How to write a letter stating deductible to employer? This comprehensive guide provides a step-by-step approach to successfully submitting deductible claims to your employer. It delves into the intricacies of understanding deductible claims, from the fundamental definitions to the crucial documentation needed for a smooth reimbursement process. We’ll explore the necessary letter structure, supporting documentation requirements, and strategies for handling potential objections.

Navigating the process of claiming reimbursements can be tricky, but this guide simplifies the procedure. From understanding the legal framework to avoiding common mistakes, this detailed Artikel empowers you with the knowledge and tools to maximize your chances of success.

Understanding Deductible Claims

A deductible, in the context of employer reimbursements, is a specific amount of expenses an employee must pay out-of-pocket before the employer begins to cover the costs. This threshold is often a crucial element in understanding and managing healthcare expenses. Knowing the deductible helps employees budget and anticipate the financial commitment required for various medical or other covered services.Deductibles are designed to encourage cost-consciousness and manage the overall cost of healthcare or other eligible expenses.

They provide a clear boundary between the employee’s responsibility and the employer’s reimbursement commitment. Accurate record-keeping and understanding the specifics of your employer’s plan are vital for claiming reimbursements effectively.

Definition of Deductible Expenses

A deductible represents the amount of expenses an employee must pay before their employer starts covering medical, dental, or other eligible expenses. It acts as a financial threshold, ensuring employees share a portion of the costs. Employers often set different deductibles for various categories of expenses.

Types of Deductible Claims

Various types of expenses qualify for employer reimbursements, often with distinct deductibles. These categories commonly include medical expenses, dental expenses, vision care, and even some over-the-counter medications depending on the employer’s plan. It’s essential to understand the specific types of claims your employer covers to ensure accurate documentation and claim processing.

Importance of Accurate Documentation

Accurate documentation is critical when claiming reimbursements for deductible expenses. This ensures proper categorization and approval of the expenses. Clear and detailed records of expenses, including dates, descriptions, receipts, and any required supporting documents, are vital for processing the claims efficiently and avoiding delays. Thorough documentation minimizes potential issues during the claim review process.

Common Deductible Expenses

This table Artikels common deductible expenses for various categories, offering a quick reference for employees. Note that specific amounts and coverage vary significantly based on the employer’s plan. Always consult your employer’s policy for the most up-to-date information.

| Category | Examples of Expenses |

|---|---|

| Medical | Doctor visits, hospital stays, prescription medications, lab tests, physical therapy |

| Dental | Check-ups, cleanings, fillings, crowns, bridges |

| Vision | Eye exams, eyeglasses, contact lenses |

| Other | Eligible over-the-counter medications (verify with your employer), some preventive care (check your plan details) |

Letter Structure and Format

Crafting a clear and professional letter requesting a deductible claim from your employer is crucial for a smooth and efficient process. This structured approach ensures your claim is understood and processed promptly. The letter’s format and language directly impact its effectiveness.Understanding the specific format and language elements for this letter is paramount. A well-structured letter will expedite the processing of your claim and ensure your employer fully understands your request.

The subsequent sections will detail the structure and language elements to use for maximum effectiveness.

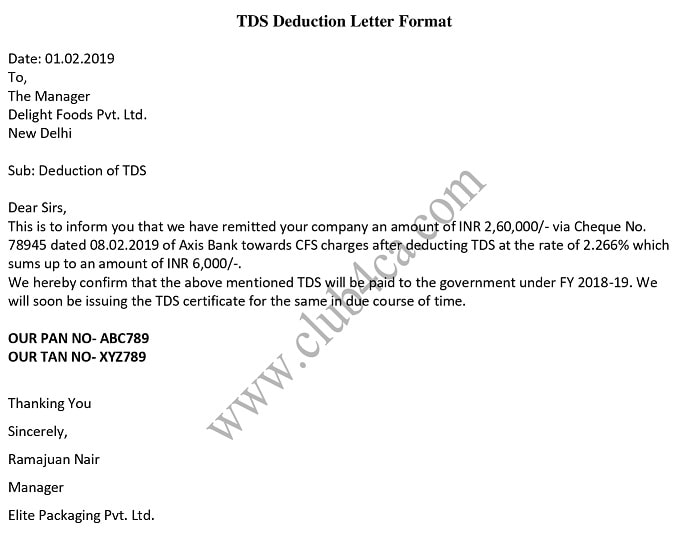

Letter Template, How to write a letter stating deductible to employer

This template provides a structured format for requesting a deductible claim from your employer. The organized layout ensures clarity and completeness.

[Your Name] [Your Address] [Your Phone Number] [Your Email Address] [Date] [Employer Name] [Employer Address] Subject: Deductible Claim Request - [Your Name] -[Policy Number, if applicable] Dear [Employer Contact Person, if known, otherwise use title like "Dear HR Department"], This letter formally requests the processing of my deductible claim for [brief description of deductible, e.g., medical expenses, accident claim]. Relevant documentation, including [list key documents, e.g., medical bills, receipts, accident report], is attached for your review. [Optional: Briefly explain the reason for the claim, e.g., "I incurred these expenses as a result of a recent accident."]. I request that you process my claim in accordance with the terms Artikeld in our [Policy Name or Company Policy Document].Please advise on the next steps for processing my claim. Thank you for your time and attention to this matter. Sincerely, [Your Signature] [Your Typed Name]

Elements of the Letter

The letter should encompass several key elements presented in a logical order, ensuring clarity and conciseness. Each component contributes to a complete and understandable claim.

- Header: Includes your contact information and the employer’s contact information. The date is essential. The subject line should clearly state the purpose of the letter.

- Introduction: Clearly state the purpose of the letter, requesting a deductible claim. Mention the type of deductible claim, using precise language.

- Details: Provide a concise summary of the expenses. Attach supporting documents like receipts and bills to substantiate your claim. Explain the reason for the claim, if appropriate.

- Request: State your request for processing in accordance with company policy, and inquire about the next steps.

- Closing: Express gratitude and reiterate your commitment to the claim process.

Professional Language Examples

Using precise and professional language throughout the letter enhances its credibility and efficiency. The following examples demonstrate this.

- Instead of: “I had some medical bills.”

Use: “I incurred medical expenses totaling [amount] due to [brief reason].” - Instead of: “I’m asking for the deductible.”

Use: “I request the processing of my deductible claim in accordance with our company policy.” - Instead of: “The papers are attached.”

Use: “Supporting documentation, including medical bills and receipts, is attached for your review.”

Formatting for Readability

Proper formatting enhances the letter’s clarity and professionalism.

- Use a clear and consistent font.

- Maintain proper spacing between paragraphs.

- Use bullet points or numbered lists for complex information.

- Ensure the letter is concise and avoids unnecessary jargon.

Supporting Documentation

Providing adequate supporting documentation is crucial for successfully processing deductible claims. This meticulous documentation verifies the expenses incurred and ensures the employer’s fair and accurate reimbursement. Thoroughness in this step is key to minimizing delays and potential disputes.

Supporting documentation serves as the bedrock of a valid deductible claim. It acts as irrefutable evidence, substantiating the incurred expenses and demonstrating their direct connection to the employee’s need. Without proper documentation, the claim may be rejected or significantly delayed.

Types of Supporting Documents

Proper documentation involves various types of supporting materials. These include, but are not limited to, receipts, invoices, and medical bills. These documents are fundamental to the verification process and should be collected diligently.

- Receipts: Receipts serve as tangible proof of payment for the incurred expenses. They typically include details like date, time, amount, and description of the purchase. They must clearly indicate the relationship between the expense and the employee’s deductible claim.

- Invoices: Invoices are essential when the expenses are incurred from a vendor or service provider. These documents detail the service rendered, quantities, rates, and total amounts owed. Ensure the invoice aligns with the deductible claim’s scope.

- Medical Bills: Medical bills are crucial for demonstrating the cost of medical treatments, procedures, or consultations. They often include details such as the date of service, diagnosis, procedures performed, and the total amount charged.

Format and Organization of Documents

The format of supporting documents should be consistent and easily understandable. A structured approach to organizing documents will significantly facilitate the review process. This will streamline the claim and prevent any unnecessary delays.

- Receipt Organization: Organize receipts chronologically, grouping them by the date of purchase. Label each receipt clearly, including the date, description, and amount. Consider using a spreadsheet to list these details for easier referencing.

- Invoice Organization: Invoices should be organized in a similar manner to receipts, grouping them by the date of service or purchase. Each invoice should be accompanied by a brief description of how the service or product relates to the deductible claim.

- Medical Bill Organization: Medical bills should be organized chronologically, listing each bill by date of service. Include a brief explanation of how each service or procedure is related to the employee’s deductible claim. If possible, arrange these bills in a logical order, such as by procedure, diagnosis, or treatment plan.

Compilation Procedure

A well-defined procedure for compiling these documents will prevent omissions and ensure all necessary elements are included. This systematic process is vital for the accurate and efficient processing of deductible claims.

- Gather All Documents: Collect all relevant receipts, invoices, and medical bills related to the deductible claim. Be meticulous in gathering all documents, even if they seem insignificant.

- Organize Chronologically: Arrange the documents chronologically by the date of the service or purchase. This provides a clear and concise presentation of the expenses.

- Document Verification: Thoroughly review all documents to ensure accuracy. Cross-check details like dates, amounts, and descriptions to prevent errors.

- Maintain Documentation: Store the compiled documents securely and ensure they are easily accessible for reference if needed. Maintain copies of these documents in a safe place for future reference.

Addressing Potential Objections

Navigating employer responses to deductible claims requires a proactive and well-structured approach. A preemptive strategy, outlining potential concerns and offering solutions, can streamline the process and facilitate a smoother resolution. Understanding common objections and formulating effective counterarguments is key to successfully asserting your claim.

Potential Employer Objections

Employers may raise various objections to deductible claims. These objections often stem from differing interpretations of policy terms, lack of supporting documentation, or perceived misuse of benefits. Thorough preparation and a clear articulation of your claim are crucial to addressing these concerns.

Strategies for Addressing Objections

A professional and diplomatic approach is vital when confronting potential employer objections. Emphasize the importance of accurate record-keeping and the need for clarity in benefit administration. A well-organized presentation, coupled with concise and factual arguments, will strengthen your position.

- Documentation Issues: Employers might request additional documentation to validate your claim. Having comprehensive records, including receipts, invoices, and medical reports, is essential. A detailed explanation of the incurred expenses and their relation to the policy’s stipulations will bolster your case. Providing a comprehensive summary of the expenses and their supporting documentation, demonstrating a clear understanding of the policy, will alleviate concerns.

- Policy Interpretation Discrepancies: Differences in interpretation of policy terms can lead to objections. Familiarize yourself with the precise wording of your deductible policy. If ambiguity exists, refer to official documentation, clarifying the specific terms that relate to your situation. Precisely outlining how your expenses fall under the defined terms of the policy will resolve any misunderstandings. Highlighting specific clauses and their applicability to your case strengthens your claim.

- Timeliness Concerns: Delays in submitting or processing claims can lead to objections. Adhere to deadlines Artikeld in your employer’s policy. If delays occur due to unforeseen circumstances, communicate these issues promptly to the relevant personnel. Ensure all correspondence is meticulously documented and timed for future reference, which can mitigate concerns related to timing.

Resolving Disputes

Disputes concerning deductible claims should be approached with a collaborative spirit. Maintaining open communication with your employer’s benefits department is essential. A proactive approach, emphasizing understanding and a desire for resolution, will facilitate a smoother process.

- Seeking Clarification: If you encounter ambiguities, request clarification regarding the policy’s stipulations. Formal written requests, clearly outlining the areas of uncertainty, will avoid misinterpretations and pave the way for a more accurate assessment of your claim.

- Negotiation Strategies: A constructive dialogue with your employer’s benefits representative can help find a mutually acceptable solution. Highlighting the reasonableness of your claim and demonstrating your understanding of the policy will strengthen your case. Present a clear summary of your claim, focusing on the evidence and how it aligns with the policy’s terms, promoting mutual understanding and cooperation.

- Formal Complaint Procedures: If negotiations fail, be aware of the formal complaint procedures established by your employer or the insurance provider. Following these established procedures will provide a structured way to address the issue and potentially escalate it if necessary. Thorough documentation and adherence to the defined complaint resolution process will facilitate a more effective resolution.

Legal Considerations

Navigating the legal landscape surrounding employee deductions requires a meticulous understanding of the relevant laws and regulations. This section delves into the legal framework, highlighting key aspects of reimbursement policies, and comparing various company policies to provide a comprehensive overview. Careful attention to these details is crucial to ensure a smooth and compliant process for both the employee and the employer.

Understanding the legal framework surrounding employee deductions is essential to avoid potential conflicts and ensure a fair process. This involves comprehending the specific laws and regulations governing reimbursements, recognizing the nuances in company policies, and ultimately, presenting a claim that aligns with established legal precedents.

Legal Framework for Employee Deductions

The legal framework for employee deductions is multifaceted, encompassing various federal and state laws. Regulations typically Artikel the permissible deductions, required documentation, and procedures for processing claims. This framework aims to protect employee rights and ensure fair treatment.

Relevant Laws and Regulations Regarding Reimbursements

Several laws and regulations govern reimbursement claims, particularly those related to business expenses. Internal Revenue Service (IRS) guidelines often define the acceptable expenses and the necessary supporting documentation. State laws may also impose specific requirements, and a comprehensive understanding of these diverse regulations is vital.

Comparison of Company Policies

Different companies often have varying policies regarding employee reimbursements. Some companies may have stricter guidelines regarding the types of expenses covered or the required documentation, while others may offer more flexible approaches. Examining these differences is important to understand the potential scope of claims and how they may vary based on the specific employer’s policies.

Regulations and Examples

| Regulation Area | Description | Example |

|---|---|---|

| IRS Publication 502 | Provides guidance on business expenses and deductions. | Describes the types of business-related expenses that are deductible, such as travel, meals, and entertainment. |

| State Tax Regulations | May impose specific requirements on reimbursement claims, potentially differing from federal regulations. | A state may have specific rules for meal expenses incurred while traveling for business purposes. |

| Company Policies | Internal policies that Artikel procedures and documentation for employee reimbursements. | A company may require receipts for all expenses exceeding a certain threshold. |

| Labor Laws | Regulations that protect employee rights and ensure fair treatment in the workplace. | Laws may prohibit discrimination in reimbursement practices based on employee demographics. |

Addressing Potential Discrepancies

Identifying and addressing potential discrepancies between company policies and legal regulations is critical. This requires a thorough understanding of both the employer’s internal policies and the relevant legal framework. Discrepancies might arise from ambiguities in policies or the specific requirements of certain regulations.

Best Practices and Tips: How To Write A Letter Stating Deductible To Employer

Submitting a deductible claim effectively requires careful planning and execution. A well-structured and clearly presented letter significantly increases the likelihood of a swift and positive resolution. Following best practices ensures a smooth process for both the employee and the employer. Clear communication and meticulous attention to detail are crucial elements for success.

Thorough preparation and adherence to the employer’s specific claim procedures are paramount for a positive outcome. A well-written letter, accompanied by the necessary supporting documentation, demonstrates a proactive approach to resolving the claim.

Submitting the Claim Letter

Careful consideration of the letter’s structure, language, and presentation enhances the chances of a prompt and positive response. This section details key elements for an effective claim submission.

- Professional Tone and Clarity: Maintain a professional tone throughout the letter. Avoid ambiguity or emotional language. Use precise language and ensure the letter’s message is easily understood. Clarity and conciseness are key. For instance, instead of “I believe my deductible is…” write “My deductible claim is calculated as…” This approach fosters clarity and avoids potential misunderstandings.

- Accurate and Complete Information: Provide all necessary details accurately. Incorrect or incomplete information can delay or reject the claim. Double-check all figures, dates, and other pertinent information to ensure accuracy. This includes details about the deductible amount, the dates of service, and any relevant medical codes.

- Precise and Specific Language: Use specific and precise language to describe the deductible claim. Vague language can lead to confusion and delays. For example, instead of “significant medical expenses,” state the exact amount and the reason for the expense.

Supporting Documentation

The strength of a claim often rests on the supporting documentation. This section highlights the importance of providing relevant materials.

- Comprehensive Documentation: Ensure all required supporting documents are included. This may include receipts, invoices, bills, medical reports, or any other relevant materials. Organize these documents chronologically for clarity.

- Proper Formatting: Organize supporting documents neatly and logically. Number or label each document for easy reference. Include a detailed list of the documents attached to the letter. A well-organized presentation demonstrates a serious and professional approach to the claim.

- Copies and Originals: Submit both copies and originals of crucial documents, as requested by the employer. Retain copies for your records. This ensures a clear record for both parties.

Communication Strategies

Effective communication plays a vital role in the claim process. This section Artikels strategies for clear and timely communication.

- Proactive Communication: Maintain open communication with the employer regarding the claim status. Request updates or clarifications when necessary. This proactive approach shows your commitment to resolving the claim promptly.

- Following Up: Follow up with the employer if there is a delay in processing the claim. This proactive follow-up ensures the claim is not overlooked.

- Addressing Concerns: Be prepared to address any potential objections from the employer. This proactive approach can help prevent unnecessary delays or complications.

Handling Rejection and Appeals

Navigating the rejection of a deductible claim can be frustrating, but a systematic approach and understanding of the process can significantly increase your chances of success. A clear and well-documented appeal, supported by compelling evidence, is crucial for effective advocacy. This section will Artikel the procedure for handling a rejected claim, and the steps involved in appealing the decision.

A rejected claim doesn’t necessarily mean the end of the process. Understanding the reasons for rejection and how to address them, coupled with a strong appeal, can often lead to a favorable outcome. This guide provides practical strategies for crafting an effective appeal letter and navigating the appeal process.

Procedure for Handling a Rejected Claim

The initial step upon receiving a rejection notice is careful review. Thoroughly examine the rejection letter, noting the specific reasons cited for denial. Identify any supporting documentation you might need to counter the objections. This includes reviewing the claim form, medical records, and any correspondence related to the claim. Understanding the grounds for rejection is critical for crafting a compelling appeal.

Process of Filing an Appeal

The appeal process typically involves following a specific protocol Artikeld by the insurance provider or employer. This often involves submitting a written appeal within a prescribed timeframe. The appeal should clearly state the reasons for the original claim, the specific points of disagreement with the rejection, and the supporting documentation. Be meticulous in documenting each step of the process, including dates, names of individuals contacted, and copies of all correspondence.

Common Reasons for Rejection and How to Address Them

- Insufficient Documentation: Ensure all required medical records, bills, and supporting evidence are included in the original claim. If there are gaps in the documentation, obtain any missing records and clearly explain the reason for the delay or absence of the document.

- Incorrect Diagnosis or Procedure Codes: Review the diagnosis and procedure codes used in the claim form. If necessary, consult with a healthcare professional to obtain corrected codes and/or additional documentation. Provide evidence to support the accurate coding and the medical necessity of the services.

- Exclusions or Limitations: If the claim is rejected due to coverage limitations or exclusions, thoroughly review your policy document. If the exclusion is unclear, request clarification from the insurer. Highlight specific provisions that might allow for coverage.

- Failure to Meet Waiting Periods or Eligibility Requirements: Ensure you understand the eligibility criteria and waiting periods. Provide any necessary documentation that satisfies the conditions for coverage, such as pre-authorization approvals or proof of eligibility.

- Denial of Medical Necessity: If the claim is rejected based on the medical necessity of the treatment, provide additional medical documentation and/or expert opinions to justify the need for the service. Highlight the professional recommendations and any relevant clinical guidelines that support the treatment.

Format of an Appeal Letter

A well-structured appeal letter is key to success. Include a clear and concise introduction, a detailed explanation of the rejected claim, and a request for reconsideration.

- Heading: Include the date, recipient’s name, and contact information.

- Statement of the Claim: Briefly reiterate the details of the original claim.

- Reasons for Rejection: Clearly state the insurer’s reasons for rejection.

- Counterarguments: Provide compelling evidence and arguments addressing the insurer’s objections. For example, if the insurer questioned the medical necessity of a service, include supporting documentation from a healthcare professional.

- Supporting Documentation: Attach all relevant documents to support your claim.

- Request for Reconsideration: Clearly state your request for the claim to be reconsidered.

- Closing: End the letter professionally, thanking the recipient for their time and attention.

Avoiding Common Mistakes

Submitting a deductible claim involves meticulous attention to detail. Errors, however seemingly minor, can lead to delays, rejections, and ultimately, the denial of your claim. Understanding the potential pitfalls and employing preventative measures is crucial for a successful outcome.

Inaccurate Claim Information

Providing incorrect or incomplete information is a common pitfall. This includes misrepresenting the medical expenses, dates of service, or the nature of the treatment. Mistakes in identifying the correct medical providers or treatment codes can also cause delays or rejection. Precise and accurate information is paramount. Ensure all details are double-checked for accuracy before submitting.

Carefully review the documentation provided by the healthcare provider. If any details are unclear, contact the provider immediately to get the correct information.

Missing or Insufficient Documentation

Failure to provide the necessary supporting documentation can result in claim rejection. This often involves missing receipts, bills, or other proof of payment. This could also include lacking the required pre-authorization or referrals. Thoroughly gather all relevant documents, including invoices, receipts, and medical reports. Organize them chronologically and clearly label each item.

A clear and comprehensive record of supporting evidence is essential for a smooth claim process.

Late Submission of Claims

Meeting deadlines is critical for successful claim processing. Submitting the claim after the stipulated timeframe may lead to automatic rejection. Employers typically have specific deadlines for the submission of deductible claims. Regularly review the employer’s policy regarding the claim submission deadlines. Set reminders and maintain a system to track important dates and deadlines.

If unforeseen circumstances prevent you from meeting the deadline, promptly contact your employer’s claims department to explain the situation.

Failure to Follow Claim Procedure

Not adhering to the specified claim procedures and formats can lead to delays or rejections. Employers have specific forms, instructions, and guidelines that need to be followed precisely. Carefully review the employer’s claim form and instructions. If there are any ambiguities, contact the claims department to seek clarification. Ensure that the submitted claim adheres to the specific format and requirements Artikeld by the employer.

Ignoring Claim Rejection Notifications

Ignoring rejection notices can hinder your ability to appeal or resubmit a corrected claim. Rejection notices usually explain the reason for rejection. If the claim is rejected, carefully review the reasons provided. Addressing the issues promptly and resubmitting a corrected claim with the necessary supporting documentation is essential.

Lack of Communication

Failing to communicate with the employer’s claims department about any issues or clarifications can impede the claim process. If you have any questions or concerns, contact the claims department immediately. Maintaining open communication with the claims department helps to avoid misunderstandings and expedite the processing of your claim.

Sample Letters

Understanding the nuances of a successful deductible claim, a rejected claim, and an appeal is crucial for navigating the process effectively. These sample letters illustrate the appropriate structure and tone for each scenario. They highlight key elements to include, ensuring clarity and professionalism.

Successful Claim Letter

This letter demonstrates the structure and content for a claim that was successfully processed.

| Section | Content |

|---|---|

| Date | October 26, 2023 |

| Recipient | Human Resources Department, Acme Corporation |

| Subject | Deductible Claim – John Smith – Employee ID: 12345 |

| Salutation | Dear Human Resources Department, |

| Claim Statement | I am writing to formally submit my claim for the deductible expenses incurred during the period of [Start Date] to [End Date]. These expenses relate to [briefly describe the medical expenses]. A detailed breakdown of the expenses is attached. |

| Supporting Documents |

|

| Supporting Documentation Explanation | The attached documents clearly Artikel the incurred expenses and the necessity of the medical services rendered. |

| Request | I request reimbursement for the deductible amount of $[Amount]. |

| Closing | Thank you for your prompt attention to this matter. Sincerely, John Smith |

Rejected Claim Letter

This letter demonstrates the structure for a rejected claim, outlining the necessary steps to address the rejection.

| Section | Content |

|---|---|

| Date | November 15, 2023 |

| Recipient | Employee Benefits Administrator, ABC Company |

| Subject | Appeal of Deductible Claim – Jane Doe – Employee ID: 67890 |

| Salutation | Dear Employee Benefits Administrator, |

| Claim Summary | My claim for deductible expenses, submitted on [Date of Original Claim], was recently denied. |

| Reasons for Rejection | The denial letter cited [specific reason for rejection, e.g., insufficient documentation, exceeding the coverage limit]. |

| Request for Review | I respectfully request a review of my claim, as I believe the rejection was based on a misunderstanding of the policy terms. I have attached additional supporting documentation to demonstrate the validity of my expenses. |

| Supporting Documents |

|

| Closing | Thank you for your time and consideration. Sincerely, Jane Doe |

Appeal Letter

This letter shows the appropriate format for appealing a rejected claim, emphasizing the importance of addressing the rejection’s specific points.

| Section | Content |

|---|---|

| Date | December 5, 2023 |

| Recipient | Employee Benefits Appeals Board, XYZ Corporation |

| Subject | Appeal of Deductible Claim – David Lee – Employee ID: 90123 |

| Salutation | To the Employee Benefits Appeals Board, |

| Claim Summary | My original claim for deductible expenses, submitted on [Date of Original Claim] and subsequently rejected on [Date of Rejection], is being appealed. |

| Reasons for Rejection | The denial letter cited [specific reason for rejection, e.g., insufficient documentation, exceeding the coverage limit]. |

| Addressing the Objections | I believe the rejection was based on an incomplete understanding of the policy. The attached documentation clearly demonstrates [explain why the objection is unfounded]. |

| Supporting Documents |

|

| Closing | Thank you for considering my appeal. Sincerely, David Lee |

End of Discussion

In conclusion, submitting deductible claims to your employer doesn’t have to be daunting. By meticulously following the Artikeld steps, you can ensure a clear and concise presentation of your expenses. Thorough documentation and understanding the potential objections from your employer are key. Remember to maintain clear communication and professionalism throughout the entire process. This guide provides the necessary knowledge to navigate the reimbursement process effectively, allowing you to confidently submit your deductible claims and receive timely reimbursements.

FAQ Resource

What types of documents are required to support a deductible claim?

Supporting documents typically include receipts, invoices, medical bills, and other relevant documentation to substantiate the expenses claimed.

What should I do if my deductible claim is rejected?

Review the reasons for rejection and address any concerns raised by your employer. If necessary, submit an appeal with additional supporting documentation.

How can I ensure my letter is easy to read and understand?

Use clear and concise language, organize the information logically, and format the letter for easy readability. Avoid jargon or overly technical terms.

What are some common mistakes people make when submitting deductible claims?

Common mistakes include submitting incomplete or inaccurate documentation, failing to meet deadlines, or not following the employer’s specific claim procedure. Careful review of the employer’s guidelines before submission is crucial.

Nimila

Nimila