High risk car insurance Georgia is a crucial consideration for drivers facing elevated insurance premiums due to factors like a poor driving record. This comprehensive guide delves into the nuances of high-risk insurance policies, exploring the types available, factors affecting premiums, and the claim process.

Navigating the complexities of high-risk insurance can be challenging. This guide aims to simplify the process, offering insights into the specific requirements and options available to drivers in Georgia. Understanding the factors that contribute to high-risk classifications, and the available resources for assistance are vital in this journey.

Overview of High-Risk Car Insurance in Georgia

Seeking prudent financial measures for your vehicle’s protection is a testament to your wisdom. High-risk auto insurance in Georgia is designed for drivers with a history of accidents or violations that increase their likelihood of future claims. Understanding this specialized coverage is crucial for navigating the complexities of the insurance market.High-risk car insurance in Georgia is a type of vehicle insurance tailored for drivers with a history of traffic violations or accidents.

These violations can include, but are not limited to, speeding tickets, DUI convictions, or at-fault accidents. This type of insurance typically carries higher premiums than standard policies due to the increased risk associated with these drivers.

Factors Classifying a Driver as High-Risk in Georgia

Several factors contribute to a driver being classified as high-risk in Georgia. These factors are often assessed by insurance companies to evaluate the likelihood of future claims. A significant factor includes a history of traffic violations, such as speeding tickets, reckless driving, or driving under the influence (DUI). Accidents, especially at-fault accidents, are another critical factor. The frequency and severity of these events greatly influence the risk assessment.

Furthermore, a poor driving record, encompassing multiple violations, significantly increases the risk classification. Insurance companies consider a driver’s history of claims and their past interactions with the insurance industry. Additionally, the geographical location of the driver can be taken into account, as certain areas may have higher accident rates than others.

Common Misconceptions about High-Risk Insurance in Georgia

A common misconception is that high-risk insurance is only for individuals with severe violations. This is not entirely accurate. Even seemingly minor violations can contribute to a high-risk classification if they occur frequently. Another misconception is that high-risk insurance is inaccessible. While premiums may be higher, various options and providers are available to cater to diverse needs.

A further misconception is that high-risk insurance will have limited coverage. In reality, coverage is still available, although specific limitations might apply due to the higher risk assessment. Insurance companies might also employ different underwriting methods, such as focusing on recent driving behaviors or evaluating the frequency of traffic incidents.

Comparison of High-Risk and Standard Insurance Options

| Characteristic | Standard Insurance | High-Risk Insurance |

|---|---|---|

| Premiums | Generally lower | Significantly higher |

| Coverage | Comprehensive coverage, including liability, collision, and comprehensive | Comprehensive coverage, but potential limitations on coverage amounts or types of vehicles. |

| Exclusions | Exclusions may exist for specific vehicles or drivers, but less common than in high-risk policies. | Exclusions may apply to certain vehicles, drivers, or geographical locations, and may have stricter terms. |

This table illustrates a basic comparison. Specific premiums, coverage, and exclusions can vary significantly based on individual circumstances and insurance providers.

Types of High-Risk Car Insurance Policies in Georgia

Navigating the complexities of high-risk car insurance can feel like traversing a challenging terrain. Understanding the different policy types available in Georgia is crucial for finding the best fit for your specific needs and driving record. This knowledge empowers you to make informed decisions, ensuring your vehicle and financial well-being are adequately protected.High-risk insurance policies in Georgia cater to drivers with a history of accidents, violations, or other factors that have resulted in higher premiums.

These policies often offer broader coverage options and may include provisions that reflect the unique challenges faced by drivers in this category.

Different Types of High-Risk Policies, High risk car insurance georgia

High-risk car insurance policies in Georgia are often categorized based on the level of coverage and the specific needs of the driver. These categories reflect the varying levels of risk associated with different driving histories. This variety of options aims to meet the unique circumstances of individuals with high-risk driving profiles.

- Basic High-Risk Policies: These policies provide fundamental coverage, including liability, collision, and comprehensive, but often at a higher premium than standard policies. The premiums are typically adjusted to reflect the higher risk associated with the driver’s history. They represent the most basic level of coverage tailored for high-risk drivers, emphasizing essential protections.

- Enhanced High-Risk Policies: These policies build upon the basic coverage, adding additional options like uninsured/underinsured motorist protection. These policies recognize that drivers with a history of incidents might face more significant financial burdens in the event of an accident involving other parties. They expand the basic coverage to encompass a broader range of protection scenarios.

- Specialty High-Risk Policies: Some insurers offer specialized policies for drivers with particularly challenging circumstances, such as those with a history of DUI or those facing specific challenges with their driving history. These specialized policies may involve unique terms and conditions designed to meet the specific needs of the drivers. They offer tailored solutions for individuals with more complex or specific driving histories, requiring individualized approaches to risk management.

Coverage Options in High-Risk Policies

High-risk policies in Georgia typically include standard coverages, but with potential modifications. This section highlights the typical coverages found in these policies, with particular attention to their potential modifications in high-risk situations.

- Liability Coverage: This protects you if you cause an accident and are legally liable for damages to another person or their property. High-risk policies may offer varying liability limits, reflecting the elevated risk profile.

- Collision Coverage: This pays for damages to your vehicle in an accident, regardless of who is at fault. High-risk policies may offer different collision coverage limits and terms compared to standard policies.

- Comprehensive Coverage: This covers damages to your vehicle from events other than collisions, such as theft, vandalism, or weather-related incidents. High-risk policies may offer varying comprehensive coverage limits and terms.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages. This is particularly important for high-risk drivers who might be more vulnerable to accidents with uninsured or underinsured drivers.

Examples of High-Risk Insurance Policies in Georgia

Specific policies vary among insurers, but common examples in Georgia include policies tailored for drivers with a history of at-fault accidents or violations, as well as policies for drivers with a history of DUIs.

Comparison of High-Risk Policies

High-risk policies differ based on terms, conditions, and premium structures. The key factors to consider include the insurer, the policy’s specific coverage limits, deductibles, and exclusions. It’s essential to compare different policies based on these factors to identify the best fit for your needs. A thorough comparison ensures you’re selecting the policy that aligns with your specific financial circumstances.

Coverage Limits Table

| Policy Type | Liability Limits (example) | Collision Limits (example) | Comprehensive Limits (example) |

|---|---|---|---|

| Basic High-Risk | $25,000/$50,000/$25,000 | $10,000 | $5,000 |

| Enhanced High-Risk | $50,000/$100,000/$25,000 | $25,000 | $10,000 |

| Specialty High-Risk | $100,000/$300,000/$25,000 | $50,000 | $25,000 |

Note: These are examples and specific limits may vary based on the insurer and individual circumstances.

Finding High-Risk Car Insurance Providers in Georgia

Finding the right high-risk car insurance provider in Georgia is crucial for those facing challenges in obtaining standard coverage. This process, though potentially daunting, can be navigated with the right resources and a well-defined strategy. Just as seeking guidance from a trusted advisor can strengthen faith and understanding in religious matters, so too can a structured approach to finding high-risk insurance help one navigate the complexities of the market.

Locating High-Risk Providers

Locating high-risk car insurance providers in Georgia requires proactive effort. Many reputable providers specialize in this area, recognizing the unique needs of individuals with a history of accidents or violations. Directly contacting insurance companies specializing in high-risk coverage is a vital initial step.

Online Resources and Platforms

Reliable online resources are invaluable tools in this process. Dedicated comparison websites provide a platform to view quotes from multiple providers simultaneously. These platforms often aggregate quotes from various companies, streamlining the search for the most favorable terms. Furthermore, independent comparison websites offer objective assessments of different providers and their services, akin to a theological review of different religious practices.

Comparing Quotes

Comparing quotes from multiple providers is essential for obtaining the most competitive rates. This involves examining premium costs, deductibles, coverage options, and policy specifics. Carefully evaluating each quote, understanding the terms and conditions, and selecting the most suitable policy is vital, just as scrutinizing religious texts is crucial for gaining a deeper understanding.

High-Risk Insurance Providers in Georgia (Illustrative)

This table presents a sample of high-risk insurance providers in Georgia, along with contact information and estimated average premium rates. Keep in mind that actual premiums can vary based on individual circumstances.

| Provider Name | Contact Information | Estimated Average Premium (per year) |

|---|---|---|

| Georgia High-Risk Auto Insurance | (XXX) XXX-XXXX, [email protected] | $2,500 – $4,000 |

| Southern Risk Solutions | (XXX) XXX-XXXX, [email protected] | $2,200 – $3,800 |

| Reliable Auto Insurance | (XXX) XXX-XXXX, [email protected] | $2,800 – $4,500 |

| SafeDrive Insurance | (XXX) XXX-XXXX, [email protected] | $2,000 – $3,500 |

Note: Premium rates are estimates and may vary based on factors such as driving record, vehicle type, and location. Contact each provider directly for personalized quotes.

Understanding Premium Costs and Factors Affecting Them: High Risk Car Insurance Georgia

Navigating the complexities of high-risk car insurance in Georgia often involves understanding the factors that influence premium costs. Just as a prudent shepherd carefully considers the needs of their flock, insurance providers assess various aspects of a driver’s history and driving behavior to determine the appropriate level of coverage. This assessment is critical for ensuring fair pricing and responsible allocation of resources within the insurance market.Premium costs for high-risk car insurance in Georgia are not arbitrary.

They are meticulously calculated to reflect the likelihood of claims and the associated financial burdens on the insurance company. This process, though potentially daunting for drivers with less-than-ideal driving records, is essential for maintaining the stability and viability of the insurance industry.

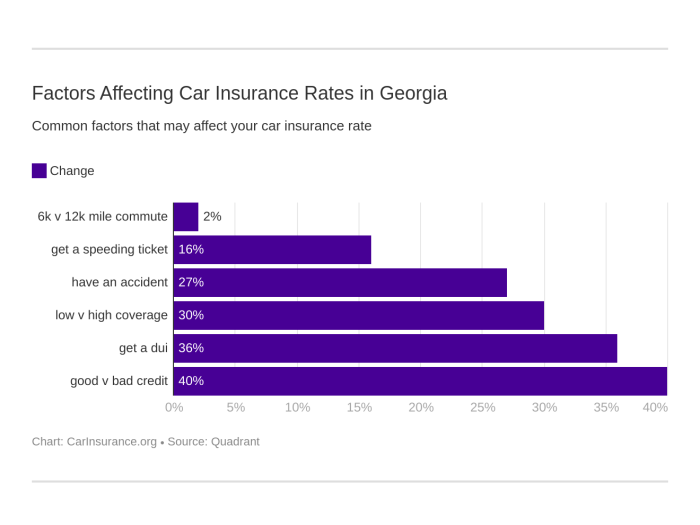

Factors Influencing Premium Costs

High-risk car insurance premiums are significantly affected by several key factors. Understanding these factors can help drivers with less-than-perfect driving records make informed decisions about their insurance needs. The driving record is a crucial component in determining premium costs, as it provides a historical context of a driver’s behavior and responsibility on the road.

Driving History

Driving history, including past accidents and violations, plays a substantial role in determining high-risk car insurance premiums. A history of accidents or traffic violations signals a higher risk profile for the insurance company, necessitating a higher premium to reflect the increased likelihood of future claims. For instance, drivers with a history of multiple speeding tickets or accidents involving property damage will likely face higher premiums compared to drivers with clean records.

This principle is grounded in the statistical reality that drivers with a history of incidents are more prone to future incidents.

Accidents and Claims

The frequency and severity of accidents and claims directly impact premiums. A driver with a history of accidents or claims will be assigned a higher risk rating, leading to higher premiums. The severity of the accident, such as the amount of property damage or injuries involved, also contributes to the premium calculation. This is because more severe incidents typically result in larger claims payouts.

Consider a driver who has had two accidents in the last three years; this driver will likely pay a higher premium compared to someone with no accidents in the same period.

Common Reasons for High Premiums

Several factors can contribute to high premiums for high-risk policies in Georgia. These include:

- A history of accidents and traffic violations, including reckless driving.

- A history of at-fault accidents.

- DUI or DWI convictions.

- Teen drivers with limited driving experience.

- A history of uninsured or underinsured motorist claims.

- Driving with a suspended or revoked license.

- Poor credit history (in some instances).

These factors are often correlated with a higher likelihood of future claims, which directly impacts the cost of insurance premiums. These factors are not exhaustive, and insurers may consider other relevant aspects of a driver’s history.

Discounts for High-Risk Drivers

Discounts for high-risk drivers in Georgia are available, although their availability and extent can vary significantly based on the insurance provider. Factors that may qualify a high-risk driver for discounts include:

- Driver safety courses completed.

- Maintaining a clean driving record for a specific period.

- Utilizing a safety-enhancing vehicle feature such as anti-theft devices.

- Insuring multiple vehicles with the same company.

These discounts can be valuable in offsetting the higher premiums associated with a high-risk profile. Drivers should actively explore and utilize any applicable discounts offered by insurance providers.

Negotiating or Reducing Premiums

Negotiating or potentially reducing premiums for high-risk policies in Georgia can be achieved through several approaches. A thorough understanding of the factors influencing premiums, such as driving history, accidents, and claims, is crucial.

- Shop around among multiple insurance providers. Comparing quotes from different companies can reveal significant differences in pricing.

- Enhancing the driving record by actively avoiding traffic violations and maintaining a safe driving style.

- Improving the credit score can potentially lead to a lower premium in some instances.

- Enrolling in defensive driving courses.

- Increasing the deductible amount.

These strategies can contribute to a reduction in premiums, especially for drivers actively seeking to mitigate their risk profile.

Table of Common Factors Impacting High-Risk Auto Insurance Premiums

| Factor | Impact on Premium |

|---|---|

| Driving History (Accidents, Violations) | Higher premiums for a history of accidents or violations. |

| Claims History | Higher premiums for a history of claims. |

| Vehicle Type | Premiums can vary based on the vehicle’s make, model, and features. |

| Location | Premiums may differ depending on the geographic area of residence. |

| Credit Score | (In some instances) A lower credit score can result in higher premiums. |

This table highlights the various factors influencing premium costs for high-risk car insurance in Georgia.

Claim Filing and Dispute Resolution for High-Risk Policies

Navigating the complexities of insurance claims can be daunting, especially for those with high-risk auto insurance policies in Georgia. This section delves into the specifics of the claim filing process, potential challenges, and dispute resolution options, ensuring policyholders understand their rights and responsibilities. Understanding these processes is crucial for a smooth and just resolution in the event of an accident or damage.The claim filing process for high-risk auto insurance policies in Georgia adheres to the same fundamental principles as standard policies, although there might be variations in handling and processing due to the nature of the risk profile.

Thorough documentation and adherence to the Artikeld procedures are key to a swift and successful claim resolution.

Claim Filing Process Overview

The claim filing process typically involves several steps. Policyholders must first contact their insurance provider to initiate the claim process. A clear and concise description of the incident, including the date, time, location, and involved parties, is essential. Documentation such as police reports, witness statements, medical records, and repair estimates is crucial for supporting the claim.

Steps Involved in Reporting and Resolving Claims

- Initial Contact: Policyholders must contact their insurance provider promptly to report the claim. This usually involves providing the required details of the incident.

- Documentation Collection: Gathering comprehensive documentation, including police reports, medical records, witness statements, and repair estimates, is critical to support the claim.

- Claim Assessment: The insurance company evaluates the claim based on the provided documentation and evidence to determine the validity and extent of coverage.

- Negotiation and Settlement: If the claim is valid, the insurance company will work to negotiate a fair settlement with the policyholder. This might involve discussions on the amount of compensation for damages or repairs.

- Payment and Closure: Once the settlement is finalized, the insurance company will issue payment to the policyholder according to the agreed-upon terms. The claim is then closed, and all outstanding issues are resolved.

Potential Challenges and Issues in Claim Resolution

Various challenges can arise during the claim resolution process. These challenges include disagreements on the cause of the accident, conflicting witness statements, disputes over the extent of damages, and delays in processing the claim. Furthermore, high-risk policyholders might encounter increased scrutiny in the claim assessment phase due to the inherent risk profile. It’s vital for policyholders to be proactive and organized to mitigate these potential issues.

Options for Resolving Disputes Related to High-Risk Claims

Policyholders have several options for resolving disputes related to high-risk claims. These may include mediation, where a neutral third party helps facilitate communication and agreement. Arbitration is another possibility, where a pre-selected individual or panel makes a binding decision on the dispute. In some cases, legal action might be necessary to protect the policyholder’s rights.

Rights of High-Risk Policyholders in Georgia

High-risk policyholders in Georgia possess the same fundamental rights as other policyholders. These include the right to be treated fairly and with respect, the right to receive prompt and accurate information about the claim status, and the right to challenge any decisions made by the insurance company that they deem unjust. They have the right to legal counsel if they feel their rights are not being respected.

Claim Filing and Resolution Process Table

| Step | Description |

|---|---|

| Initial Report | Contact insurance provider to report claim. |

| Documentation Gathering | Collect all relevant documents (police reports, medical records, etc.). |

| Claim Assessment | Insurance company evaluates the claim’s validity. |

| Negotiation/Settlement | Discuss and agree on compensation amount. |

| Payment and Closure | Receive payment and claim closure. |

Legal Considerations for High-Risk Drivers in Georgia

Navigating the complexities of high-risk car insurance in Georgia requires understanding the legal framework governing such policies. This framework protects both drivers and insurance providers, ensuring a degree of accountability and fairness in the system. Understanding the legal implications empowers high-risk drivers to make informed decisions and navigate potential challenges effectively.

Legal Implications of Being a High-Risk Driver in Georgia

High-risk drivers in Georgia face specific legal implications stemming from their driving record and insurance status. These implications can range from increased premiums to potential penalties for violating insurance regulations. A clear understanding of these implications is crucial for responsible driving and maintaining compliance with the law.

Specific Laws and Regulations Regarding High-Risk Insurance in Georgia

Georgia’s laws and regulations pertaining to high-risk insurance policies are designed to balance the need for responsible drivers with the necessity of protecting vulnerable road users. These regulations often involve factors like the driver’s history of accidents, violations, and claims, as well as the type and scope of coverage required. Compliance with these regulations is essential to avoid legal complications.

Penalties for Violating Insurance Regulations in Georgia

Violating insurance regulations in Georgia can lead to significant penalties. These penalties can vary depending on the severity of the violation and may include fines, suspension of driving privileges, or even criminal charges. High-risk drivers should be acutely aware of these potential consequences and ensure compliance with all applicable laws.

Process for Obtaining a Certificate of Insurance

Obtaining a certificate of insurance is a crucial step for high-risk drivers. The process typically involves submitting required documentation, including proof of insurance coverage. Insurance providers will then issue a certificate, confirming the validity and details of the coverage. Drivers should carefully review the certificate to ensure it accurately reflects the policy terms and conditions.

Legal Rights of High-Risk Drivers When Interacting with Insurance Providers

High-risk drivers possess specific legal rights when interacting with insurance providers. These rights include the right to fair treatment, transparency in policy details, and prompt responses to inquiries. Understanding these rights empowers drivers to assert their position in the event of disputes or disagreements.

Key Legal Considerations for High-Risk Drivers

| Legal Consideration | Explanation |

|---|---|

| Insurance Requirements | Drivers must maintain valid high-risk insurance coverage as mandated by Georgia law. Failure to do so may result in penalties. |

| Violation Penalties | Driving with expired or invalid high-risk insurance can result in fines, suspension of driving privileges, or criminal charges, depending on the severity of the violation. |

| Claim Filing | High-risk drivers have the right to file claims according to the terms and conditions Artikeld in their insurance policy. Prompt and accurate documentation is crucial for a smooth claim process. |

| Dispute Resolution | In case of disputes with insurance providers, high-risk drivers can utilize available dispute resolution mechanisms to address their concerns. These mechanisms may include mediation or arbitration processes. |

| Policy Transparency | Insurance policies should clearly Artikel the terms, conditions, and exclusions, providing clarity to the high-risk driver regarding coverage limits and responsibilities. |

Resources and Support for High-Risk Drivers in Georgia

Seeking affordable car insurance as a high-risk driver can feel like navigating a complex spiritual journey. Understanding the available resources and support systems is crucial for finding a path toward financial stability and peace of mind. This section will illuminate the avenues for assistance and support, offering clarity and hope.Georgia, a state rich in community spirit, offers various resources for high-risk drivers.

These resources are designed to help navigate the complexities of obtaining insurance, reducing premiums, and maintaining financial well-being. These avenues are often supported by a strong network of non-profit organizations and government agencies.

Available Resources to Assist High-Risk Drivers

Many resources exist to assist high-risk drivers in securing affordable insurance. These resources often include counseling, financial guidance, and information regarding insurance options tailored to specific needs. Understanding these resources can empower high-risk drivers to make informed decisions and secure the necessary coverage.

Support Systems for High-Risk Drivers in Georgia

Georgia’s support systems for high-risk drivers encompass various avenues. These systems often include individual counseling and financial assistance programs. These resources can be instrumental in helping high-risk drivers find affordable insurance options.

Examples of Non-Profit Organizations or Government Agencies

Several non-profit organizations and government agencies offer assistance to high-risk drivers. These entities often provide financial guidance, insurance counseling, and resources to navigate the insurance application process. This assistance is a testament to the community’s commitment to supporting those facing challenges. For example, the Georgia Department of Insurance often has resources and information available to assist drivers.

Also, some local community centers and religious organizations may offer assistance programs for their members.

Contact Information for Relevant Organizations

Contact information for relevant organizations can vary greatly. To locate contact information, a driver can utilize online searches, or visit the relevant agency’s website. Many organizations offer online forms for inquiries and information requests, streamlining the process for drivers. This direct contact can provide access to specific information and support tailored to individual circumstances.

Programs for Reducing Insurance Premiums

Various programs exist to reduce insurance premiums for high-risk drivers. These programs often involve completing safe driving courses, participating in financial management workshops, and making conscious lifestyle choices that reflect responsible driving. Examples of such programs can include driver education courses, financial counseling, and even participation in community service programs.

Table Listing Resources and Support Systems

| Resource Category | Example Resource | Description |

|---|---|---|

| Government Agencies | Georgia Department of Insurance | Provides information and resources related to insurance policies and regulations, potentially including programs for high-risk drivers. |

| Non-profit Organizations | Local Community Centers | Offer financial assistance, counseling, and guidance to drivers seeking affordable insurance. |

| Insurance Companies | Specific Insurance Companies (e.g., State Farm, GEICO) | May offer specialized programs or discounts for high-risk drivers. |

| Community Services | Religious Organizations | Provide financial assistance and support to members, potentially offering guidance on insurance options. |

Final Thoughts

In conclusion, securing high-risk car insurance in Georgia requires a thorough understanding of the available options, factors influencing premiums, and the claims process. By exploring the diverse policies, understanding the legal considerations, and utilizing available resources, drivers can find suitable coverage. This guide provides a starting point for navigating the challenges associated with high-risk insurance and empowers drivers to make informed decisions.

FAQ

What are the common factors that classify a driver as high-risk in Georgia?

Drivers with a history of accidents, violations, or claims may be classified as high-risk. Specific violations, such as DUI or reckless driving, often result in higher premiums.

What are some common misconceptions about high-risk insurance in Georgia?

One common misconception is that high-risk insurance is significantly more expensive than standard insurance. While premiums are typically higher, there are often options available to reduce costs. Another misconception is that high-risk insurance is not available. This is often untrue as several providers cater to high-risk drivers.

How can I compare quotes from multiple high-risk insurance providers in Georgia?

Many online platforms allow you to input your details and receive quotes from multiple providers simultaneously. This streamlined approach facilitates easy comparison and selection.

What are my rights as a high-risk policyholder in Georgia regarding claims?

High-risk policyholders have the same rights as standard policyholders regarding claims. Fair and prompt handling of claims is expected from insurers. However, policy terms and conditions should be reviewed thoroughly.

Nimila

Nimila