Car rental insurance in Ireland is crucial for a smooth trip. Different plans cater to various needs, from budget-friendly basics to comprehensive covers. Knowing the ins and outs of each policy, plus the factors influencing costs, is key to finding the right fit for your Irish adventure.

This guide dives deep into the world of car rental insurance in Ireland, exploring various policies, costs, legal requirements, claims processes, and tips for choosing the perfect plan. We’ll break down the essential details, making it easier for you to navigate the complexities of Irish car rental insurance.

Overview of Car Rental Insurance in Ireland

Car rental insurance in Ireland is a crucial aspect of the entire process, offering varying levels of protection against potential damages and liabilities. Understanding the different types and their coverage is essential for making informed decisions. This comprehensive overview details the available insurance options, their inclusions and exclusions, and how major rental companies structure their packages.Car rental companies in Ireland provide various insurance packages to cater to different needs and budgets.

Understanding the nuances of each package is vital to ensure the chosen coverage adequately protects against potential mishaps during the rental period. This detailed information will help you select the most suitable insurance option based on your specific requirements.

Types of Car Rental Insurance

Different insurance packages cater to varying degrees of risk tolerance and financial protection. The basic package typically provides minimal coverage, while premium packages offer broader protection. Rental companies often provide options that address a range of potential incidents.

Common Inclusions and Exclusions

Insurance packages often include liability coverage, which protects against damage to another party’s vehicle or injuries sustained by others. This is a fundamental aspect of most policies. Exclusions, on the other hand, detail scenarios not covered by the insurance. These may include pre-existing damage to the rental car or damage caused by specific actions like reckless driving.

Comparison of Insurance Packages from Major Rental Companies

Major car rental companies in Ireland typically offer similar core insurance packages, but the specifics of coverage and exclusions may vary. A comparison of these packages reveals differences in the levels of protection offered. Some companies may offer add-ons or supplemental policies that enhance the base insurance. Thorough research into the precise terms and conditions is crucial.

Rental Insurance Options Table

| Insurance Type | Coverage | Exclusions | Cost |

|---|---|---|---|

| Basic | Third-party liability, basic damage waiver (CDW). | Damage to the rental car caused by negligence, pre-existing damage, damage due to reckless driving, specific types of accidents (e.g., those involving off-road driving), and certain personal belongings. | Generally, the lowest cost option. |

| Premium | Comprehensive coverage including third-party liability, damage waiver (CDW), and potentially additional add-ons like theft protection or personal accident insurance. | Damage resulting from intentional acts, certain types of wear and tear, or specific circumstances (e.g., damage due to natural disasters). | Higher cost compared to basic options. |

| Additional Options (Add-ons) | Specific enhancements to basic or premium packages, such as personal accident cover, additional driver coverage, or excess protection. | Conditions stipulated in the add-on policy, which may differ from the base insurance. | Cost depends on the add-on selected. |

Factors Affecting Car Rental Insurance Costs

Car rental insurance premiums in Ireland are influenced by a complex interplay of factors. Understanding these elements allows potential renters to make informed decisions and secure the most appropriate coverage for their needs. Pricing strategies are often tailored to reflect the risks associated with each rental scenario.Rental insurance costs are not static; they are dynamically adjusted based on various criteria.

Rental companies meticulously consider these factors to calculate premiums that balance risk and profitability. This approach ensures fair pricing and a stable insurance market.

Rental Duration Impact

Rental duration is a primary determinant of insurance costs. Longer rentals typically incur higher premiums. This reflects the increased exposure to potential damage or loss over a longer period. For example, a one-week rental carries a greater risk of an accident or damage compared to a single-day rental.

Vehicle Type Influence

The type of vehicle rented significantly affects insurance costs. Higher-value vehicles, or those with unique characteristics (e.g., luxury models, convertibles, or SUVs), usually command higher premiums. This reflects the higher financial value of the vehicle and the potential for greater damage. The vehicle’s features, like advanced safety equipment, also impact the calculation.

Driver Age and Experience Impact

Driver age and experience are critical factors in insurance calculations. Younger drivers, often perceived as having a higher accident risk, typically pay higher premiums. Conversely, drivers with a proven track record of safe driving and substantial experience often benefit from lower rates. This reflects the insurance company’s assessment of the likelihood of a claim arising from the driver’s actions.

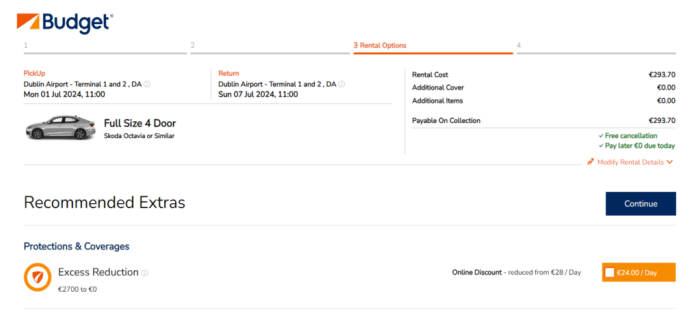

Add-on Extras Impact

The inclusion of add-on extras significantly impacts the final insurance price. Options like collision damage waiver (CDW), personal accident insurance (PAI), and supplemental protection against theft (SPAT) can add to the overall premium. These extras offer comprehensive protection, but their cost must be considered alongside the core insurance coverage. Understanding the specific coverage offered by each extra is crucial for making informed choices.

Rental Duration and Insurance Cost Relationship

| Rental Duration | Estimated Insurance Cost (Illustrative Example) |

|---|---|

| 1 Day | €20-€30 |

| 7 Days | €70-€120 |

| 14 Days | €120-€180 |

The table above illustrates the general relationship between rental duration and estimated insurance cost. Note that these are illustrative examples and actual costs may vary based on specific factors like vehicle type, driver profile, and chosen extras.

Understanding Legal Requirements

Renting a car in Ireland comes with specific legal obligations regarding insurance. Failure to comply can result in significant penalties and complications. Understanding these requirements is crucial for a smooth and worry-free rental experience.Comprehending the mandatory insurance stipulations for car rentals in Ireland is essential to avoid potential legal issues and financial repercussions. Knowing the specifics of insurance policies and their adherence to Irish regulations safeguards both the renter and the rental company.

Mandatory Insurance Requirements

Irish law mandates comprehensive insurance coverage for all vehicles operating on Irish roads. This includes third-party liability, which protects other drivers and pedestrians in the event of an accident. Renting a car without adequate insurance is a serious offense with significant penalties.

Penalties for Inadequate Insurance

Driving without proper insurance in Ireland carries substantial penalties. These penalties can include hefty fines, potential imprisonment, and a damaged driving record. These consequences can have lasting impacts on an individual’s ability to rent cars in the future. Furthermore, the renter’s personal assets might be vulnerable if the insurance coverage is insufficient.

Implications of Driving Without Insurance

Driving without adequate insurance in Ireland can have severe consequences. Beyond the financial penalties, driving without insurance jeopardizes the safety and well-being of other road users. This practice exposes individuals to legal ramifications and significant financial burdens. Furthermore, insurance companies may not cover incidents that occur when the vehicle is driven without insurance, creating additional financial risks for the driver.

Examples of Insurance Policies and Compliance

Various insurance policies cater to different needs and budgets. Rental companies often offer various packages, including comprehensive coverage. It’s crucial to carefully review the policy details and ensure it meets the Irish legal requirements. For example, a policy that only covers third-party liability might not suffice if the renter wishes to cover damages to the rented car.

A comprehensive policy that covers both third-party liability and potential damage to the vehicle is a more robust option. A standard policy from a reputable insurance company, especially one tailored to car rentals, is likely to adhere to Irish laws. Renting a car with a policy that does not comply with Irish law is both risky and potentially illegal.

Claims Process and Procedures: Car Rental Insurance In Ireland

Navigating a car rental claim in Ireland can feel daunting, but a clear understanding of the process can alleviate stress. This section details the steps involved in filing a claim, the necessary documentation, and the typical timeframe for resolution. It also highlights potential issues that might trigger a claim and Artikels the options for dealing with damaged vehicles.

Filing a Car Rental Insurance Claim

The process for filing a car rental insurance claim in Ireland generally involves reporting the incident to the rental company immediately, documenting all relevant details, and following the company’s specific claim procedure. This ensures the claim is handled efficiently and transparently.

Required Documents for a Claim

A comprehensive claim requires a range of supporting documents. These documents typically include the rental agreement, police report (if applicable), photographs of the damage, and a detailed description of the incident. The rental company will likely specify the precise documents needed.

- Rental Agreement: This document serves as the primary contract between the renter and the rental company. It Artikels the terms of the rental, including insurance coverage and responsibilities.

- Police Report: If the incident involved an accident, a police report is crucial. It provides official documentation of the event and any associated details.

- Photographs of Damage: Clear and comprehensive photographs of the damage to the rental vehicle are essential. These visual records help in assessing the extent of the damage and aid in the claim settlement process.

- Detailed Description of the Incident: A written account of the incident, including the circumstances surrounding the damage, is vital. This description should include details about the other party involved, if applicable, and the specific events leading to the damage.

Typical Timeframe for Processing Claims

The timeframe for processing a car rental insurance claim in Ireland can vary depending on the complexity of the claim and the rental company’s internal procedures. However, a claim typically takes a few days to several weeks for resolution. Factors such as the need for further investigations, third-party involvement, and administrative delays can influence the duration.

Options for Dealing with a Damaged Vehicle

Upon filing a claim, the rental company will typically assess the damage. Depending on the severity and type of damage, several options may be available. These include repairs to the vehicle, a replacement vehicle, or a payout based on the assessed value of the damage.

- Repairs: The rental company may arrange for repairs to the damaged vehicle if it is deemed economically viable. This is a common solution for minor damages.

- Replacement Vehicle: In cases of significant damage or when the rental vehicle is irreparable, the rental company might provide a replacement vehicle.

- Payout: In some situations, the rental company may issue a payout to the renter based on the assessed value of the damage, especially if repairs are not an option or if the damage exceeds the cost of repair.

Common Issues Leading to Claims

Accidents involving other drivers, parking incidents, or damage due to negligence are common causes of claims. Damage from hitting a curb, or running into a stationary object can also lead to claims.

- Accidents: Collisions with other vehicles are a significant cause of claims. These can range from minor fender benders to more serious accidents.

- Parking Incidents: Damage incurred while parking, such as scratching another vehicle or damaging the rental car itself, can trigger a claim.

- Negligence: Damage caused by the renter’s negligence, like failing to secure items in the car, or mishandling the vehicle, can also result in a claim.

Flowchart of the Claim Process

(A visual flowchart is not possible in text format, but the steps are detailed below)The claim process typically involves the following steps:

- Report the incident to the rental company immediately.

- Collect all necessary documentation (rental agreement, police report, photos, etc.).

- Submit the claim form and supporting documents to the rental company.

- The rental company assesses the damage and investigates the claim.

- The rental company notifies the renter of the claim status and any required further action.

- The rental company resolves the claim and notifies the renter of the outcome.

Tips for Choosing the Right Insurance

Navigating the world of car rental insurance in Ireland can feel overwhelming. Understanding the various options and tailoring your coverage to your specific needs is crucial for avoiding unexpected costs and ensuring a smooth rental experience. This section provides essential guidance on selecting the right insurance package for your Irish car rental.Choosing the right insurance is paramount to protect your interests during your rental period.

This involves a meticulous assessment of your driving habits, the type of vehicle you’re renting, and the overall risk associated with your trip. Careful consideration of these factors, coupled with a comparison of quotes, empowers you to make an informed decision that aligns with your budget and risk tolerance.

Comparing Quotes for Optimal Value

Comparing quotes from different insurance providers is a fundamental step in securing the most advantageous deal. This process involves gathering quotes from various companies, examining the terms and conditions of each policy, and meticulously analyzing the associated costs.

- Thorough Research: Use online comparison tools, contact rental companies directly, and solicit quotes from independent insurance providers. This ensures a comprehensive overview of available options.

- Detailed Comparison: Carefully examine each quote’s specifics, noting the types of coverages included (e.g., liability, collision, comprehensive), excess amounts, and any applicable deductibles. Scrutinize the policy wording to understand the limitations and exclusions.

- Value Assessment: Evaluate the total cost of the insurance package against the level of protection offered. Consider whether the premium justifies the coverage provided, considering the potential risks associated with your trip.

Understanding Insurance Coverage Types

Understanding the different types of insurance coverage is crucial for selecting the appropriate package. Different options cater to varying needs and risk profiles.

- Comprehensive Insurance: Comprehensive insurance provides the broadest coverage, protecting against damage or loss of the rental vehicle, including damage caused by factors such as accidents, theft, or natural disasters. This is often the most expensive option but provides the greatest peace of mind.

- Basic Insurance (Liability Only): Basic insurance, often referred to as liability-only, offers the least protection. It typically only covers damages to others in the event of an accident. This option may not cover the rental car itself, leaving you liable for any damage incurred during the rental period.

- Collision Insurance: Collision insurance covers damages to the rental car resulting from an accident, regardless of fault. This provides protection against damage to your vehicle, but may not cover other forms of damage.

Factors to Consider When Comparing Quotes

Several factors influence the cost of car rental insurance. Understanding these elements helps in identifying the most suitable option for your circumstances.

| Factor | Explanation |

|---|---|

| Rental Duration | Longer rentals typically result in higher insurance premiums. |

| Vehicle Type | Luxury vehicles and high-performance cars usually come with higher insurance costs. |

| Driver Profile | Young drivers and drivers with a poor driving record often face higher premiums. |

| Rental Location | Specific locations might influence insurance costs due to local factors. |

| Policy Exclusions | Review exclusions carefully to understand the scope of coverage. |

Benefits of Comprehensive Insurance

Comprehensive insurance offers a significant advantage by providing extensive coverage against various potential damages. This broader protection alleviates financial burdens in the event of an accident or theft.

Drawbacks of Basic Insurance, Car rental insurance in ireland

Opting for basic insurance may seem cost-effective initially, but it carries significant risks. The limited coverage provided may not adequately protect your financial interests if an accident or damage occurs during your rental period.

Recent Trends in Car Rental Insurance

Recent years have witnessed dynamic shifts in the car rental insurance landscape in Ireland, influenced by evolving customer needs, technological advancements, and regulatory changes. Understanding these trends is crucial for both rental companies and customers to navigate the complexities of the market effectively. This section delves into the key developments shaping the future of car rental insurance in the country.

Technological Advancements

Technological advancements are reshaping car rental insurance policies. Digital platforms and mobile applications have become integral parts of the insurance process, allowing customers to access policies, make claims, and manage their insurance online. This shift enhances convenience and efficiency, streamlining the entire process. The use of telematics data in assessing risk is also increasing. This data, collected through embedded devices in vehicles, provides insurers with real-time insights into driving behavior, leading to more accurate risk assessments and potentially lower premiums for safer drivers.

Online Comparison Tools

Online comparison tools play a significant role in the modern car rental insurance market. These tools provide users with a comprehensive overview of various insurance options from different providers, allowing them to easily compare costs and coverage. This empowers customers to make informed decisions by comparing prices and features, and enables them to find the most suitable insurance plan.

For example, a customer seeking a specific level of excess protection can utilize a comparison tool to find the most cost-effective policy with that feature.

Impact of Changing Legal Requirements

Irish legislation concerning car rental insurance is evolving. Recent changes in legal requirements have led to increased scrutiny of insurance policies and coverage levels. Insurers must adapt their offerings to comply with the evolving legal landscape, potentially leading to shifts in pricing and coverage packages. This includes ensuring policies meet the minimum standards required by the law.

Cost and Coverage Comparisons

Recent insurance policies demonstrate variations in costs and coverage. The cost of car rental insurance is influenced by several factors, including the type of vehicle, rental duration, driver profile, and the level of coverage selected. Policies may offer different levels of excess protection, third-party liability, and comprehensive coverage, impacting the overall cost. A policy with a lower excess amount will typically cost more than one with a higher excess.

Comprehensive coverage will be more expensive than basic liability protection. For example, a short-term rental of an economy car with a high excess protection would likely cost less than a long-term rental of a luxury vehicle with comprehensive coverage.

Emerging Issues and Concerns

Emerging issues in car rental insurance include the rising cost of premiums and the need for clarity in policy terms. This trend may be attributed to factors like the increasing frequency and severity of accidents, inflation, and ongoing market fluctuations. Clear and accessible policy terms and conditions are essential to avoid misunderstandings and disputes.

Closing Notes

In conclusion, understanding car rental insurance in Ireland is vital for any traveler. By comparing policies, understanding costs, and knowing your legal obligations, you can confidently rent a car and enjoy your Irish getaway without the stress of unexpected expenses. Remember to prioritize your needs and choose the insurance that best fits your budget and travel plans.

Questions Often Asked

What’s the difference between basic and premium insurance?

Basic insurance typically covers the minimum legal requirements, while premium insurance offers broader protection against various incidents, including damage or theft.

How does the rental duration affect insurance costs?

Longer rentals generally mean higher insurance premiums. The cost per day usually decreases as the rental period extends.

What documents are needed for a claim?

Essential documents for a claim usually include your rental agreement, proof of damage, police report (if applicable), and any other documentation requested by the rental company.

Are there any hidden costs in the insurance?

Be mindful of add-on extras or hidden fees associated with specific policies. Always review the fine print before committing to an insurance package.

Nimila

Nimila