How to add taxes in PlanSwift? This guide breaks down the whole process, from basic setup to advanced configurations. It’s like a cheat sheet for getting your taxes right in PlanSwift, so you can focus on the important stuff. We’ll cover everything from adding different tax types to generating reports, making sure you’re totally clued up on the ins and outs.

PlanSwift is a powerful tool for managing projects, and accurate tax calculations are crucial. This guide walks you through the steps, providing clear examples and tables to make it easy to follow. We’ll even tackle common problems and troubleshooting tips so you can avoid any tax-related headaches.

Introduction to Planswift Tax Handling

Planswift is a comprehensive project management software designed for businesses to effectively manage various aspects of their operations. It provides a platform for tracking tasks, managing resources, and facilitating collaboration among team members. Beyond basic project management, Planswift offers functionalities tailored for businesses requiring detailed financial tracking, including the calculation and management of taxes. This allows for a more streamlined and organized approach to financial planning and reporting within project contexts.Accurate tax calculations are crucial for maintaining financial compliance and avoiding penalties.

Inaccurate tax data can lead to significant issues, ranging from financial discrepancies to legal repercussions. Planswift’s tax handling features are designed to ensure users input and manage taxes correctly, mitigating these risks. This detailed guide will cover the common tax scenarios within Planswift, emphasizing the importance of accurate calculations and providing practical examples.

Common Tax Scenarios in Planswift

Users frequently encounter various tax scenarios in project management. These include sales taxes, income taxes, payroll taxes, and potentially other region-specific levies. Accurate calculation of these taxes within the context of specific projects is critical for ensuring compliance and financial stability. These scenarios are diverse and involve intricate calculations, particularly when dealing with multiple jurisdictions or complex tax structures.

Importance of Accurate Tax Calculations

Accurate tax calculations are essential for financial planning and reporting. They ensure compliance with tax regulations, avoiding penalties and legal issues. Precise calculations allow businesses to accurately forecast their financial position, budget effectively, and make informed decisions about project pricing and profitability. Furthermore, accurate tax calculations facilitate the preparation of financial reports and audits, ensuring transparency and accountability.

Example of a Tax Calculation in Planswift

Consider a project involving the sale of goods. If a company sells $10,000 worth of goods and the applicable sales tax rate is 8%, the sales tax amount would be $800. Planswift allows users to input the relevant tax rates and quantities to automatically calculate the total tax amount, which can then be allocated to the appropriate project or cost center.

This automated calculation minimizes manual errors and ensures accuracy in tax reporting.

Types of Taxes Supported in Planswift

Understanding the various types of taxes Planswift supports is vital for appropriate data entry and reporting. A structured approach to tax categorization enhances the accuracy of financial records.

| Tax Type | Description |

|---|---|

| Sales Tax | Levied on the sale of goods or services. |

| Income Tax | Collected on an individual’s or entity’s income. |

| Payroll Tax | Collected from employees’ wages and salaries, including social security and Medicare contributions. |

| VAT (Value Added Tax) | A consumption tax levied at each stage of the production process. |

| Property Tax | Levied on real estate holdings. |

Adding Taxes to Projects

Adding taxes to projects in Planswift is a crucial aspect of accurate financial reporting and ensures compliance with local regulations. Properly configured taxes allow for precise calculations and prevent errors in invoicing and financial statements. This process enables businesses to manage tax obligations efficiently and avoid penalties.Accurate tax handling in Planswift is essential for businesses to maintain compliance with local tax laws and ensure the correct amount of tax is collected and paid.

This meticulous approach minimizes the risk of errors and penalties associated with incorrect tax calculations.

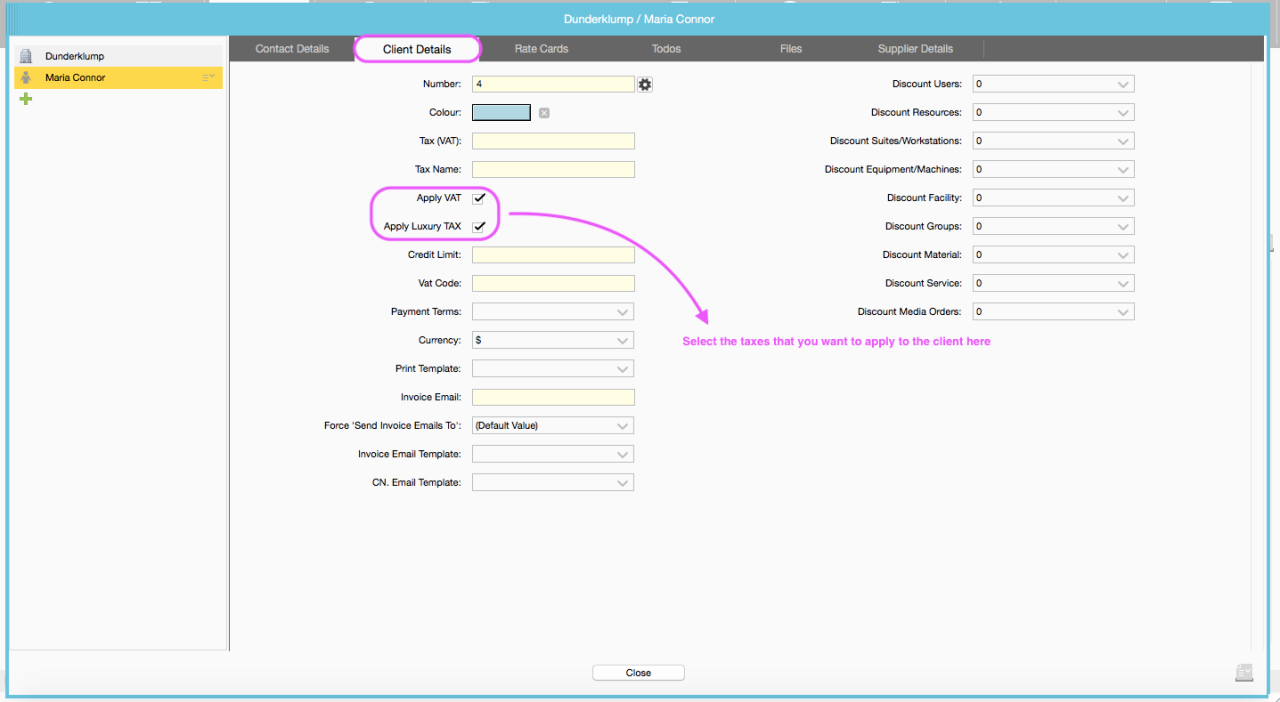

Tax Configuration Options

Planswift offers various options for configuring tax rates, enabling flexibility in handling diverse tax scenarios. These options ensure that projects reflect the specific tax requirements of different jurisdictions and clients.Different tax rates can be applied based on the project’s location, the type of products or services provided, or other relevant factors. This adaptability allows Planswift to accommodate various business situations.

Tax rates can be set individually for each project, or a default rate can be applied across multiple projects, depending on the complexity of the tax structure.

Adding a Tax to a Specific Project

To add a tax to a project, navigate to the project settings within Planswift. This step is typically found under the project’s management section. From there, access the tax configuration section.

- Locate the “Add Tax” button or a similar designation. Clicking this button initiates the process of defining the tax parameters.

- Select the type of tax. This selection typically involves choosing from a list of predefined tax categories (e.g., sales tax, VAT, GST). Ensure the selected tax type aligns with the applicable regulations for the project’s location.

- Enter the tax rate. The rate should be entered in the designated field. For example, if the applicable rate is 10%, enter “10”.

- Specify the tax application method. Planswift allows for different tax application methods, such as including tax in the price or calculating it separately. Choose the method that best reflects the tax regulations for the project.

- Associate the tax with specific products or services. This allows for targeted tax application, enabling clients to track specific taxes on particular products or services. This is vital for transparent reporting and billing.

Tax Calculation Methods

Planswift supports various tax calculation methods to cater to diverse business needs. These methods allow for accurate calculation of taxes in accordance with the specific requirements of each project.

- Tax Included: The tax amount is calculated and included directly in the price of the product or service. This method is straightforward and simplifies calculations.

- Tax Excluded: The tax amount is calculated separately and added to the price. This approach provides a clearer view of the price breakdown and the tax component.

- Taxable Amount: Planswift determines the taxable amount based on the specific rules defined for the project, enabling accurate tax calculation according to the applicable tax laws.

Configuring Tax Rates

Tax rates can be configured either by defining individual rates for specific projects or using a default rate for multiple projects. This approach enables scalability and consistency in tax calculations.

- Project-Specific Rates: Each project can have its own tax rate based on the location and specific tax regulations. This approach allows for flexibility in handling projects with varying tax requirements.

- Default Rates: A default tax rate can be set for projects with similar tax requirements. This is an efficient approach for standardized operations.

Example of Tax Configuration

Consider a project in California. The sales tax rate is 7.25%. To add this tax, select “Sales Tax” as the tax type, enter “7.25” as the tax rate, and choose “Tax Included” as the calculation method. The tax will automatically be calculated and included in the price of the products or services associated with the project.

Comparison of Tax Configurations

| Configuration | Description | Advantages |

|---|---|---|

| Project-Specific | Individual tax rates for each project | Flexibility for varied tax requirements |

| Default Rates | Single tax rate applied to multiple projects | Efficiency for standardized operations |

Tax Calculation Methods in Planswift

Planswift offers various tax calculation methods to ensure accurate and efficient tax handling within project estimations and financial reporting. Understanding these methods is crucial for project managers and financial analysts to make informed decisions and maintain profitability. The choice of method often depends on the complexity of the project and the specific tax regulations applicable.Different calculation methods can significantly impact project profitability, and Planswift provides tools to adapt to various scenarios.

This section delves into the different tax calculation methods used within Planswift, evaluating their accuracy, efficiency, and impact on project profitability. It also provides guidance on adjusting the method for specific projects.

Tax Calculation Methodologies

Planswift employs several methodologies for tax calculations, each with its own strengths and weaknesses. Understanding these methodologies is essential for selecting the most appropriate method for each project. Factors like project scope, complexity, and applicable tax regulations all play a crucial role in the selection process.

- Standard Deduction Method: This method utilizes pre-defined tax rates and deductions to calculate taxes. It is generally simpler and faster than other methods, making it suitable for straightforward projects. This method is suitable for projects with well-defined tax structures and stable tax rates. However, its accuracy can be limited when dealing with complex tax scenarios or significant variations in tax regulations.

- Detailed Calculation Method: This method allows for a more precise calculation by considering various tax components and specific deductions. This method is generally more accurate than the standard deduction method, but it requires more data input and potentially more time to complete. This method is ideal for projects with complex tax structures or projects involving numerous deductions and exemptions. The level of accuracy is often critical for high-value contracts or projects with intricate tax situations.

- Marginal Tax Rate Method: This method calculates taxes based on the applicable marginal tax rates for each income bracket. This approach is accurate, especially for projects with varying income levels. However, it can be more complex than the standard deduction method, particularly when dealing with multiple tax jurisdictions.

Accuracy and Efficiency Comparison

The accuracy and efficiency of tax calculation methods vary depending on the project’s characteristics. The standard deduction method is generally faster but less accurate. The detailed calculation method offers higher accuracy but requires more time and effort. The marginal tax rate method strikes a balance, providing accuracy for projects with varying income levels.

Impact on Project Profitability

The chosen tax calculation method directly affects project profitability. Inaccurate calculations can lead to underestimated or overestimated tax liabilities, impacting the project’s overall financial performance. A detailed method, though more time-consuming, can minimize errors, ensuring accurate tax projections and maximizing profitability.

Adjusting Tax Calculation Methods

Adjusting the tax calculation method for specific projects involves considering project-specific factors. For instance, if a project involves multiple jurisdictions with varying tax rates, the detailed calculation method might be more suitable. Conversely, for simple projects with consistent tax rates, the standard deduction method might suffice. It is essential to carefully analyze the project’s characteristics and tax regulations before selecting a method.

Formula Example (Detailed Calculation Method)

Total Tax = (Gross Income

- Tax Rate)

- (Deductions

- Deduction Rate)

This formula demonstrates the calculation of total tax by multiplying gross income by the tax rate, then subtracting the product of deductions and deduction rate.

Tax Calculation Steps (Table)

| Scenario | Method | Calculation Steps | Result |

|---|---|---|---|

| Simple Project (Single Jurisdiction) | Standard Deduction | Use pre-defined tax rates and deductions. | Accurate, but potentially less precise. |

| Complex Project (Multiple Jurisdictions) | Detailed Calculation | Consider all relevant tax components and specific deductions. | Accurate, but time-consuming. |

| Project with Varying Income | Marginal Tax Rate | Apply marginal tax rates for each income bracket. | Accurate, especially for variable income levels. |

Tax Reporting and Output

Generating tax reports is a crucial aspect of financial management in Planswift. Accurate and comprehensive tax reports enable businesses to comply with tax regulations, track tax liabilities, and make informed financial decisions. Planswift offers various report formats, allowing users to customize the output to meet specific needs and requirements.

Generating Tax Reports in Planswift

Planswift provides a user-friendly interface for generating various tax reports. Users can select the desired report type, specify the reporting period, and choose the desired level of detail. This flexibility ensures that users can obtain reports tailored to their specific needs.

Tax Report Format

Planswift tax reports are designed with clarity and comprehensiveness in mind. The reports typically include essential elements such as project details, tax codes, tax amounts, and applicable tax rates. This structure allows for easy interpretation and analysis of the data. Furthermore, the reports are generally presented in a tabular format, making data extraction and comparison straightforward.

Customizing Tax Reports

Planswift allows users to customize tax reports to suit their specific requirements. Users can select the specific data fields they need in the report, and tailor the report format to meet unique presentation preferences. This can include filtering by project, client, or other relevant criteria. Customization options enhance the usability and practicality of the reports for different reporting needs.

Examples of Tax Reports

Various tax reports can be generated within Planswift, including reports for income tax, sales tax, and payroll tax. These reports provide a detailed breakdown of tax liabilities for specific periods. For instance, a sales tax report could show the total sales, the applicable tax rate, and the calculated sales tax amount for a particular period. Payroll tax reports can show deductions, tax rates, and tax amounts for employees.

Sample Tax Report

The following sample tax report, generated by Planswift, illustrates the format and content of a typical report. Note that this is a sample and actual reports may vary based on user-specific configurations.

| Project Name | Tax Code | Tax Amount | Tax Rate |

|---|---|---|---|

| Project Alpha | Sales Tax | $1,200 | 8% |

| Project Beta | Income Tax | $5,000 | 25% |

| Project Gamma | Payroll Tax | $800 | 10% |

| Project Delta | Sales Tax | $750 | 5% |

Troubleshooting Tax Issues

Navigating tax calculations within Planswift can sometimes present challenges. This section details common issues, their resolutions, and potential causes for discrepancies, empowering users to troubleshoot effectively. Properly addressing these issues ensures accurate tax reporting and avoids potential errors in financial planning.

Common Tax Calculation Errors

Understanding the potential pitfalls in tax calculations within Planswift is crucial for accurate financial reporting. Incorrect input data, misconfigurations, or incompatible settings can all contribute to errors. Careful review and meticulous attention to detail are essential to prevent discrepancies.

- Incorrect Tax Rates: Inaccurate tax rates can lead to incorrect tax calculations. Double-checking the tax rates applied to specific transactions and ensuring they align with the relevant jurisdictions is vital. If discrepancies are detected, verify the rate within the Planswift settings or update the relevant data sources to ensure accuracy.

- Data Entry Errors: Errors in entering project details, including income, expenses, or other relevant data, can result in incorrect tax calculations. Careful verification of the entered data is necessary to maintain the accuracy of the tax calculations. Regular data validation and review can prevent these errors.

- Incompatible Calculation Methods: Different projects or clients may necessitate unique tax calculation methods. Mismatched calculation methods within Planswift can result in incorrect outcomes. Ensure the correct calculation method is selected and applied consistently throughout the project to avoid miscalculations.

- Missing or Incorrect Deductions: Planswift allows for various deductions that impact tax liabilities. Failure to account for eligible deductions or using incorrect deduction amounts will affect the accuracy of the calculation. Ensure that all applicable deductions are correctly applied and accounted for in the calculation to reflect the correct tax amount.

Resolving Tax Calculation Discrepancies, How to add taxes in planswift

Troubleshooting discrepancies in tax calculations involves a systematic approach. Identify the source of the error, and then employ appropriate corrective measures. A step-by-step process is crucial to ensure accurate resolution.

- Verify Input Data: Double-check the accuracy of all entered data, including income, expenses, and other relevant details. Comparing the entered data with supporting documents or source records can confirm accuracy. Correcting any discrepancies in input data is a vital step to prevent errors in subsequent calculations.

- Review Tax Rate Settings: Ensure that the correct tax rates are applied to the respective transactions. Verify that the rates match the relevant jurisdiction’s regulations. Consult with tax professionals if needed to confirm the correctness of the tax rates applied in Planswift.

- Check Calculation Method Settings: Review the selected calculation method to ensure compatibility with the project’s requirements. Different calculation methods may apply to various scenarios, so verifying the correct selection is essential. Selecting the appropriate calculation method ensures accurate results.

- Identify Missing Deductions: Ensure all applicable deductions are included in the calculation. Consult tax guidelines and supporting documents to confirm the eligibility and amount of each deduction. Incorporating accurate deductions directly into the Planswift system will yield accurate tax calculations.

- Contact Support: If the issue persists after reviewing the above steps, contact Planswift support for assistance. Provide detailed information about the project, the discrepancies observed, and any supporting documentation. Technical support can offer tailored guidance to resolve complex issues.

Potential Causes for Discrepancies

Discrepancies in tax calculations can stem from various factors. These include incorrect input data, mismatched tax rates, or incompatibility of the selected calculation method.

Troubleshooting Tax Calculation Errors

Systematic troubleshooting involves several steps. First, validate the input data. Second, check tax rate accuracy. Third, review calculation methods. Fourth, identify missing deductions.

Finally, seek support if the issue persists. Thorough review and analysis of each step will help resolve any errors effectively.

Frequently Asked Questions (FAQ)

- How do I change the tax rate for a specific project? Locate the project settings and adjust the relevant tax rate parameters. Double-check the updated rate against official sources to ensure accuracy.

- What should I do if I encounter an error message during tax calculation? Carefully review the error message and identify the specific cause. Address any data entry errors or configuration issues accordingly. Contact Planswift support for further assistance if necessary.

Common Tax Errors and Solutions

| Common Tax Error | Solution |

|---|---|

| Incorrect tax rate applied | Verify and update the tax rate in Planswift settings to match the correct jurisdiction. |

| Missing deductions | Identify and include all applicable deductions in the Planswift calculation. |

| Data entry error | Review and correct any errors in the input data, ensuring accuracy. |

| Incompatible calculation method | Select the appropriate calculation method based on the project’s requirements. |

Advanced Tax Configurations

Planswift offers a robust system for handling complex tax scenarios. Beyond basic tax calculations, advanced configurations allow for tailoring the system to specific business needs, including exemptions, deductions, and varying tax jurisdictions. This section delves into these features, demonstrating how to optimize Planswift for diverse tax environments.

Tax Exemptions and Deductions

Configuring tax exemptions or deductions in Planswift involves specifying criteria and conditions. This process ensures accurate tax calculations by excluding certain components from the taxable base. For example, employee contributions to retirement plans or specific medical expenses can be excluded, resulting in lower tax liabilities. The system’s flexibility allows for a variety of exemption criteria, from fixed amounts to percentages or specific itemized expenses.

Tax Codes and Their Impact

Tax codes are fundamental to Planswift’s tax calculation engine. Each code represents a specific tax type and jurisdiction, defining the applicable tax rate and calculation method. Different tax codes apply to various income sources or business activities. Using the correct tax code is crucial for accurate calculations. Inaccurate tax code assignments can lead to errors in reporting and financial planning.

Tax Jurisdictions in Planswift

Planswift supports multiple tax jurisdictions. This is essential for businesses operating across different states, countries, or regions. Each jurisdiction has its own tax laws, rates, and regulations. Managing multiple jurisdictions within Planswift ensures that taxes are calculated and reported accurately for each applicable region. This feature is particularly important for multinational corporations or companies with complex distribution networks.

Managing Multiple Tax Jurisdictions within a Project

Managing multiple tax jurisdictions within a project in Planswift requires careful setup and organization. Users must define the relevant jurisdictions for each project, specifying the applicable tax codes for each jurisdiction. A well-structured approach to managing multiple tax jurisdictions ensures that the correct tax rates and rules are applied to each transaction within the project. For instance, a project involving international sales would require defining different tax jurisdictions for each country involved.

Example: Using Tax Codes in a Complex Project

Consider a construction project spanning multiple states. Different states have varying sales tax rates and regulations. The project involves material purchases from vendors in various states and construction labor in each state. In Planswift, each vendor transaction would be assigned the appropriate tax code for the vendor’s state of origin. Construction labor costs would be assigned to the tax code of the state where the labor was performed.

This ensures accurate calculation of state sales taxes and withholding taxes, providing a comprehensive and accurate financial picture of the project. A comprehensive report can be generated that summarizes tax liabilities by state.

Best Practices for Tax Management in Planswift

Effective tax management in Planswift is crucial for accurate financial reporting and compliance. Consistent application of best practices ensures the integrity of your data, minimizes errors, and streamlines the tax process. This section Artikels key strategies for maintaining accurate tax records and optimizing tax calculations within the Planswift platform.

Maintaining Accurate Tax Records in Planswift

Maintaining accurate tax records is paramount in Planswift. Regularly reviewing and updating tax information within the platform is vital for avoiding discrepancies and ensuring compliance. Employing robust record-keeping practices, including meticulous documentation of all tax-related transactions and adjustments, will facilitate the identification of any potential errors or omissions during audits. This proactive approach ensures that tax calculations are consistently accurate, leading to smooth reporting and avoiding potential penalties.

Managing Tax Compliance in Planswift

Managing tax compliance in Planswift requires a structured approach. Understanding and adhering to the specific tax regulations relevant to your projects and jurisdiction is essential. Regularly reviewing and updating tax laws and regulations is critical to maintain compliance. Using Planswift’s built-in tools for tracking deadlines and submitting reports on time is also a significant factor. This systematic approach minimizes the risk of penalties and ensures adherence to all relevant tax requirements.

Regularly Reviewing Tax Settings

Regular review of tax settings in Planswift is essential for ensuring accuracy and compliance. Periodically verifying that the correct tax rates, codes, and withholding percentages are applied to your projects will prevent errors and ensure that your calculations are up to date. This includes examining applicable changes in tax laws and updating your Planswift configurations accordingly. Prompt adjustments to tax settings prevent discrepancies and maintain the reliability of financial data.

Using Tax Templates in Planswift

Employing tax templates in Planswift can significantly streamline the tax management process. Pre-configured templates can help to ensure consistent application of tax rules and reduce the risk of manual errors. Using templates allows for quicker setup and minimizes the potential for human error in data entry, improving efficiency and accuracy. Templates can also save significant time and effort by pre-populating necessary information and ensuring that all required fields are included.

Optimizing Tax Calculations in Planswift

Optimizing tax calculations in Planswift involves understanding the different calculation methods available within the platform. By utilizing the appropriate calculation methods, you can ensure that your tax calculations are accurate and in line with the most current regulations. Careful selection and application of calculation methods can improve the efficiency and accuracy of the tax calculations. This leads to more reliable financial reports and reduces the risk of errors.

Recommendations for Efficient Tax Management in Planswift

- Regularly update tax rates and codes within Planswift to reflect any changes in legislation.

- Implement a robust system for documenting all tax-related transactions and adjustments.

- Utilize tax templates to streamline setup and reduce manual errors.

- Actively monitor tax deadlines and ensure timely submission of reports.

- Thoroughly review tax settings periodically to guarantee accuracy and compliance.

- Employ appropriate calculation methods for precise tax calculations.

- Maintain a clear record of all tax-related communications and approvals.

Concluding Remarks

So, there you have it—a complete guide to adding taxes in PlanSwift. Hopefully, this guide has given you the confidence to handle your taxes like a pro. Remember, accurate tax handling is key to a smooth project. If you have any more questions or need help with something specific, feel free to check out the FAQs below.

Happy planning!

FAQ Section: How To Add Taxes In Planswift

How do I add sales tax to a project?

Navigate to the project settings, then find the tax section. Add a new tax type, specify the rate, and assign it to the relevant products or services.

What if my tax calculations are off?

Double-check your tax rates, ensure correct product/service assignments, and review your calculation methods. If the problem persists, check the FAQ section for common issues and solutions.

What types of tax reports can I generate?

PlanSwift offers various reports, including detailed summaries, itemized lists, and summaries of all your taxes. Check your PlanSwift documentation for the exact report options.

How do I adjust the tax calculation method for a specific project?

This usually involves modifying the project’s settings. Consult the PlanSwift documentation for the precise steps.

Nimila

Nimila