term care insurance are typically not deductible as an itemized expense for federal income tax purposes. This means the premiums paid are considered personal expenses and do not reduce taxable income. However, certain situations may offer exceptions. For instance, some employers may offer long-term care insurance as a benefit, and the premiums paid through the employer-sponsored plan might not be taxable to the employee.

Taxation of Long-Term Care Benefits

Long-term care benefits received from an insurance policy are generally taxable as ordinary income. This means the recipient will need to report the benefit amount on their income tax return, and it will be subject to standard income tax rates. The specific amount included in the recipient’s gross income will vary according to the terms of the policy and applicable regulations.

Deductibility of Long-Term Care Expenses

In certain situations, long-term care expenses may be deductible. These expenses typically arise when individuals pay for care outside of their insurance coverage, and some circumstances permit a deduction for these expenses as itemized deductions. Examples include medical expenses exceeding a certain percentage of adjusted gross income.

Taxation of Long-Term Care Benefits for Self-Employed Individuals

Self-employed individuals face unique tax considerations regarding long-term care insurance. Premiums paid for self-employed individuals are generally not deductible as a business expense. However, the self-employed individual may be able to deduct the premiums paid as a business expense under certain circumstances, such as when the insurance is considered a necessary business expense to support the business owner’s health.

The self-employed individual’s benefits received would be taxed as ordinary income.

Variability in Tax Treatment Based on State Laws

State laws can influence the tax treatment of long-term care benefits. For example, some states may offer specific deductions or credits for long-term care expenses, while others may not. The presence or absence of such state-level provisions can impact the overall tax burden on individuals receiving long-term care benefits.

Comparison of Tax Implications Across Benefit Sources

| Benefit Source | Tax Treatment of Premiums | Tax Treatment of Benefits |

|---|---|---|

| Private Long-Term Care Insurance | Generally not deductible | Taxed as ordinary income |

| Employer-Sponsored Long-Term Care Insurance | May or may not be taxable to the employee | Taxed as ordinary income |

| Government Programs (e.g., Medicaid) | Not applicable | Generally not taxable, depending on the specific program and benefit |

This table illustrates the general tax implications associated with long-term care benefits from different sources. The specific tax treatment will depend on the specific policy, plan, and applicable regulations. Individuals should consult with a qualified tax professional for personalized advice.

Illustrative Example: Premium Payments

A single individual, Jane Doe, pays $2,500 annually in premiums for a long-term care insurance policy. This amount is not deductible as an itemized expense for federal income tax purposes.

Illustrative Example: Benefits Received

Mr. Smith receives $4,000 per month in long-term care benefits from his insurance policy. This amount is considered ordinary income and is subject to federal and potentially state income tax.

Illustrative Example: Deductible Expenses

A retired individual, Ms. Brown, incurs $10,000 in long-term care expenses in a year. If these expenses exceed a certain percentage of her adjusted gross income, a portion of these expenses might be deductible as itemized medical expenses.

Illustrative Example: Self-Employed Individual

A self-employed contractor, Mr. Jones, pays $3,000 in premiums for a long-term care insurance policy. In this scenario, the premiums are not deductible as a business expense unless the insurance is deemed a necessary business expense. Any benefits received would be taxed as ordinary income.

Illustrative Example: State Variations

A resident of State X receives long-term care benefits and experiences a different tax treatment compared to a resident of State Y. State X might offer a tax credit for long-term care expenses, while State Y does not. This demonstrates the variation in tax implications across different jurisdictions.

Epilogue

In conclusion, understanding the tax implications of long-term care insurance is essential for making informed financial decisions. The tax treatment of premiums, benefits, and expenses varies significantly based on individual circumstances, income levels, and state regulations. We’ve explored the nuances of this topic, highlighting the key factors influencing taxability and providing a comprehensive overview. This guide aims to empower you to navigate these complex considerations, ensuring you are well-equipped to protect your financial well-being during periods of extended care.

FAQ Resource

Are premiums paid for long-term care insurance tax deductible?

In some cases, premiums paid for long-term care insurance may be tax-deductible. Specific rules and regulations regarding deductibility vary based on individual income levels and other factors.

What types of long-term care services are typically covered?

Coverage options often include in-home care, assisted living facilities, and skilled nursing care. Specific services vary depending on the policy.

How do state laws influence the tax treatment of long-term care benefits?

State laws can affect the taxability of long-term care benefits. There may be variations in the tax implications depending on the state of residence.

Can long-term care expenses be deductible?

Certain long-term care expenses may be deductible, but eligibility is subject to specific rules and regulations. Detailed guidelines and specific examples will be provided in the comprehensive guide.

Nimila

Nimila