How to buy a duplex with no money is a seriously tempting prospect, right? But it’s not as easy as it sounds. There’s a whole lotta hoops to jump through, and you gotta be prepared for some serious hustle. We’re gonna break down the whole process, from finding the right financing to managing the property, so you can get a feel for what’s involved.

This guide dives deep into the nitty-gritty of acquiring a duplex without a hefty down payment. We’ll explore various financing options, like hard money loans and private lenders, and dissect the crucial factors for evaluating potential properties. Get ready to learn the ropes on how to make this dream a reality, even with a zero-down-payment approach.

Introduction to Duplex Ownership with Limited Funds

Buying a duplex with zero cash upfront is a bold, but potentially rewarding, financial strategy. It requires a deep understanding of the market, meticulous financial planning, and a willingness to navigate the often-complex world of real estate financing. While the allure of owning a rental property is strong, the path to achieving this goal without a traditional down payment is paved with challenges and potential pitfalls.

Careful research and a realistic assessment of your financial capabilities are paramount to success.

Challenges and Potential Pitfalls

The biggest hurdle in purchasing a duplex with limited funds is the lack of a substantial down payment. This significantly increases the risk of loan denial or unfavorable financing terms. Furthermore, the lack of equity in the property can make it harder to refinance or sell later, potentially leading to financial difficulties. Hidden costs, such as unexpected repairs or property taxes, can quickly deplete savings if not carefully budgeted for.

Competition from other buyers, often with more substantial down payments, can make securing a suitable property challenging.

Financial Requirements for Duplex Purchases

A thorough understanding of the financial requirements is crucial for success. The following table Artikels key aspects:

| Requirement | Description | Example | Impact |

|---|---|---|---|

| Down Payment | Initial investment required for the property. | 0% | Significantly increases the risk of loan denial or unfavorable financing terms, limits the available financing options. |

| Funding Sources | Alternative methods of financing beyond traditional loans. | Private lenders, investors, or creative financing solutions. | Provides access to potentially faster funding, but may come with higher interest rates or other fees. |

| Credit Score | Measure of creditworthiness used by lenders to assess risk. | High scores (700+) | Significantly improves the chances of loan approval and often results in more favorable loan terms, potentially lowering interest rates. |

| Debt-to-Income Ratio (DTI) | Percentage of gross monthly income allocated to debt obligations. | 40% | A high DTI can negatively impact loan approval. Lenders carefully evaluate a buyer’s ability to comfortably manage additional debt. |

Importance of Thorough Research

A crucial step in the process is meticulous market research. Understanding local property values, rental rates, and potential maintenance costs is essential for making informed decisions. Thorough due diligence on the specific duplex, including inspections and appraisals, is paramount to avoid unforeseen problems later. Researching and comparing financing options, including private lenders and investors, is vital to finding the most suitable and affordable solution.

Analyzing comparable sales in the area can help set a realistic purchase price.

Exploring Financing Options

Buying a duplex with no money down requires creative financing strategies. Traditional mortgages are often out of reach for those without significant savings. This necessitates exploring alternative avenues and understanding the nuances of each option. Success hinges on careful research and understanding the potential pitfalls of each approach.

Hard Money Loans, How to buy a duplex with no money

Hard money loans are short-term, high-interest loans designed for real estate investment. They typically require a significant down payment or equity in other assets. They are often used when traditional financing isn’t available or is too slow. The fast approval process is attractive, allowing investors to quickly secure funding for renovations and acquisitions. However, the high interest rates and short terms can make these loans expensive in the long run.

Private Money Lenders

Private money lenders are individuals or companies who provide direct investment capital for real estate ventures. They often offer flexible terms and personalized loan structures, accommodating unique circumstances and needs. The process may involve more negotiation than traditional loans, and interest rates might be higher than traditional financing. Private lenders often focus on building long-term relationships with borrowers, making them a viable option for experienced investors.

Rent-to-Own Agreements

Rent-to-own agreements allow potential buyers to occupy and rent the property while making payments toward eventual ownership. This approach is often appealing for individuals with limited funds, as it lowers the upfront financial commitment. However, the process can be lengthy, and securing the loan at the end of the agreement may not always be guaranteed.

Financing Options Comparison

| Option | Description | Pros | Cons |

|---|---|---|---|

| Hard Money Loans | Short-term financing, typically for quick acquisitions or renovations. | Fast approval, readily available. | High interest rates, short terms, often requiring significant equity. |

| Private Money Lenders | Direct investment capital from individuals or companies. | Flexible terms, personalized financing. | Potentially higher interest rates than traditional loans, more negotiation required. |

| Rent-to-Own Agreements | Purchase with rental payments leading to eventual ownership. | Lower upfront commitment, less risk initially. | Lengthy process, no guarantee of final purchase. |

Creative Financing Techniques

Creative financing strategies often involve combining different financing methods or negotiating unique terms with lenders. For example, an investor might use a hard money loan to acquire a property and then leverage rent-to-own payments to build equity over time. These strategies allow for flexibility and can help overcome obstacles in securing traditional financing. It’s essential to carefully evaluate the terms and risks associated with each creative financing approach to avoid financial pitfalls.

Evaluating Duplex Properties

Buying a duplex without a hefty down payment requires meticulous evaluation. Beyond the financing, understanding the property itself is paramount. A well-chosen duplex can be a strong investment, but a poorly evaluated one can lead to financial headaches. Thorough due diligence is key to mitigating risks and maximizing potential returns.Careful property evaluation is not just about the asking price; it’s about understanding the long-term viability and potential for profit.

This involves assessing factors like location, condition, and rental potential. Each aspect contributes to the overall value proposition, and understanding their interplay is essential for informed decision-making.

Location Analysis

Location significantly impacts a duplex’s value and rental potential. Proximity to amenities like schools, shops, and public transportation directly affects tenant demand. A well-located duplex often commands higher rental rates and attracts a larger pool of potential tenants. Consider the surrounding neighborhood’s reputation, safety, and overall appeal to renters. For example, a duplex near a growing business district might command higher rents due to increased demand.

Condition Assessment

The physical condition of the duplex is crucial. Significant maintenance issues can quickly eat into potential profits. A thorough inspection is vital. Look for signs of wear and tear, structural problems, and outdated systems. Assess the condition of the roof, plumbing, electrical wiring, and HVAC systems.

Identifying necessary repairs beforehand helps you anticipate costs and negotiate a fair price. A duplex requiring extensive renovations might seem appealing at a lower price, but these hidden costs can be substantial.

Rent Potential Evaluation

Estimating potential rental income is vital. Research comparable rental rates in the area for similar properties. Factor in potential vacancy periods, which are unavoidable and can significantly affect income. Use online resources and local market data to get a realistic picture of the area’s rental market. For instance, a duplex in a high-demand area might command rents exceeding $2000 per month, while a similar property in a less desirable location might yield only $1500.

Accurate income projections help you understand the financial feasibility of the purchase.

Property Taxes and Expenses

Local property taxes can significantly impact your investment. Knowing the annual assessment is crucial. Also, consider ongoing expenses like insurance, maintenance, and potential repairs. Researching historical property tax rates in the area can provide valuable insights into future costs. The example of a $2000 yearly property tax shows the necessity of including these costs in your financial projections.

Summary of Key Evaluation Criteria

| Criterion | Description | Example | Impact |

|---|---|---|---|

| Location | Proximity to amenities | Near schools, shops | Higher demand, rental rates |

| Condition | Maintenance requirements | Minor repairs needed | Reduced upfront costs, potential issues |

| Rent Potential | Estimated rental income | $1500/month | Income generation, financial stability |

| Property Taxes | Yearly assessment | $2000 | Cost of ownership |

Managing the Purchase Process

Buying a duplex with limited funds requires meticulous planning and execution. Navigating the complexities of the real estate market demands a structured approach, from initial research to final closing. This meticulous process ensures a smooth transition into duplex ownership, minimizing potential pitfalls.

Step-by-Step Guide to the Purchase Process

This structured approach streamlines the process, minimizing potential complications. Understanding each step is crucial for successful acquisition.

- Research Financing Options: Thoroughly investigate all available financing options, including FHA loans, VA loans, and conventional loans tailored for investment properties. Consider loan programs designed for real estate investors, as these often have more favorable terms than those aimed at primary residences. Compare interest rates, down payment requirements, and loan terms from various lenders. Analyzing different loan types and comparing their associated fees, such as closing costs and origination fees, is critical to making an informed decision.

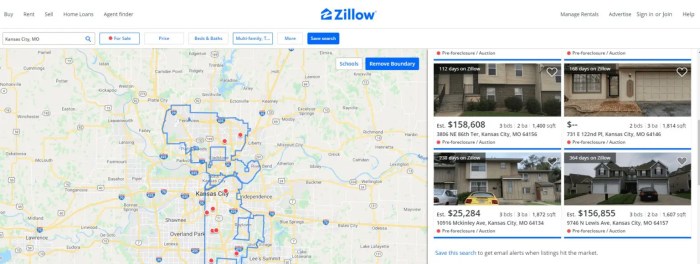

- Identify Potential Properties: Using resources like online real estate portals, local real estate agents, and community forums, identify duplexes within your budget and desired location. Consider factors such as property condition, neighborhood desirability, and proximity to amenities. Scrutinize listings meticulously, focusing on factors that impact long-term value and profitability. Compare comparable properties in the area to gauge market value and potential return on investment.

- Conduct Thorough Property Inspections: Employ a qualified home inspector to evaluate the duplex’s structural integrity, plumbing, electrical systems, and overall condition. This step is crucial to uncover potential hidden issues that could impact your financial commitment. A comprehensive inspection report details any necessary repairs or renovations, providing a clear picture of the property’s current state. Consider consulting with contractors for preliminary cost estimates of repairs if necessary.

- Negotiate Purchase Terms: Once you’ve identified a suitable property, negotiate the purchase price and terms with the seller. Leverage market research and comparable sales to support your offer. Incorporate contingencies into the purchase agreement to protect your interests. For example, a contingency clause for a satisfactory home inspection result will protect you from unfavorable conditions.

- Secure Financing: After successfully negotiating terms, apply for and secure the chosen financing option. This involves submitting required documents, such as financial statements and credit reports. Be prepared to address any lender concerns regarding your financial profile and the property’s investment potential. Thorough preparation and accurate documentation will facilitate a smoother and faster approval process.

- Close the Deal: This final step involves completing all necessary paperwork, paying closing costs, and transferring ownership. Work closely with your real estate attorney to ensure all legal requirements are met. Verify all details meticulously to avoid costly mistakes. Ensure all documentation is accurate and in compliance with legal regulations.

Legal and Regulatory Requirements

Understanding local, state, and federal regulations is paramount. These regulations govern property transactions and ensure fairness for all parties involved.

- Real Estate Licensing Laws: Real estate agents and brokers must adhere to state licensing regulations, which detail their responsibilities during the purchase process. Understanding these requirements will ensure you’re working with a qualified professional.

- Property Tax Laws: Comprehending local and state property tax regulations is essential. Understand how property taxes are assessed and how they may impact your financial projections.

- Mortgage Lending Regulations: Compliance with mortgage lending regulations is crucial. Understanding these regulations helps you understand your responsibilities and ensure your transaction adheres to established guidelines.

Importance of Working with Qualified Professionals

Engaging qualified professionals can significantly enhance your chances of success.

- Real Estate Agents: Experienced real estate agents possess in-depth knowledge of local market trends and property values. They can guide you through the process, helping you identify suitable properties and negotiate favorable terms.

- Financial Advisors: Financial advisors can provide expert advice on investment strategies and assist with securing the necessary financing for your duplex purchase.

- Real Estate Attorneys: Attorneys specializing in real estate transactions can ensure that all legal requirements are met and that the purchase agreement protects your interests.

Building a Sustainable Duplex Portfolio

Owning a duplex can be a rewarding investment, but long-term success hinges on building a sustainable portfolio. This involves more than just securing the initial purchase; it’s about creating a system that ensures consistent income, manageable expenses, and future growth. Understanding the strategies for long-term success is crucial for turning duplex ownership into a profitable venture.A sustainable duplex portfolio isn’t just about buying properties; it’s about cultivating a system of effective management and proactive maintenance.

This approach ensures the properties remain profitable and appealing to tenants, maximizing returns while minimizing potential headaches. Careful planning and execution are essential elements for building and maintaining a profitable portfolio.

Property Management Strategies

Effective property management is vital for the success of any rental portfolio. It encompasses everything from tenant selection and communication to regular inspections and timely maintenance. A well-managed property not only brings consistent income but also minimizes the risk of costly repairs and tenant disputes. This proactive approach ensures the smooth operation of the duplexes, ensuring sustained income and minimizing unexpected expenses.

- Tenant Screening: Thorough tenant screening is crucial. A robust screening process helps identify responsible tenants who are likely to pay rent on time and maintain the property. This reduces the risk of late payments or property damage, saving potential headaches.

- Clear Lease Agreements: Comprehensive lease agreements Artikel the terms of the tenancy, including rent, payment schedule, and responsibilities of both landlord and tenant. A well-drafted lease acts as a legal document and safeguards both parties.

- Proactive Maintenance: Regular property inspections and timely maintenance prevent small problems from escalating into costly repairs. This approach not only minimizes expenses but also ensures tenant satisfaction, improving occupancy rates.

Maximizing Rental Income

Rental income is the lifeblood of any investment property. Strategies to maximize rental income focus on attracting and retaining quality tenants, optimizing pricing, and maximizing property appeal. A clear understanding of market trends and tenant preferences is essential for attracting the best tenants.

- Competitive Rent Pricing: Research comparable rental rates in the area to ensure your rent is competitive. Factors such as property condition, location, and amenities influence optimal pricing. A competitive rent attracts more potential tenants.

- Marketing Strategies: Utilize various marketing channels to advertise your properties effectively. Highlighting key features and benefits of the duplex can attract more tenants. Online listings, social media, and local advertising are examples of effective strategies.

- Property Upgrades: Minor upgrades can significantly improve the appeal of a property and increase rental income. Focus on improvements that enhance the property’s value and comfort for tenants, such as updated appliances, new paint, or modern fixtures.

Minimizing Expenses

Managing expenses is a crucial part of creating a sustainable duplex portfolio. This includes everything from insurance and property taxes to maintenance and repairs. Efficient expense management ensures that a larger portion of rental income translates into profit. A proactive approach to expense management can significantly boost profitability.

- Negotiating Utilities: Negotiate favorable rates for utilities such as water, electricity, and gas. Contacting providers and comparing prices can lead to substantial savings.

- Insurance Strategies: Explore different insurance options and compare coverage amounts and premiums to find the most cost-effective solution. The best insurance plan is one that protects your investment without overspending.

- Budgeting and Tracking: Establish a detailed budget that Artikels all potential expenses associated with owning a duplex. Tracking expenses meticulously allows for identifying areas where costs can be reduced without compromising quality.

Risks and Mitigation Strategies

Buying a duplex with no money down presents unique challenges. While the potential for significant returns is enticing, careful consideration of inherent risks and proactive mitigation strategies is paramount. Ignoring these factors can lead to financial hardship and even foreclosure. This section Artikels the key risks and practical steps to navigate them successfully.

Potential Risks of Duplex Ownership with Limited Funds

The path to duplex ownership with limited capital is paved with potential pitfalls. Understanding these risks is crucial for developing a robust strategy. Failure to anticipate and address these issues can lead to significant financial losses and even legal complications.

- Default Risk: Tenant non-payment is a significant concern. A poor tenant screening process can lead to substantial financial losses. This is exacerbated when the owner has limited resources to cover potential vacancies or late payments.

- Property Damage: Tenants may cause damage to the property, requiring costly repairs. Without adequate insurance, the owner could face substantial out-of-pocket expenses, impacting their financial stability. Examples include vandalism, accidental damage, or even normal wear and tear that becomes excessive over time.

- Financing Issues: Securing financing for a duplex purchase with limited funds can be challenging. The lack of equity can limit the availability of conventional loans. Alternative financing options may carry higher interest rates or more stringent terms.

- Operational Challenges: Managing a duplex requires consistent attention to maintenance, repairs, and tenant relations. Lack of experience in property management can lead to costly errors or disputes. The complexity of ongoing operations can be overwhelming, especially for first-time owners.

- Legal Issues: Misunderstandings with tenants or legal violations can result in significant legal battles and financial liabilities. Compliance with local housing codes and tenant laws is crucial to avoid legal disputes.

Mitigation Strategies for Minimizing Risks

Addressing these risks proactively is crucial to maximizing the chances of success. Careful planning and robust strategies can help to mitigate potential financial losses and maintain a sustainable investment.

| Risk | Description | Mitigation Strategy | Impact |

|---|---|---|---|

| Default Risk | Tenant not paying rent | Strict screening process (credit checks, background checks, rental history verification), a strong lease agreement, and a clear process for addressing late payments. | Reduces financial loss, protects investment. |

| Property Damage | Tenant causing damage | Comprehensive insurance coverage (renters insurance), detailed move-in/move-out inspections, and clear lease terms regarding damage responsibility. | Covers repair costs, protects owner’s assets. |

| Financing Issues | Difficulty securing financing | Explore alternative financing options (hard money loans, private investors, or a combination of sources), establish a strong financial profile, and develop a comprehensive business plan. | Access to alternative financing, enhances borrowing opportunities. |

| Operational Challenges | Managing a duplex | Partner with a property management company (if needed), create a detailed maintenance schedule, and build a strong network of trusted contractors. | Reduces stress and ensures efficient operations. |

| Legal Issues | Misunderstandings with tenants | Thorough legal consultation to ensure the lease agreement is compliant with local laws, and seek advice for handling tenant disputes. | Reduces legal complications, promotes compliance. |

Summary

So, buying a duplex with no money down is definitely doable, but it’s not a walk in the park. You need a solid plan, a deep understanding of the risks, and a willingness to put in the work. This guide provides a comprehensive overview of the process, equipping you with the knowledge to navigate the challenges and make informed decisions.

Remember, thorough research and a realistic approach are key to success in this game.

Popular Questions: How To Buy A Duplex With No Money

What are some common challenges in buying a duplex with no money down?

Higher risk of debt, limited financing options, and a need for extensive research and financial planning are common hurdles. Also, you’ll likely face higher interest rates and potentially stricter eligibility criteria compared to traditional loans.

How can I find reliable private lenders?

Networking, online platforms dedicated to connecting borrowers and lenders, and referrals from trusted sources are good places to start. Just make sure you thoroughly vet potential lenders to avoid scams and shady deals.

What are the key factors to consider when choosing a duplex?

Location, condition, potential rental income, and property taxes are all crucial. A good location with high demand and a well-maintained property with a good rent potential will make a huge difference in your success.

What are some ways to mitigate the risks of buying a duplex with no money down?

Diversifying funding options, having a strong credit score and debt-to-income ratio, thorough due diligence on the property, and having a strict tenant screening process can significantly reduce potential risks.

Nimila

Nimila