Cheap car insurance in Fort Lauderdale is a crucial consideration for drivers in this dynamic city. Factors like driving records, vehicle types, and location all play a role in determining premium costs. Understanding these factors and utilizing comparison tools can help drivers find the most affordable options while maintaining adequate coverage.

This comprehensive guide provides an in-depth analysis of the Fort Lauderdale car insurance market, exploring various strategies to secure lower premiums. From identifying reputable providers to understanding coverage options and discounts, this guide empowers drivers to make informed decisions and save money on their car insurance.

Introduction to Cheap Car Insurance in Fort Lauderdale

Fort Lauderdale’s vibrant lifestyle comes with a price, including car insurance premiums. Navigating the market for affordable coverage requires understanding the local factors that drive costs and common pitfalls to avoid. This analysis delves into the nuances of car insurance in Fort Lauderdale, highlighting strategies for securing competitive rates.The car insurance landscape in Fort Lauderdale, like many urban areas, is influenced by a complex interplay of factors.

These include the city’s traffic density, the prevalence of accidents, and even the frequency of severe weather events. Understanding these factors is crucial for securing the best possible coverage at a reasonable price.

Factors Influencing Car Insurance Premiums

Several elements contribute to the cost of car insurance in Fort Lauderdale. Traffic congestion, a common characteristic of urban areas, often leads to higher accident rates. This, in turn, increases insurance premiums to cover potential claims. The prevalence of specific types of vehicles, such as luxury or sports cars, can also impact rates. Similarly, the city’s proximity to the coast and potential for severe weather events, including hurricanes and storms, may contribute to higher premiums.

Common Misconceptions about Cheap Car Insurance

A common misconception is that cheap car insurance equates to poor coverage. In reality, affordable rates can be achieved without sacrificing essential protections. Another misconception is that discounts are not available in the market. Insurance companies often offer a variety of discounts for safe driving habits, certain vehicle types, and good credit scores.

Importance of Comparing Quotes

The sheer volume of insurance providers available often overwhelms consumers. Comparison shopping is critical for finding the most competitive rates. Insurance companies employ different rating models and use various factors to determine premiums. A thorough comparison of quotes from multiple providers can yield significant savings. A comparison of quotes from different insurers is not only beneficial for finding lower premiums but also for understanding the nuances of various insurance packages.

Finding cheap car insurance in Fort Lauderdale can be tricky, but it’s definitely doable. A good place to start your research is by checking out various quotes online. While you’re comparing rates, you might also want to consider if Reveal is a good cat food – is reveal a good cat food – for your furry friend.

Ultimately, the best approach to getting the right coverage at the right price is to shop around. Comparing different providers is key to finding the best deal in Fort Lauderdale.

This approach allows for informed decision-making, selecting the best fit for individual needs and financial situations. By analyzing the quotes, you can identify the coverage levels and premiums offered by each insurer.

Identifying Affordable Insurance Providers

Navigating the complex landscape of car insurance in Fort Lauderdale requires a strategic approach to securing affordable coverage without compromising essential protections. Understanding the various providers and their offerings is crucial for making an informed decision. The key is to identify reputable companies that offer competitive rates and comprehensive coverage tailored to individual needs.Finding reputable and affordable insurance providers involves a multi-faceted approach.

Researching different companies, comparing their policies, and understanding their coverage options are essential steps. Fort Lauderdale’s diverse insurance market presents numerous choices, but the selection process can be streamlined with a methodical evaluation of providers based on their financial stability, claims history, and customer reviews. A comparative analysis, including price points and coverage details, empowers consumers to make informed decisions.

Researching Insurance Providers

Thorough research is paramount in identifying reputable and affordable insurance providers. Begin by consulting online resources, including independent comparison websites and consumer reviews. These platforms often aggregate information from various providers, allowing for side-by-side comparisons of rates and coverage. Reviewing insurance company websites directly provides insight into their policies, coverage details, and customer service initiatives. Direct contact with insurance agents in Fort Lauderdale can yield personalized recommendations and insights tailored to individual circumstances.

Top Insurance Companies in Fort Lauderdale

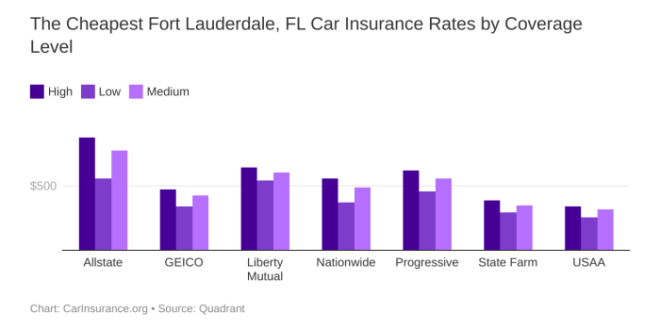

Several insurance companies are renowned for offering competitive rates in Fort Lauderdale. These include, but are not limited to, State Farm, Geico, Progressive, and Allstate. Each company boasts a distinct reputation, offering a variety of coverage options.

Comparing Coverage Options

Insurance policies differ in their coverage options and price points. Understanding these variations is critical in selecting the appropriate policy. Comprehensive coverage, including collision and liability, is often essential, but the specifics of each policy vary. Consider factors like deductibles, policy limits, and add-ons such as roadside assistance or rental car coverage when comparing policies.

Policy Examples and Price Ranges

A sample comparison illustrates the variability in insurance premiums. State Farm’s policy for a 25-year-old driver with a clean driving record and a modest vehicle might range from $1,200 to $1,800 annually. In contrast, a similar policy with Geico could fall between $1,000 and $1,500. The price range depends on numerous factors, including vehicle type, driving history, and location within Fort Lauderdale.

Comparative Table of Policies

| Company | Policy Type | Premium | Coverage Details |

|---|---|---|---|

| State Farm | Basic Liability | $1,200 | Covers damages to other vehicles in case of an accident. Requires a deductible. |

| State Farm | Comprehensive | $1,500 | Covers damages to the insured vehicle, regardless of who is at fault. Includes a deductible. |

| Geico | Basic Liability | $1,000 | Covers damages to other vehicles in case of an accident. Requires a deductible. |

| Geico | Comprehensive | $1,300 | Covers damages to the insured vehicle, regardless of who is at fault. Includes a deductible. |

| Progressive | Basic Liability | $1,100 | Covers damages to other vehicles in case of an accident. Requires a deductible. |

Factors Affecting Car Insurance Premiums in Fort Lauderdale

Fort Lauderdale’s vibrant lifestyle, coupled with its diverse demographics and driving conditions, influences car insurance rates. Understanding the key factors that shape these premiums is crucial for anyone seeking affordable coverage. These factors, ranging from driving history to vehicle characteristics, play a significant role in determining the cost of insurance.

Finding cheap car insurance in Fort Lauderdale can be tricky, but checking out local options is key. For a tasty lunch break, consider browsing Don Pancho’s Mexican food menu, here , to get a feel for the diverse dishes. Once you’ve grabbed some tacos, you can continue your search for the best Fort Lauderdale car insurance deal.

Driving Record

Driving records are a critical determinant in car insurance premiums. A history of accidents, traffic violations, or even a recent speeding ticket can dramatically increase premiums. Insurance companies assess driving records to evaluate the risk of future claims. This assessment is a crucial element in determining premiums, as claims history is a strong indicator of future accident risk.

Policies typically consider the frequency and severity of past incidents. For example, a driver with multiple speeding tickets or a recent accident involving significant property damage is likely to face higher premiums compared to a driver with a clean record. Insurance companies weigh the factors to assess risk and adjust premiums accordingly.

Vehicle Type and Model

The type and model of a vehicle significantly impact insurance costs. Certain vehicles are inherently more expensive to repair or replace, which directly influences the premium. Luxury vehicles, sports cars, and high-performance models often command higher premiums due to their potential for higher repair costs. Conversely, vehicles with a reputation for reliability and lower repair costs generally result in lower premiums.

This is a direct correlation between vehicle value and insurance costs.

Location within Fort Lauderdale

Geographic location within Fort Lauderdale can affect insurance rates. Areas with higher crime rates, more traffic congestion, or greater exposure to weather-related risks often have higher premiums. Specific areas within the city might have higher rates due to a concentrated number of accidents or traffic-related incidents. These localized factors affect the perception of risk, leading to varying premiums across different parts of the city.

Age and Gender

Age and gender are also factors considered in determining insurance rates. Statistical data often shows that younger drivers and male drivers are more likely to be involved in accidents than their older or female counterparts. This data forms the basis for insurance companies to assess risk. This established correlation influences premium rates, with younger drivers and male drivers often facing higher premiums.

However, these generalizations don’t apply to all individuals.

Claims History

Claims history plays a crucial role in determining future insurance rates. A driver with a history of making multiple claims will typically face higher premiums compared to a driver with a clean claims history. Insurance companies use this data to assess the likelihood of future claims and adjust premiums accordingly. This is a straightforward assessment of risk, where claims history directly correlates with the expected future claim frequency.

Correlation Between Factors and Insurance Premiums

| Factor | Description | Impact on Premium |

|---|---|---|

| Driving Record | Number and severity of accidents, traffic violations | Higher premiums for poor records |

| Vehicle Type/Model | Luxury, sports, or high-performance vehicles | Higher premiums for high-value vehicles |

| Location | Areas with higher crime, traffic, or weather risks | Higher premiums in high-risk areas |

| Age | Younger drivers are statistically more accident-prone | Higher premiums for younger drivers |

| Gender | Historical data suggests gender differences in accident rates | Potential for higher premiums for male drivers |

| Claims History | Number of previous claims filed | Higher premiums for frequent claims |

Strategies for Obtaining Lower Premiums

Navigating the complexities of car insurance in Fort Lauderdale can feel daunting. However, understanding the strategies to lower premiums can significantly reduce your out-of-pocket costs. By adopting proactive measures and leveraging available tools, drivers can secure more affordable coverage without sacrificing essential protections.Lowering car insurance premiums is achievable through a combination of smart choices and careful consideration of various factors.

These strategies extend beyond simply comparing quotes; they involve a holistic approach to managing your insurance needs.

Bundling Insurance Policies

Bundling multiple insurance policies, such as home and auto insurance, with the same provider, often yields substantial discounts. This practice demonstrates a commitment to the insurer, and in turn, they reward this loyalty. By consolidating policies, you consolidate your risk profile, making it more attractive for insurers to offer competitive rates. For example, a homeowner with a comprehensive auto insurance policy can potentially receive a 10% discount or more on their overall premium, based on the insurer’s specific bundling program.

Leveraging Discounts Offered by Providers

Insurance providers often offer a range of discounts for various reasons, from safe driving records to specific lifestyle choices. Understanding and capitalizing on these discounts can be crucial in obtaining lower premiums. These discounts can range from a few percentage points to significant reductions in the overall cost. For instance, students with good academic standing might qualify for a student discount, or those who participate in defensive driving courses may receive a safe driving discount.

Safe Driving Habits

Maintaining a safe driving record is fundamental to obtaining lower car insurance premiums. Insurance companies use driving history data to assess risk. Accidents and violations negatively impact your premium, while a clean driving record demonstrates responsible behavior, potentially leading to substantial savings. In Fort Lauderdale, where traffic congestion is prevalent, drivers who avoid reckless maneuvers and maintain consistent defensive driving habits are more likely to receive favorable insurance rates.

List of Available Discounts

Insurance providers in Fort Lauderdale offer a variety of discounts. Some common examples include:

- Defensive Driving Courses: Completing a defensive driving course demonstrates a commitment to safe driving practices, leading to a discount on premiums.

- Good Student Discounts: Students with good academic standing often qualify for a discount, reflecting their responsible behavior.

- Multi-Policy Discounts: Bundling home and auto insurance with the same provider frequently results in a significant discount.

- Multiple Vehicle Discounts: Owning multiple vehicles with the same insurance provider can qualify for a discount.

- Safe Driver Discounts: Maintaining a clean driving record for a specific period (e.g., 3 years) demonstrates safe driving habits and often leads to a discount.

Discount Breakdown

The following table provides an overview of potential savings associated with various discounts. Note that actual savings may vary based on individual circumstances and insurance provider policies.

| Discount Type | Description | Potential Savings |

|---|---|---|

| Defensive Driving | Completion of a defensive driving course | 5-15% |

| Good Student | Maintaining good academic standing | 3-10% |

| Multi-Policy | Bundling home and auto insurance | 5-15% |

| Multiple Vehicle | Insuring multiple vehicles with the same provider | 3-10% |

| Safe Driver | Maintaining a clean driving record | 5-15% |

Understanding Coverage Options and Deductibles

Navigating the complexities of car insurance in Fort Lauderdale requires a deep understanding of coverage options and their associated deductibles. Choosing the right coverage is crucial to protecting your financial well-being while minimizing premiums. Understanding the nuances of liability, collision, and comprehensive coverage, along with the impact of deductibles, empowers you to make informed decisions that align with your specific needs and budget.Different types of car insurance coverage are designed to address various potential risks.

A comprehensive understanding of these options is vital for selecting the appropriate policy. Choosing the right level of coverage is a critical aspect of managing financial risk.

Types of Car Insurance Coverage

Different types of car insurance coverages provide varying degrees of protection. Liability coverage protects you if you are found at fault for an accident. Collision coverage addresses damage to your vehicle regardless of fault. Comprehensive coverage covers damage from perils beyond accidents, such as theft, vandalism, or weather events. Understanding the distinctions between these coverages is essential for making informed choices.

Importance of Policy Details

Thorough review of policy details is critical for avoiding surprises. Pay close attention to the specific terms and conditions, including exclusions and limitations. Understanding the policy’s language ensures you are fully aware of the scope of protection. Clarifying any ambiguous clauses with your insurance provider is crucial.

Impact of Deductibles on Premiums

Deductibles, the amount you pay out-of-pocket before insurance coverage kicks in, significantly impact your premiums. Lower deductibles typically correlate with higher premiums, while higher deductibles result in lower premiums. Finding a balance between cost and protection is essential. A higher deductible means a lower monthly payment, but you bear the brunt of the cost if a claim is made.

Comparison of Coverage Levels, Cheap car insurance in fort lauderdale

Different coverage levels provide varying degrees of protection. For instance, a basic policy might offer minimal liability coverage, while a more comprehensive policy might include collision, comprehensive, and potentially uninsured/underinsured motorist coverage. Evaluating your needs and budget is paramount in selecting the right coverage level.

Examples of Coverage Levels and Premiums

Consider the following hypothetical examples to illustrate the impact of coverage levels on premiums:

- A policy with $100,000 in liability coverage, $1,000 deductible collision, and $500 deductible comprehensive, might cost $150 per month.

- A policy with $300,000 in liability coverage, $500 deductible collision, and $1,000 deductible comprehensive, might cost $200 per month.

- A policy with $500,000 in liability coverage, $2,500 deductible collision, and $1,500 deductible comprehensive, might cost $180 per month.

These are illustrative examples and actual premiums may vary depending on individual circumstances.

Comparative Table of Coverage Options

The table below summarizes different coverage options and their associated premiums. These premiums are illustrative and can vary significantly based on factors like driving record, vehicle type, and location.

| Coverage Type | Description | Premium (Illustrative) |

|---|---|---|

| Liability | Covers damages you cause to others’ property or injuries to others in an accident where you are at fault. | $80-$150 |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | $50-$120 |

| Comprehensive | Covers damage to your vehicle from events other than collisions, such as theft, vandalism, or weather events. | $30-$80 |

Tips for Comparing Car Insurance Quotes

Navigating the labyrinth of car insurance providers in Fort Lauderdale can feel daunting. The sheer volume of options, coupled with the intricate details of coverage, can leave consumers overwhelmed. This crucial step, however, is essential for securing the most affordable and comprehensive protection for your vehicle. Understanding how to compare quotes effectively can save you significant money and ensure you’re well-protected.Comparing quotes isn’t just about finding the lowest price; it’s about evaluating the total value of the insurance package, factoring in coverage, deductibles, and any additional add-ons.

A seemingly low premium might come with limited coverage or unfavorable terms, making a thorough comparison paramount.

Importance of Comparing Quotes from Multiple Providers

A crucial element of securing the best car insurance in Fort Lauderdale is comparing quotes from multiple providers. This proactive approach allows for a comprehensive analysis of available options, ensuring you’re not locked into an unfavorable or unnecessarily expensive policy. A single quote might not reflect the best available deal, potentially overlooking significant savings offered by other insurers.

Obtaining Online Quotes

The modern approach to obtaining car insurance quotes is predominantly online. This streamlined process allows for quick comparisons and eliminates the need for extensive paperwork or in-person visits. Simply visiting the websites of various insurance companies provides a multitude of quotes, often in a matter of minutes. Using online quote generators is a straightforward and time-efficient method.

Utilizing Comparison Websites

Comparison websites are invaluable tools for quickly gathering quotes from multiple insurers. These platforms aggregate quotes from various providers, enabling a direct comparison of premiums and coverage options. This consolidated approach makes the process significantly more efficient, allowing you to rapidly identify potentially better deals.

Benefits of Online Comparison Tools

Online comparison tools offer several advantages over traditional methods. They often provide real-time quote updates, allowing you to see how different factors, like driving history or vehicle details, affect your premium. Furthermore, these tools can highlight hidden fees or restrictive clauses in policies, empowering you to make informed decisions. The ease of use and accessibility of these platforms are undeniable advantages.

Reliable Online Comparison Websites

Numerous reliable online comparison websites facilitate the quote-comparison process. These platforms aggregate quotes from various insurers, allowing for quick and easy comparisons. Some reputable websites include [Insert list of 3-5 reputable comparison websites here]. These sites are designed to simplify the comparison process and empower consumers to secure the best possible insurance deal.

Comparing Quotes from Different Companies

| Company | Policy Type | Premium | Coverage Details |

|---|---|---|---|

| Insurer A | Comprehensive | $1,200 | Collision, liability, comprehensive, uninsured/underinsured motorist |

| Insurer B | Basic | $900 | Liability, collision, comprehensive (limited coverage) |

| Insurer C | Premium | $1,500 | Collision, liability, comprehensive, uninsured/underinsured motorist, roadside assistance |

This table demonstrates a basic example of how to compare quotes. The table highlights the importance of comparing not only premiums but also the specific coverage details offered by each company. It’s crucial to review the fine print to understand what’s included in each policy.

Resources and Support for Consumers

Navigating the complexities of car insurance can be daunting. Understanding your rights and options, and having access to reliable resources, is crucial for securing the best possible coverage at the most competitive price. Consumers in Fort Lauderdale, like those nationwide, can benefit from readily available support systems to help them understand and manage their insurance policies.Fort Lauderdale residents seeking affordable car insurance often benefit from local resources and support networks.

These networks provide crucial information, empowering consumers to make informed decisions and avoid potentially costly mistakes.

Local Consumer Protection Agencies

Consumer protection agencies play a vital role in safeguarding consumers’ rights and interests when dealing with insurance companies. These agencies often provide valuable information about car insurance, including available coverage options, potential scams, and how to file a complaint if necessary. They also help consumers understand their rights regarding fair pricing and treatment.

Consumer Advocacy Groups for Car Insurance

Consumer advocacy groups dedicated to car insurance provide an independent voice for consumers. These organizations frequently research and publish reports on industry trends, insurance company practices, and best practices for consumers. They can be instrumental in helping consumers understand their rights and navigate the complexities of insurance policies. For example, they might publish guides on negotiating better rates or filing claims effectively.

Importance of Understanding Policy Documents

Thorough comprehension of your car insurance policy documents is paramount. Policies contain crucial details about coverage limits, exclusions, and specific terms and conditions. Failing to understand these specifics could lead to unexpected gaps in coverage or financial burden during a claim. This knowledge empowers you to ask informed questions, and helps prevent costly misunderstandings.

Reliable Resources for Consumers

Accessing accurate and reliable information is essential for consumers seeking clarity on car insurance. Numerous websites and organizations offer valuable resources to help consumers make informed decisions. These resources typically cover topics ranging from identifying reputable insurers to understanding policy terms. For instance, some resources offer tools to compare quotes and estimate premiums.

Government Websites and Consumer Protection Agencies

| Resource | Description | Link |

|---|---|---|

| Florida Department of Financial Services | Provides information on insurance companies, consumer protection, and complaint resolution. | (Insert Link Here) |

| National Association of Insurance Commissioners (NAIC) | A national organization representing state insurance regulators. Offers resources for consumers and industry professionals. | (Insert Link Here) |

| Your State’s Insurance Department | Provides information specific to your state’s insurance regulations and consumer protection. | (Insert Link Here) |

| Consumer Financial Protection Bureau (CFPB) | A federal agency that protects consumers from financial harm, including those from insurance companies. | (Insert Link Here) |

Ending Remarks

In conclusion, obtaining cheap car insurance in Fort Lauderdale requires a proactive approach. By comparing quotes, understanding coverage needs, and leveraging available discounts, drivers can significantly reduce their insurance costs. This guide has provided a framework for navigating the complexities of the local market and making informed choices for affordable and adequate coverage.

Detailed FAQs: Cheap Car Insurance In Fort Lauderdale

What is the average cost of car insurance in Fort Lauderdale?

The average cost of car insurance in Fort Lauderdale varies considerably based on factors like driver age, vehicle type, and coverage selections. However, a general range can be found through online comparison tools.

How does my driving record affect my insurance premium?

A clean driving record generally results in lower premiums. Traffic violations, accidents, and DUIs significantly increase premiums.

Are there any discounts available for bundling insurance policies?

Many insurance providers offer discounts for bundling auto insurance with home or renters insurance policies.

What is the difference between liability, collision, and comprehensive coverage?

Liability coverage protects against damages you cause to others. Collision coverage protects your vehicle in the event of an accident regardless of fault. Comprehensive coverage protects against damage to your vehicle caused by non-collision events like vandalism or weather.

Nimila

Nimila